08 Sep Bitfinex Securities Approaches $250 Million Tokenised Securities Milestone and Units Out Plans to Attain Full Astana Worldwide Finance Centre Licence

Astana, Kazakhstan – September 8, 2025 – Bitfinex Securities, a regulated platform that allows entities to lift capital by the itemizing of tokenised securities, confirms it’s submitting its software emigrate from the Astana Worldwide Finance Centre’s (AIFC) FintechLab to grow to be an Authorised Funding Alternate.

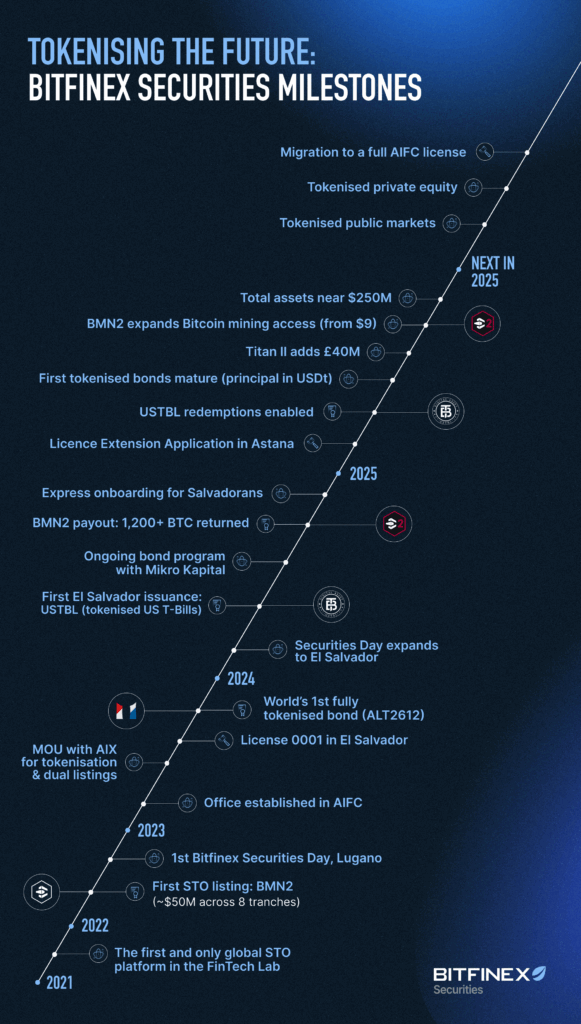

Bitfinex Securities joined the AIFC’s Fintech Lab, a regulatory sandbox to assist improvement of the area’s monetary trade, in September 2021. Since then, it has issued $206 million price of tokenised securities while within the AIFC FintechLab, together with Mikro Kapital’s common tokenised bond programme and the primary Blockstream Mining Notice. Bitfinex Securities has additionally been individually licensed in El Salvador, by the Commision Nacional de Activos Digitales – El Salvador, since April 2023.

Bitfinex Securities’ licence extension plans in Astana come because the platform confirms it’s on the right track to succeed in $250 million in tokenised property throughout the platform, and alerts the numerous momentum spearheading Bitfinex Securities’ progress. This yr has already seen quite a lot of highlights, together with:

- The direct itemizing of TITAN1 and TITAN2, Bitfinex Securities’ first tokenised fairness issuances, price a mixed complete of GBP 143 million;

- The profitable full redemption of Mikro Kapital’s first tokenised bond, which paid out USDt 630,000;

- The direct itemizing of Blockstream Mining Notice 2 (BMN2) to allow secondary market buying and selling alternatives from just below $9, primarily based on honest worth.

Paolo Ardoino, CTO of Bitfinex Securities stated: “We proceed to be pleased about the assist that we obtain from AIFC, who’re a confirmed innovator in regulation of digital property. After a profitable preliminary licence interval, we’re happy to verify we’re making use of to improve to a full licence in Astana this yr. It’s no shock that forward-looking jurisdictions equivalent to AIFC are seeing the advantages of offering a transparent and strong regulatory surroundings to draw and nurture corporations equivalent to Bitfinex Securities.”

Jesse Knutson, Head of Operations at Bitfinex Securities, commented: “Approaching $250 million in tokenised property on our platform is a vital milestone, and is a marker of the belief we’ve constructed with issuers. Given all of our listings are underpinned by the Liquid Community, it additionally highlights how the Bitcoin ecosystem is taking part in an vital position within the improvement of tokenised monetary markets. As urge for food for tokenised securities continues to develop, we sit up for increasing our listings to make Bitfinex Securities the pre-eminent platform for the complete spectrum of tokenised property.”

Bitfinex Securities can also be regulated in El Salvador, and was the world’s first worldwide digital asset platform to be licensed beneath the nation’s Digital Asset Issuance Regulation.

About Bitfinex Securities

Based in 2021, Bitfinex Securities seeks to harness the technological developments of the digital asset trade to remodel international capital markets. With real-time settlement, 24/7/365 buying and selling capabilities, entry to international liquidity, and assist for self-custody, Bitfinex Securities goals to create extra environment friendly, cost-effective, and seamless interactions between buyers and issuers. Bitfinex Securities is licensed and controlled within the Astana Worldwide Monetary Centre in Kazakhstan and El Salvador.

Media Contact at Bitfinex Securities