Bitcoin (BTC) has declined greater than 10% from its newest all-time excessive (ATH) of $124,128, recorded on Binance in August 2025. Nevertheless, contemporary on-chain knowledge means that the cryptocurrency could also be making ready for its subsequent bullish wave, as miners are beginning to present a structural shift in habits.

Bitcoin Miners Shift Technique – New Excessive Forward?

Based on a CryptoQuant Quicktake publish by contributor Avocado_onchain, latest on-chain knowledge hints at a structural shift in Bitcoin miner habits. On the similar time, varied different metrics level towards rising resilience within the Bitcoin community.

Associated Studying

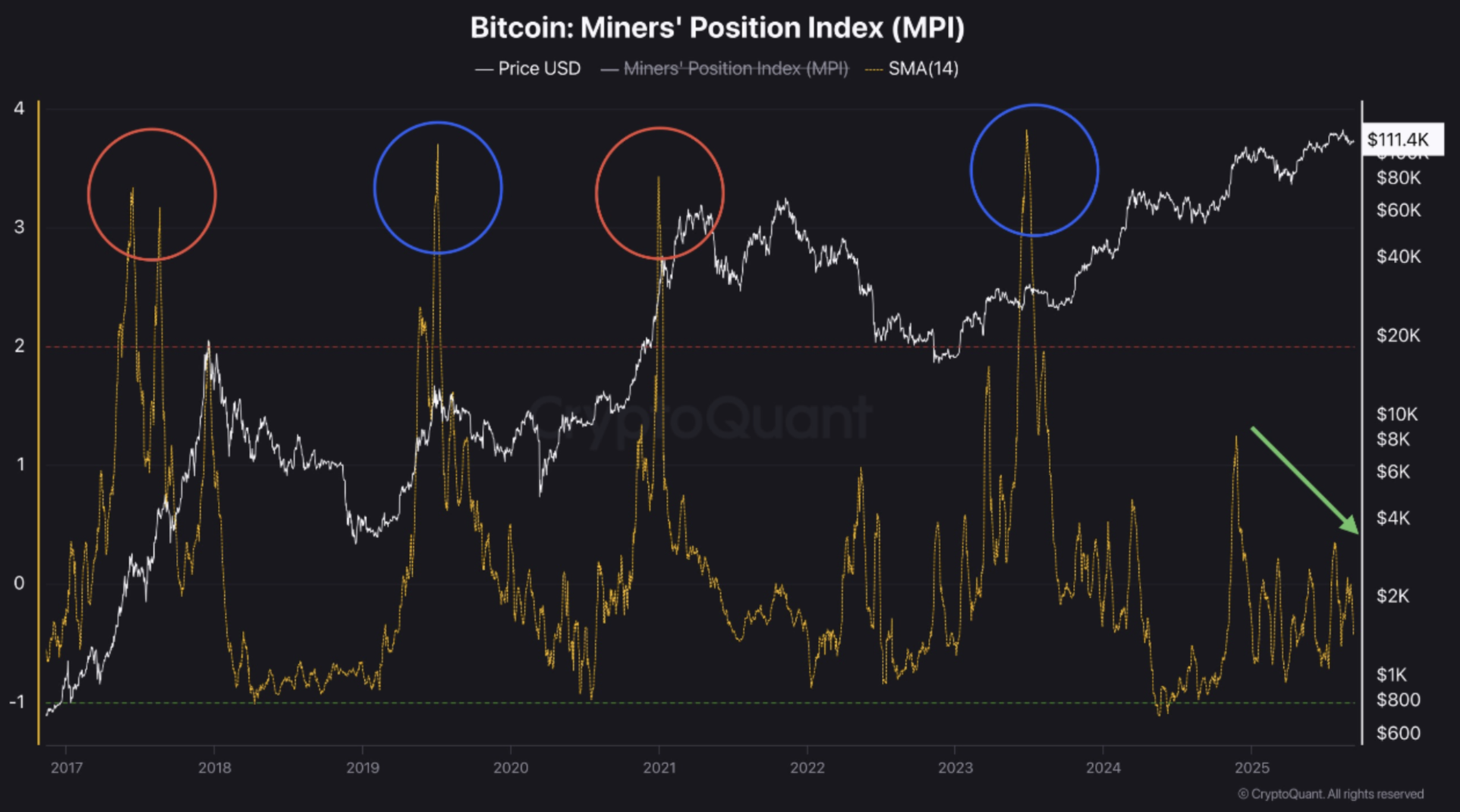

The analyst introduced consideration to the Miners’ Place Index (MPI), a metric that has traditionally proven sharp will increase in two situations – earlier than a halving when miners strategically promote their holdings, and in late phases of a bull market once they dump their holdings on retail traders.

For the uninitiated, the MPI measures the ratio of Bitcoin miners’ outflows – cash despatched to exchanges – relative to their one-year transferring common. A excessive MPI signifies that miners are promoting extra BTC than standard – signaling elevated promoting stress – whereas a low MPI suggests miners are holding or accumulating.

Nevertheless, the present market cycle exhibits a special pattern. Whereas some pre-halving promoting was evident, the late bull market sell-offs have been noticeably absent. Based on Avocado_onchain, there could possibly be two main causes for the shortage of sell-off.

First, the approval and success of spot Bitcoin exchange-traded funds (ETFs) could have had some affect on holders. Based on knowledge from SoSoValue, the overall web belongings tied in spot BTC ETFs at the moment stand at $144.3 billion – representing 6.5% of BTC’s complete market cap.

The opposite potential purpose for lukewarm gross sales of BTC at this stage of the market could possibly be the digital asset’s quickly rising adoption as a strategic reserve asset by main economies around the globe. In consequence, miners could also be shifting from short-term positive factors to long-term accumulation.

As well as, Bitcoin mining problem additionally not too long ago reached a brand new ATH, as its development curve developed a so-called “banana zone” of sharp will increase. The surge in mining problem displays rising participation within the Bitcoin community, along with strengthening its safety.

Opinion On BTC Is Cut up

Whereas the miners seem like holding BTC for the lengthy haul, some analysts predict that the highest cryptocurrency might not be out of the woods but. Crypto analyst Daan Crypto remarked that BTC could also be heading under $100,000.

Associated Studying

That mentioned, different analysts are extra optimistic about BTC’s prospects. In a latest evaluation, fellow CryptoQuant contributor CoinCare said that BTC could have one other main leg up within the bull cycle.

In the meantime, Fundstrat’s Tom Lee forecasted that BTC could surge to $200,000 by the tip of 2025. At press time, BTC trades at $114,139, up 1.5% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com