Though Ethereum (ETH) remains to be up roughly 80% over the previous three months, the second-largest cryptocurrency by market cap seems to have misplaced its momentum recently, down 0.6% over the previous month.

Binance Ethereum Buying and selling In Impartial Zone

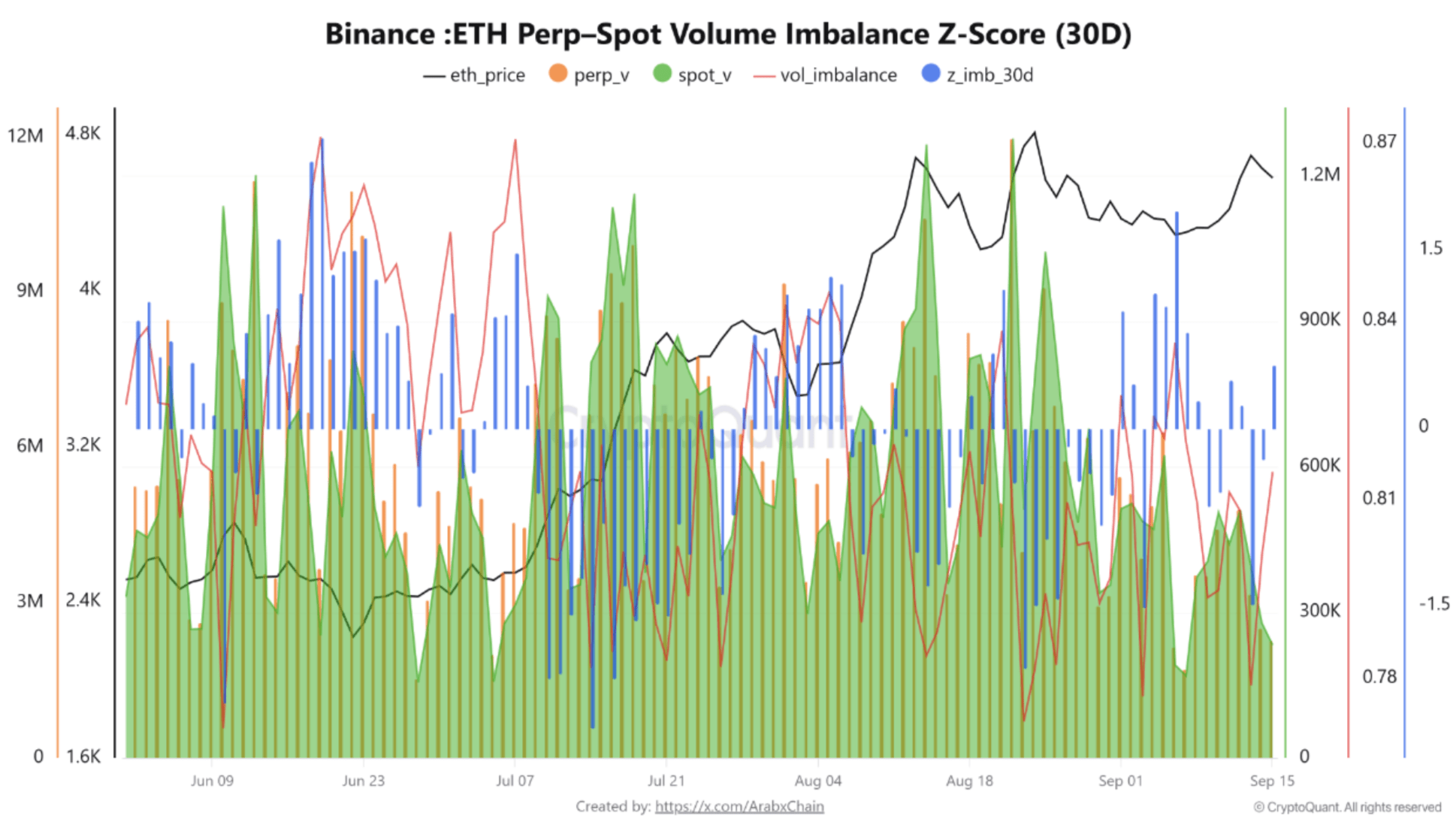

In keeping with a CryptoQuant Quicktake put up by contributor Arab Chain, Ethereum buying and selling on Binance throughout September 2025 is witnessing a interval of relative calm in comparison with different months. Notably, there was a decline within the imbalance between ETH spot and perpetual volumes.

Associated Studying

Commenting on ETH’s latest worth surge, which noticed it leap from $2,127 on June 15 to round $4,500 on the time of writing, Arab Chain famous that this rally was not supported by sturdy momentum. Neither the spot market nor leveraged speculators contributed to the value appreciation.

The CryptoQuant contributor introduced consideration to ETH’s Z-score, which has oscillated between 0.0 and -1.0 for many of September. Such a Z-score sometimes signifies the asset buying and selling in a impartial zone, with a slight tilt towards the spot market.

For the uninitiated, a Z-score measures how far an information level is from the imply, expressed in models of ordinary deviation. In buying and selling, it’s used to establish whether or not a price – like quantity or worth – is unusually excessive or low in comparison with its historic common.

In essence, ETH’s present Z-score implies that perpetual contracts are slowly dropping their dominance in buying and selling quantity. This might be on account of a number of causes, resembling speculators exiting the market or on account of elevated dependence on actual purchase/promote orders from precise traders.

The decline in perpetual buying and selling quantity is important in comparison with the interval between June and August. Consequently, the urge for food for leveraged hypothesis has dwindled too, an indication of rising warning available in the market. Arab Chain added:

Regardless of this decline, the spot market additionally confirmed restricted energy, reflecting a common lack of investor engagement. Spot quantity remained under the 500K–1M vary, which is considerably decrease than the peaks recorded in July and June.

The analyst cautioned that though the shortage of sturdy imbalances between the spot and perpetual markets could appear constructive at first, it might additionally imply there’s heightened uncertainty and stagnation pertaining to the path of ETH’s worth.

Is ETH Making ready For A New Rally?

Though ETH seems to be caught in limbo on account of its sluggish worth motion, some analysts are assured that the digital asset is prone to resume its bullish trajectory within the close to time period. For instance, ETH reserves on exchanges proceed to deplete at a speedy tempo.

Associated Studying

Equally, institutional demand for ETH continues to be sturdy, with some analysts forecasting ETH to climb to $6,800 by the tip of 2025. At press time, ETH trades at $4,439, down 1.6% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com