Key Findings

- Twenty-one states now taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities providers, items, and actions.

leisure marijuana (also referred to as hashish)—Alaska, Arizona, California, Colorado, Connecticut, Illinois, Maine, Maryland, Massachusetts, Michigan, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Virginia, and Washington. - The distinctive points raised by hashish taxation created all kinds of tax designs. These embrace advert valorem charges utilized on the wholesale and retail ranges, and advert quantum taxes levied individually on hashish seeds, flower (mature and immature), leaves, trim, clones, entire crops, concentrates, and edibles. These charges can differ by tetrahydracannibol (THC) content material within the product.

- The expertise of taxed authorized hashish markets demonstrates that tax charges needs to be low sufficient to permit authorized markets to undercut, or not less than acquire value parity with, the illicit market.

- The income potential from hashish is substantial. States collected practically $3 billion in marijuana revenues in 2022. Nationwide legalization might generate $8.5 billion yearly for all states.

- Tax consistency throughout jurisdictions can be necessary if interstate commerce is legalized.

- Efficiency-based taxation is good. Till testing turns into more cost effective, nevertheless, a weight-based tax or a hybrid weight-based tax primarily based on a restricted variety of efficiency classes is the simplest tax design.

Introduction

Marijuana taxation is among the hottest coverage points within the United States. Twenty-one states have applied laws to legalize and tax leisure marijuana gross sales: Alaska, Arizona, California, Colorado, Connecticut, Illinois, Maine, Maryland, Massachusetts, Michigan, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Virginia, and Washington.

Marijuana markets function underneath a novel authorized framework. Federally, marijuana is assessed as a Schedule I substance underneath the Managed Substances Act, making the drug unlawful to eat, develop, or dispense. States which have legalized consumption and distribution don’t actively implement the federal restrictions.

Among the many many results this creates, every state market turns into a silo. Marijuana merchandise can’t cross state borders, so your complete course of (from seed to smoke) should happen inside a single state. This uncommon scenario, together with the novelty of legalization, has resulted in all kinds of tax designs.[1]

On this paper, we discover hashish taxation. We focus on why marijuana needs to be taxed and the assorted strengths and weaknesses of various tax designs. We then analyze classes realized from leisure marijuana taxes throughout the U.S. states. A number of of those classes can inform tax reform in states that already tax leisure hashish and assist kind a blueprint for each the adoption of taxes in different states and federal coverage. We conclude with a abstract of greatest practices for marijuana taxation.

What Is Hashish and Why Tax It?

Marijuana is derived from the hashish sativa or hemp plant. Hashish sativa has lengthy been an agricultural crop grown throughout the USA to be used as industrial hemp. There are greater than 25,000 completely different merchandise that use industrial hemp throughout quite a lot of sectors.[2] Marijuana crops differ from industrial hemp not solely in look but in addition within the quantity of THC current within the plant.

THC is the primary psychoactive compound and is mostly used to outline the efficiency of the marijuana product, despite the fact that different compounds within the plant might affect the person. Industrial hemp typically has lower than 0.3 p.c THC, whereas marijuana crops comprise considerably greater ranges. Marijuana materials ready from the flowering tops or leaves often incorporates 0.5–5.0 p.c THC and hashish crops grown underneath managed hydroponic circumstances typically comprise 9-25 p.c THC.[3]

