On-chain analytics agency Glassnode has defined how the Bitcoin worth pattern stays constructive so long as the asset trades above the short-term holder price foundation.

Bitcoin Is Nonetheless Sustaining Above Quick-Time period Holder Realized Value

In a brand new put up on X, Glassnode has mentioned in regards to the Realized Value of the Bitcoin short-term holders. The “Realized Value” right here refers to an indicator that retains observe of the associated fee foundation of the common investor or handle on the BTC community.

When the worth of the metric is larger than BTC’s spot worth, it means the buyers as an entire are sitting on some internet unrealized revenue. Then again, it being beneath the asset’s worth implies the general market is in a state of internet loss.

Within the context of the present subject, the Realized Value of a selected phase of the userbase is of curiosity: the short-term holders (STHs). This cohort contains the buyers who bought their tokens throughout the previous 155 days.

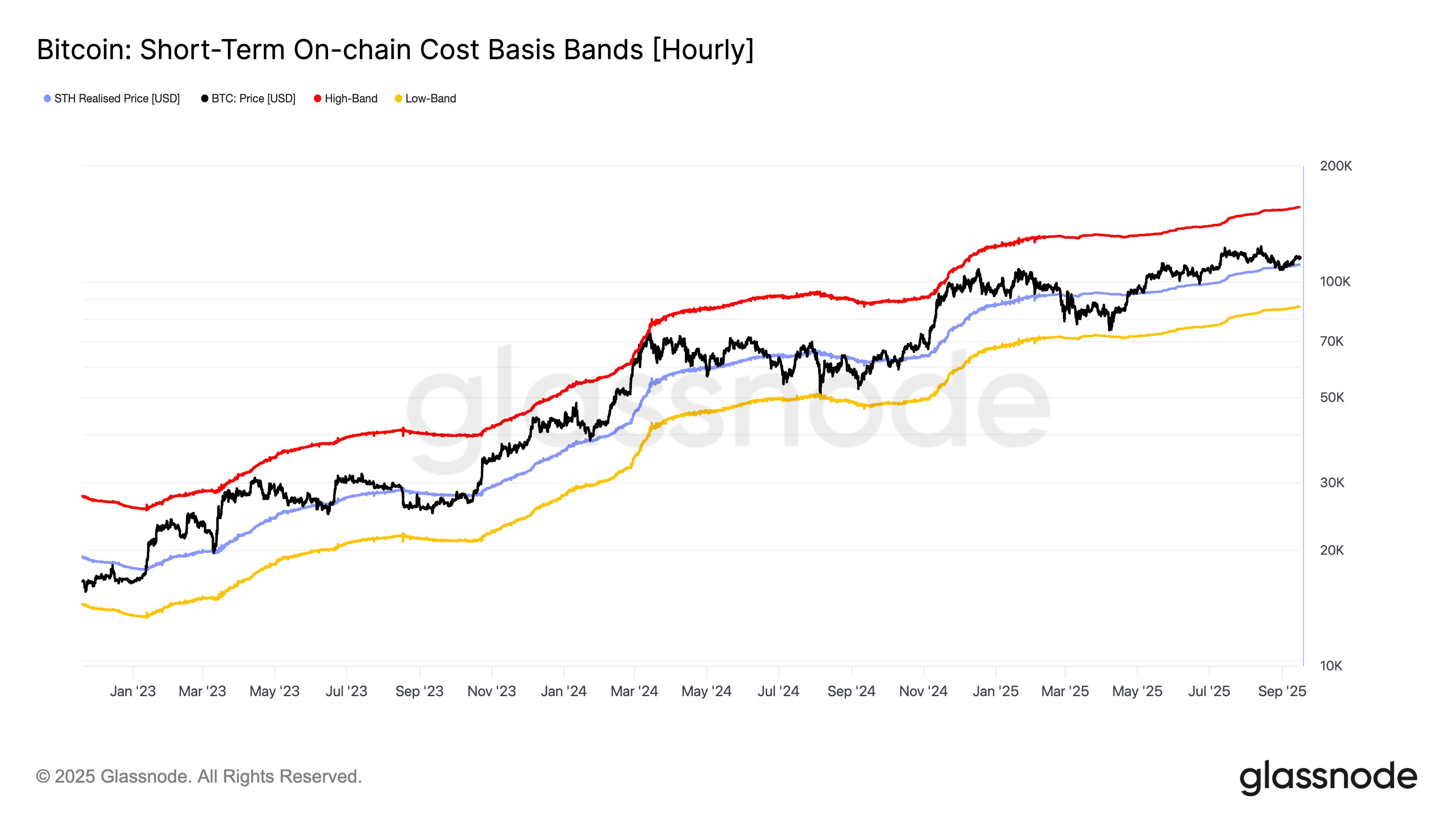

Now, right here is the chart shared by Glassnode that exhibits the pattern within the Bitcoin Realized Value for the STHs over the previous few years:

As displayed within the above graph, Bitcoin retested the STH Realized Value firstly of the month and located assist at it. Since then, the coin’s worth has seen some restoration.

This sample of the STH Realized Value performing as a assist barrier has truly been seen many occasions by means of this bull market. The explanation behind the sample might lie in investor psychology.

Statistically, the longer an investor holds onto their cash, the much less probably they grow to be to promote them sooner or later. For the reason that STHs have a comparatively low holding time, nevertheless, they don’t are typically resolute, and thus, simply make panic strikes when shifts happen out there.

The STHs can notably be inclined to panic when the cryptocurrency retests their break-even stage. When the market temper is bullish, the response comes within the type of shopping for. It’s because the STHs have a look at drawdowns to their price foundation as dip-buying alternatives.

Equally, STHs react to surges to their Realized Value by promoting throughout bearish intervals as an alternative, fearing that the asset would decline once more within the close to future and ship them again right into a state of loss.

For now, Bitcoin is sustaining above the STH Realized Value. “So long as the worth respects this stage, the pattern stays constructive,” notes the analytics agency. “Dropping this assist has coincided with phases of contraction or pullbacks.”

BTC Value

On the time of writing, Bitcoin is floating round $116,200, up nearly 5% during the last seven days.