Bitcoin (BTC) continues to defend the $112,000 assist degree following days of tepid value motion, unable to present a transparent indication in regards to the potential path of its subsequent transfer. Newest trade knowledge from Binance exhibits a current dip in whale exercise, suggesting BTC possible averted one other large sell-off.

Bitcoin Defends $112,000 In opposition to Whale Promote-Off

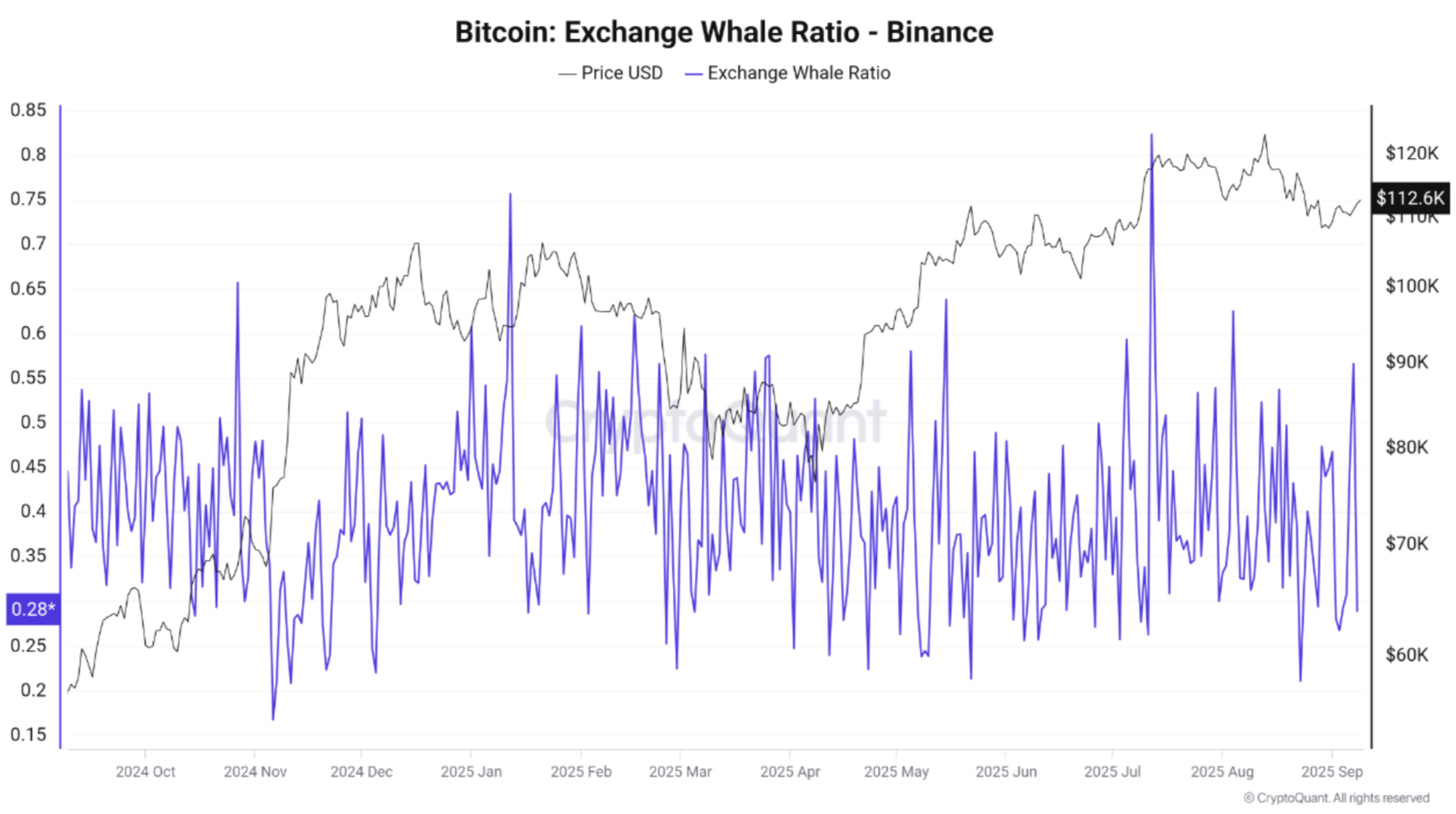

In response to a CryptoQuant Quicktake put up by contributor Arab Chain, current knowledge from the Binance crypto trade exhibits that there was a sudden spike in whale exercise on the trade on September 7, when the BTC: Change Whale Ratio surged to 0.55.

Associated Studying

Nevertheless, this surge was rapidly adopted by a decline within the metric, because the BTC: Change Whale Ratio tumbled to 0.28, on September 8. Nevertheless, the worth remained secure round $112,500, suggesting that whale actions had been short-lived and didn’t result in a sell-off in BTC.

The CryptoQuant analyst remarked that the autumn in whale stress towards the tip of the interval is a constructive short-term sign. In essence, the probability of a pointy value correction pushed by whale sell-offs on Binance is now considerably lowered. Arab Chain added:

The frequent whale fluctuations in late August and early September spotlight that main gamers are nonetheless shifting giant volumes – which means dangers stay, and the market may very well be caught off guard by a sudden transfer if substantial trade inflows are transformed into market orders.

Nevertheless, the analyst cautioned that the connection just isn’t at all times absolute. Though the rise within the metric has typically been related to a fall within the value of BTC, not each spike has led to a transparent decline in value.

As seen within the above chart, there have been cases of whale exercise surging past 0.5 for a number of days – accompanied by constructive internet inflows to exchanges. Arab Chain famous that such dynamics might result in a failure to take care of the $112,000 degree, and probably set off a drop to $108,000.

Historic knowledge for September exhibits that the start of the month is usually quiet when it comes to whale stress on Binance, aside from the occasional fast leap. Whereas this gives a safer surroundings for a gradual rise, it additionally offers whales an opportunity to exert stress in the marketplace, particularly if the general demand is weak.

Is BTC But To Hit Its Peak?

Whereas BTC is presently buying and selling roughly 10% beneath its newest all-time excessive (ATH) of $124,128, some crypto consultants opine that the flagship cryptocurrency is but to hit its peak for this market cycle.

Associated Studying

In current evaluation, Bitcoin researcher Sminston predicted that BTC might high out wherever between $200,000 – $290,000 someday in 2026. At press time, BTC trades at $112,639, down 0.1% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com