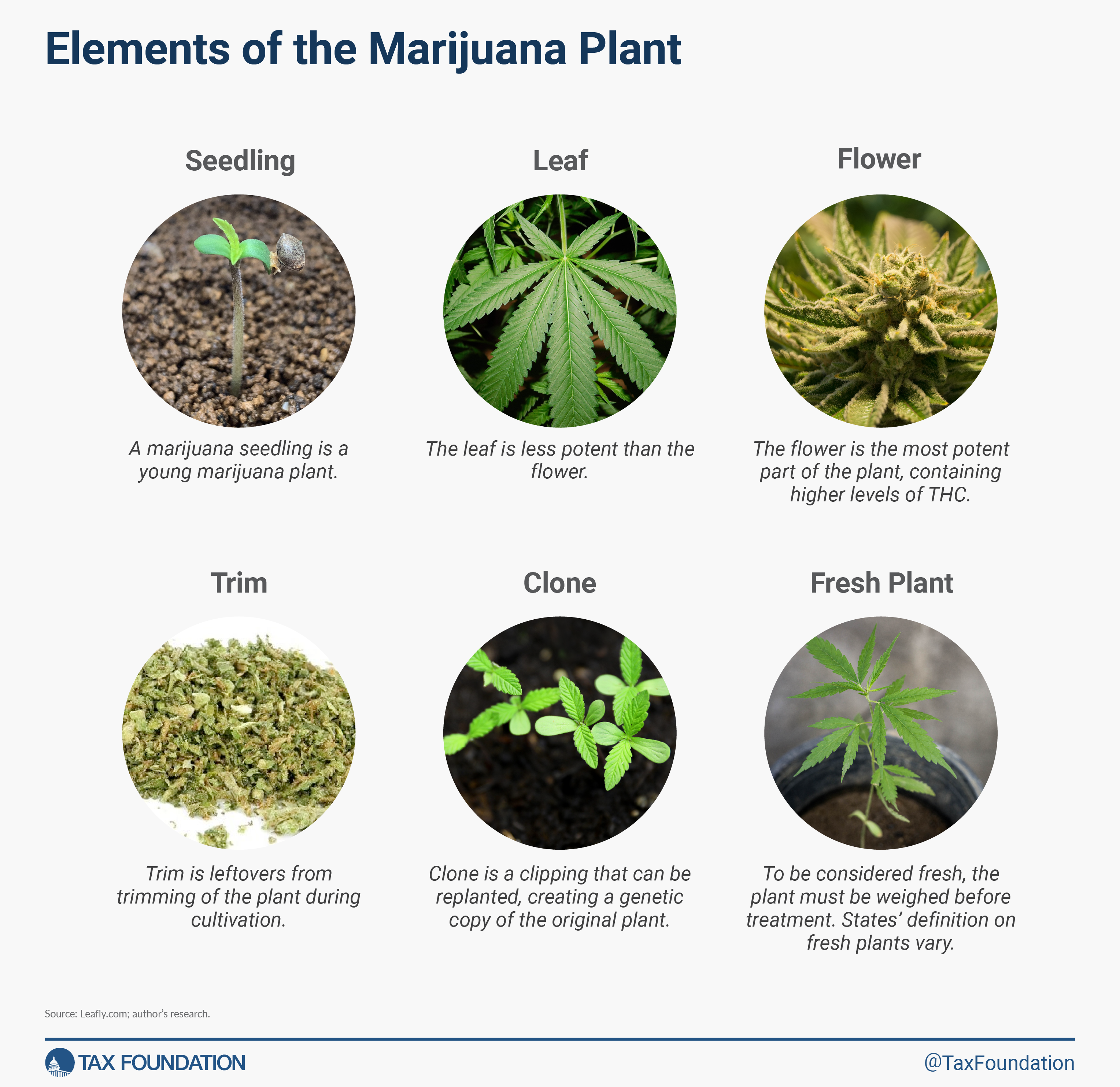

The marijuana plant has a number of parts, every with various qualities, THC efficiency, and makes use of. Separate markets have developed for the plant to be bought in several phases of improvement relying on the meant use by the buyer. A number of the hottest components of the marijuana plant are illustrated in Determine 1.

Marijuana is intoxicating, inflicting behavioral modifications and potential long-term damaging well being results. These traits prompted its prohibition and, the place legalized, product-specific “sin” excise taxes. Marijuana intoxication is dose-related, and the quantity absorbed by the physique varies by the route of administration and the focus of the supply getting used.[4] Marijuana is usually smoked because of the speedy onset of signs, however marijuana will also be eaten (e.g., brownies) or drunk (e.g., marijuana tea).

The tutorial literature on hashish could be very younger, with out a consensus on the exterior harms of hashish consumption. This lack of consensus will increase the issue of figuring out a socially optimum tax design.

Hashish Tax Designs

The design of an excise taxAn excise tax is a tax imposed on a particular good or exercise. Excise taxes are generally levied on cigarettes, alcoholic drinks, soda, gasoline, insurance coverage premiums, amusement actions, and betting, and sometimes make up a comparatively small and unstable portion of state and native and, to a lesser extent, federal tax collections.

is necessary. Effectively-designed taxes generate income with far much less societal affect than poorly designed taxes.

