The oil market hardly ever affords an easy narrative, however this previous week has been significantly complicated for merchants. On one aspect, headlines proceed to emphasise oversupply and weak demand as causes for decrease costs. On the opposite aspect, the Worldwide Vitality Company (IEA) has raised the alarm about accelerating decline charges in oil and gasoline fields, warning that with out adequate upstream funding, the world might face tighter provide within the years forward.

For merchants, this twin storyline creates a paradox: crude seems heavy within the quick time period, however the longer-term image factors to shortage dangers that might ultimately push costs increased.

Oversupply Nonetheless Dominates the Brief-Ter

Early within the week of September 8–12, the IEA and several other analysis desks highlighted a build-up in provide that might exceed demand within the second half of 2025. Non-OPEC producers resembling Brazil and Guyana are including barrels, whereas OPEC+ members have slowly introduced extra manufacturing on-line. In the meantime, U.S. demand indicators have softened, with refinery consumption slowing and gasoline consumption lagging seasonal norms.

The outcome: Brent and WTI each struggled to carry features, even when geopolitical dangers have been within the background. Merchants centered on oversupply, and the market’s incapacity to rally was itself a bearish sign.

In brief: oversupply, weaker U.S. demand, and better inventories outlined the near-term tone.

IEA Highlights a Very Totally different Danger

Simply days later, on September 16, the IEA launched one other report, this time pointing to a distinct hazard: decline charges in present oil and gasoline fields are accelerating. Many fields are previous their peak and now require heavy funding simply to take care of manufacturing.

The warning is obvious: if corporations fail to take a position, tens of millions of barrels per day may very well be misplaced to pure depletion. In follow, which means right now’s oversupply might flip into tomorrow’s scarcity.

For the buying and selling neighborhood, this was a putting shift in tone. One week: an excessive amount of oil. The following: not sufficient oil sooner or later.

Brent Technical Outlook

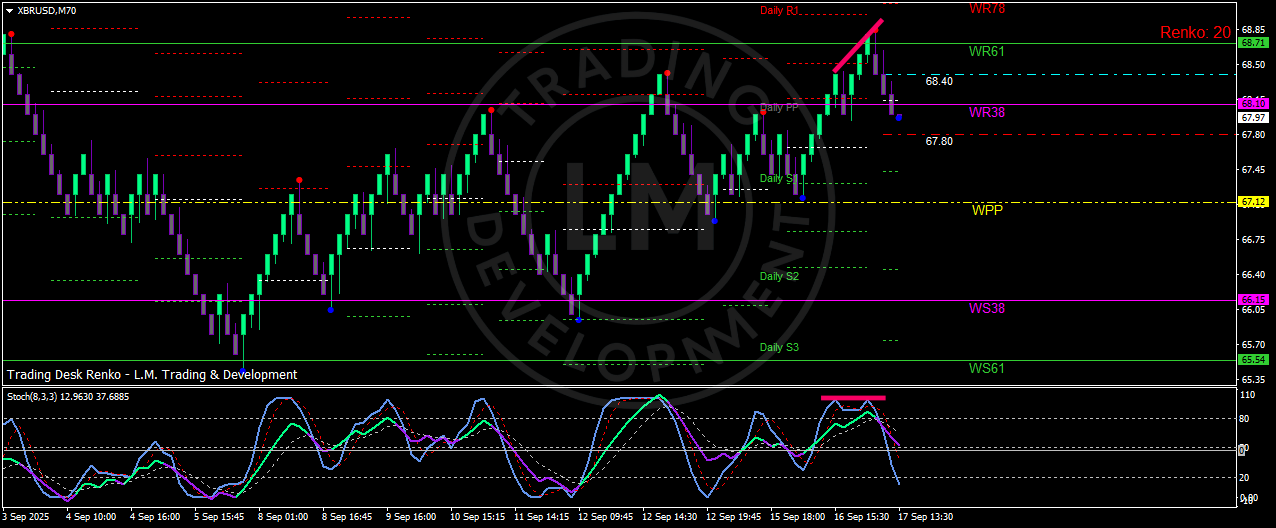

Technical ranges are reflecting this indecision.

| Resistance | Assist |

|---|---|

| WR78 – 69.14 | 68.40 (intraday pivot) |

| Day by day R1 – 68.70 | WR38 – 68.10 |

| 67.80 (native lows) | |

| WPP – 67.12 | |

| WS38 – 66.15 |

Bias: Bearish beneath 68.40. The rejection at WR78 69.14 mixed with bearish divergence on the Stochastic oscillator suggests momentum has light. Brief-term stress factors towards 67.80 and probably 67.10. Solely a breakout above 69.14 would reopen upside potential towards 69.50–70.00.

Buying and selling Implications

For short-term merchants, the oversupply narrative continues to be in management. Promoting rallies towards resistance is sensible so long as Brent stays capped beneath $69.14. Stock knowledge and U.S. gasoline demand stay key intraday drivers.

For medium- to longer-term merchants, the IEA’s warning on decline charges issues extra. If upstream funding stays weak, the provision cushion might erode rapidly. In that case, dips into help zones would possibly change into enticing accumulation factors, particularly if macro demand indicators stabilize.

This creates an uneven danger profile:

-

Draw back within the quick time period could also be restricted, as provide dangers stay within the background.

-

Upside shocks may very well be violent if sentiment flips on funding considerations or geopolitical disruptions.

Macro Drivers to Watch

-

U.S. Inventories: Weekly EIA stories stay essential for gauging demand.

-

China’s Information: Industrial manufacturing and retail gross sales figures will affect demand expectations.

-

OPEC+ Coverage: Any changes in provide quotas might alter the steadiness in This autumn.

-

Capex Bulletins: Oil majors’ funding plans will decide whether or not the IEA’s warnings materialize.

Conclusion

The oil market is dealing with a traditional commodity dilemma. Close to-term oversupply and weak demand are capping rallies and weighing on sentiment. On the identical time, the longer-term sustainability of manufacturing is doubtful as decline charges speed up.

For merchants, the message is obvious:

-

Respect the short-term bearish bias beneath $68.40.

-

Control helps at $67.80 and $67.10.

-

Be ready for volatility if capex or geopolitical headlines set off a re-pricing.

In different phrases, the market is trapped between right now’s surplus and tomorrow’s shortage.

Merchants ought to brace for uneven value motion as these two forces collide.