Maybe the closest markets from which to reflect public coverage for hashish are the well-established taxes on alcohol and tobacco. Nonetheless, hashish markets haven’t advanced a standardized product like tobacco, the place taxes will be levied by stick (cigarette) or pack, neither is the intoxicating ingredient (THC) as simply measured as alcohol content material for an appropriately focused tax.

The ensuing tax panorama is chaotic, missing an academically supported consensus basis for tax coverage. Sure states apply particular taxes, others apply advert valorem taxes, and a few states apply a hybrid strategy that makes use of each.

Value

Advert valorem taxes add a proportion tax to the value of a transaction. Value-based taxes will be utilized at any location within the provide chain, however are mostly utilized to both wholesale transactions or retail gross sales.

Essentially the most engaging characteristic of price-based taxes is that they’re comparatively easy to manage. Forty-five states already administer a common gross sales taxA gross sales tax is levied on retail gross sales of products and providers and, ideally, ought to apply to all remaining consumption with few exemptions. Many governments exempt items like groceries; base broadening, corresponding to together with groceries, might hold charges decrease. A gross sales tax ought to exempt business-to-business transactions which, when taxed, trigger tax pyramiding.

, and hashish can merely be added to the present tax baseThe tax base is the full quantity of earnings, property, property, consumption, transactions, or different financial exercise topic to taxation by a tax authority. A slim tax base is non-neutral and inefficient. A broad tax base reduces tax administration prices and permits extra income to be raised at decrease charges.

. A separate excise tax is considerably extra administratively expensive, however not a lot. In these states, the infrastructure and procedural methods are already in place for price-based tax collections and remissions. The compliance prices related to incorporating one other advert valorem tax are marginal.

Value-based taxes additionally seize a comparatively constant proportion of general spending out there. The charges don’t should be adjusted for inflationInflation is when the final value of products and providers will increase throughout the financial system, decreasing the buying energy of a forex and the worth of sure property. The identical paycheck covers much less items, providers, and payments. It’s typically known as a “hidden tax,” because it leaves taxpayers much less well-off attributable to greater prices and “bracket creep,” whereas rising the federal government’s spending energy.

or for many modifications in shopper conduct.

Value-based taxes end in greater tax funds on costlier merchandise, typically—however imperfectly—leading to greater funds for (presumably higher-priced) stronger and premium merchandise which might be extra generally bought by shoppers with greater incomes.

Value-based taxes have two main drawbacks. First, from a theoretical perspective, the social harms of hashish consumption aren’t brought on by the value of the product, however relatively by the amount of the product consumed. Whereas value and amount are associated, a poorly focused tax runs the chance of failing to perform its objectives (each elevating income and marginally deterring consumption) if market dynamics shift.

Second, income from advert valorem taxes will be extremely unstable. In a market system, costs quickly alter to altering market circumstances. As costs alter, so would any tax revenues tied to these costs.

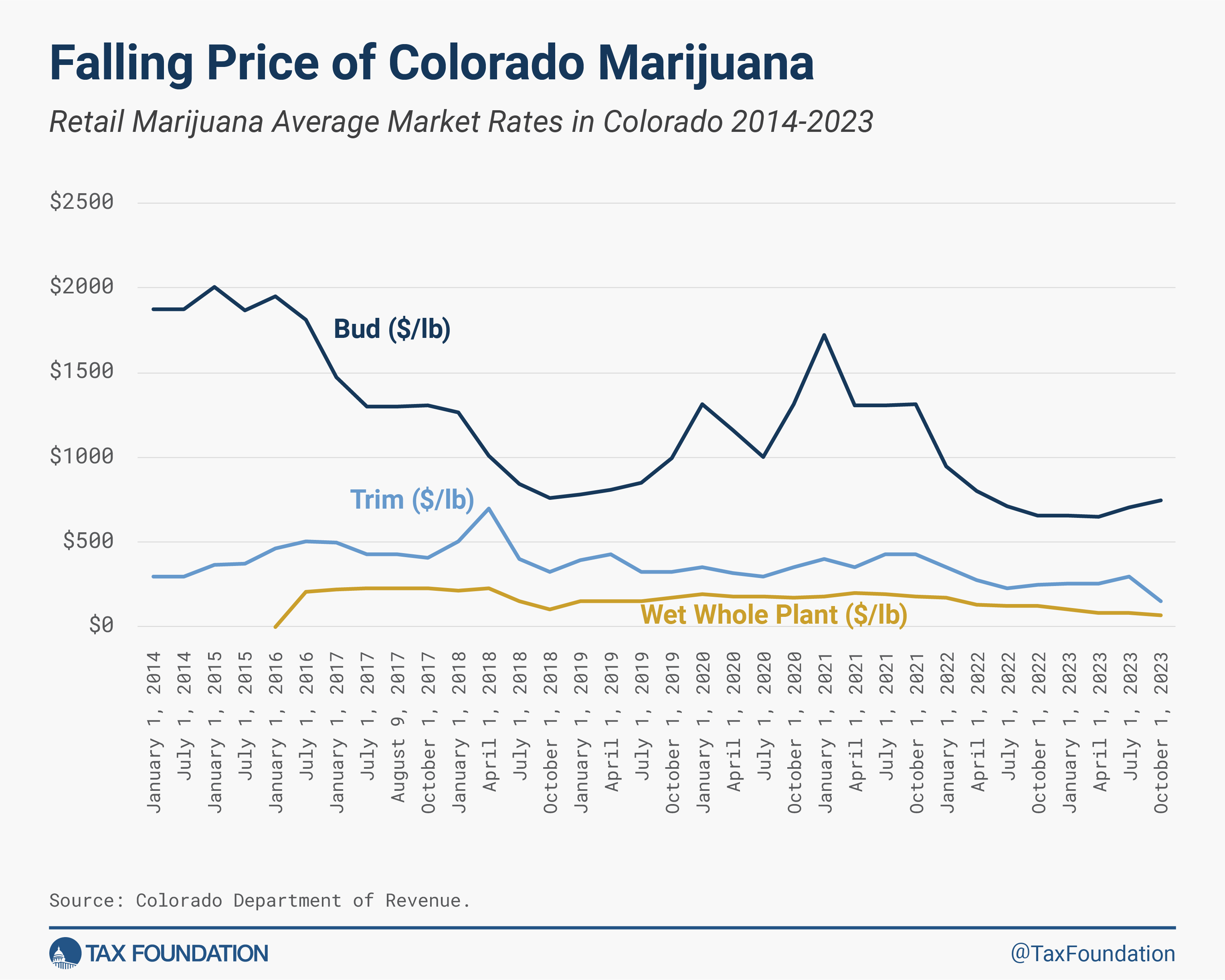

Hashish markets have skilled sizable shifts previously decade. As authorized hashish markets matured, so did rising operations. Suppliers entered the market and have been capable of scale their operations with time. The end result has been a gentle decline in value after a market has been established for a couple of years. If hashish have been legalized nationally, ending the prohibition on interstate gross sales, costs could be anticipated to drop much more precipitously.

Determine 2 exhibits the typical retail value of marijuana merchandise in Colorado for the previous decade. At first of 2014, the value for a pound of marijuana bud was $1,876. Over time, the costs steadily fell, reaching an all-time low for recorded authorized gross sales value in April of this 12 months, at $658.

Colorado levies two separate excise taxes on hashish: 15 p.c on the wholesale value and one other 15 p.c on the retail gross sales value. The whole lot of the wholesale tax revenues are devoted to the state’s fund for repairing and changing Colorado’s most needy public faculty amenities, the Constructing Glorious Colleges As we speak (BEST) fund. The retail excise tax income is shared between main applications for training, well being care, human providers, and corrections.

As the value of hashish fluctuates, and in Colorado’s case falls considerably, so does funding for any applications tied to these income streams. The volatility of revenues from price-based excise taxes is usually a vital disadvantage to their implementation.

Selecting whether or not to use advert valorem taxes on the retail or wholesale degree equally entails weighing trade-offs. Taxes utilized on the wholesale degree require fewer tax remitters and usually have lighter compliance and administration prices. The main problem to the effectiveness of wholesale taxes is tax avoidance by vertically built-in corporations. A completely built-in agency that grows crops from seeds and possesses its product till the purpose of sale by no means really sells the product as a wholesaler. If mandated to report an inter-company sale, the operator can keep away from price-based taxes by promoting the product internally at little or no value till the purpose of the retail sale.

When authorized markets first opened in Colorado, for instance, hashish retailers have been initially required to domesticate not less than 70 p.c of the hashish they bought. The vertical integration made it tough for tax authorities to implement the state’s 15 p.c wholesale value tax and resulted in regulators adopting a de facto weight-based system, by which hashish “bought” on the wholesale degree was topic to a tax primarily based on a single estimated common value of hashish, relatively than on a “sale” value reported by the agency.[5]

Amount or Weight

Particular advert quantum taxes will be less complicated than advert valorem taxes as a result of the tax will be calculated primarily based on weight, quantity, or amount as an alternative of requiring an estimated worth of the product. Cigarette excise taxes are utilized per pack and gasoline excise taxes are utilized per gallon, for instance.

The rule of thumb for excise taxes focusing on harm-generating merchandise is that the tax base ought to apply to the harm- or external-cost-causing component.[6] Concentrating on the harm-causing component greatest permits market individuals to include any exterior results into their decision-making. Amount-based taxes additionally assist higher align the tax base to the tax’s goal than advert valorem taxes.

Weight-based taxes produce better income stability than price-based taxes as a result of combination consumption fluctuates lower than market costs. Weight-based taxes additionally keep away from the price-based challenges related to vertically built-in corporations.

Weight-based taxes have two vital disadvantages. First, weight-based taxes don’t account for hashish efficiency. A tax primarily based on weight will incentivize the manufacturing of stronger hashish to decrease the tax paid per THC content material. Product high quality substitution, usually referred to as the “third legislation of demand,” is an issue that plagues excise taxation, as weight-based taxation incentivizes shoppers to change towards stronger or harmful merchandise.[7]

Weight-based methods will also be extra burdensome for companies and tax collectors. In 2022, California eradicated its weight-based cultivation tax and shifted the purpose of assortment and remittance from distributors to retailers. This laws obtained help from each the business and legislators, with Governor Newsom selling the modifications within the state’s finances by saying, “These coverage modifications intention to drastically simplify the tax construction, take away pointless administrative burdens and prices, quickly scale back the tax price to help shifting shoppers to the authorized market, and stabilize the hashish market with insurance policies which might be extra clear and may higher alter to market modifications.”[8]

Efficiency

On paper, taxing marijuana primarily based on THC content material may very well be the simplest tax design as a result of it most straight captures the externalityAn externality, in economics phrases, is a aspect impact or consequence of an exercise that isn’t mirrored in the price of that exercise, and never primarily borne by these straight concerned in stated exercise. Externalities will be brought on by both manufacturing or consumption of a superb or service and will be constructive or damaging.

related to consumption. As referenced earlier, nevertheless, taxing hashish primarily based on THC content material is harder than taxing alcoholic drinks by alcohol content material.

Dependable and cost-effective potency-based testing stays a major barrier, notably for uncooked plant materials. Testing consistency nonetheless varies throughout labs and a large proportion of product is destroyed throughout the testing course of.

A 2020 research estimated the price of testing compliance in California markets.[9] The gear and startup prices for a brand new lab exceeded $1.5 million and the annual prices of operations, upkeep, and salaries required greater than $1 million.

The authors discovered a median testing value of $136 per pound of dried hashish flower. That quantities to about 10 p.c of the 2019 common wholesale value or about 14 p.c of the September 2023 wholesale value.

So far, three states—Connecticut, Illinois, and New York—incorporate THC content material into their tax regimes. Classes from these and different states present helpful data for tax coverage throughout all U.S. States and for potential federal laws.

Classes from Hashish Taxation in U.S. States

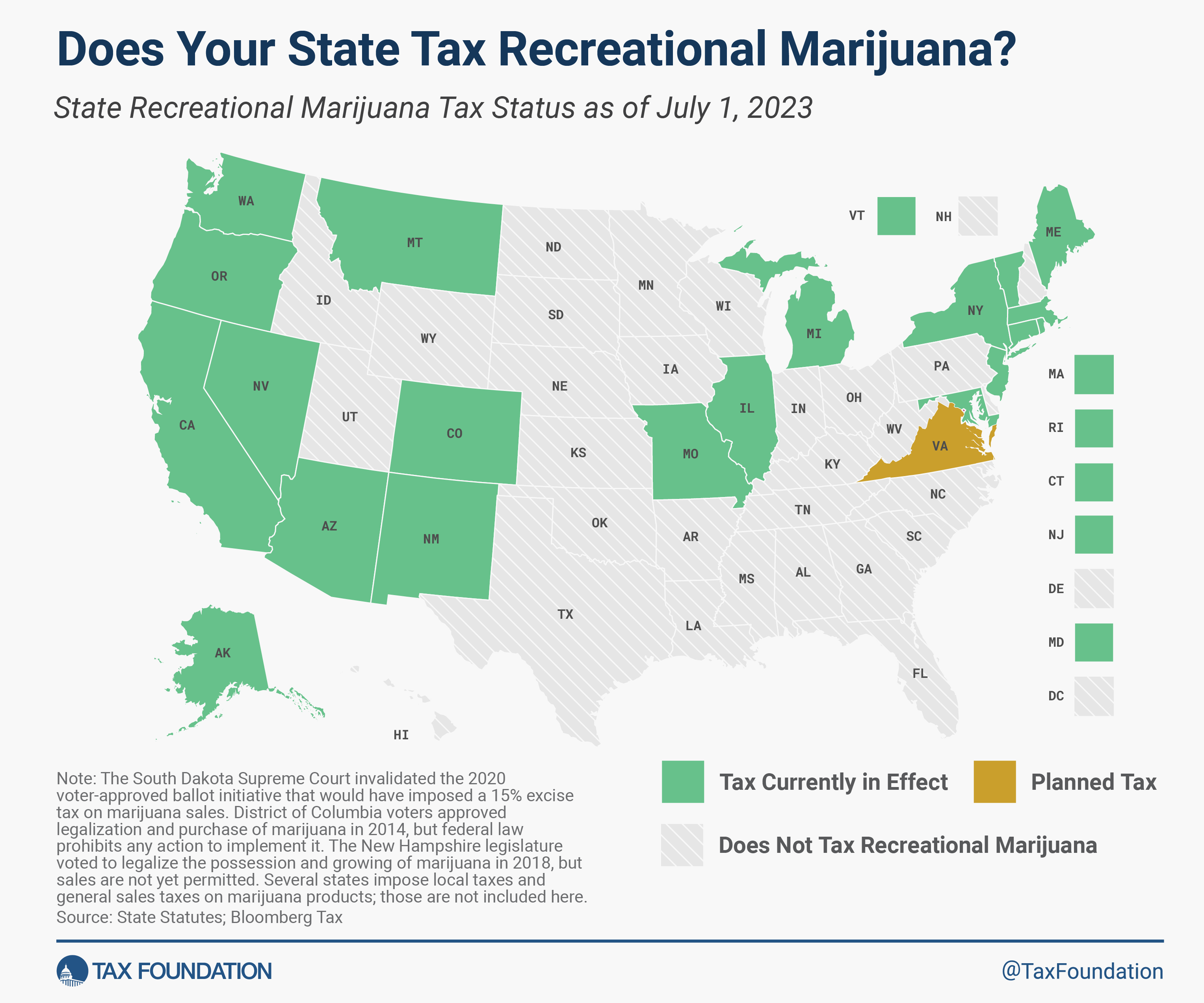

With the addition of Missouri and Maryland in 2022, 21 states have applied laws to legalize and tax leisure marijuana gross sales. The map beneath highlights state tax coverage on leisure marijuana.

The distinctive therapy of hashish has resulted in all kinds of tax designs.[10] Desk 1 beneath illustrates the number of tax insurance policies applied throughout the U.S. states.

States apply a spread of various insurance policies. Advert valorem charges are utilized on the wholesale and retail ranges, starting from 6 p.c in Missouri (as a standalone tax, although advert valorem charges go as little as 3 p.c in Connecticut, which applies a hybrid tax) to 37 p.c in Washington. Particular taxes are levied individually on hashish seeds, flower (mature and immature), leaves, trim, clones, entire crops, concentrates, and edibles, and may differ by THC content material within the product.

A number of necessary classes emerged from the rollout of marijuana legal guidelines and the adoption of authorized markets.

1. When designing the tax, charges needs to be low sufficient to permit authorized markets to undercut, or not less than acquire value parity with, the illicit market.

Figuring out the social prices of marijuana consumption is tough as a result of the educational literature on the subject could be very younger, and since some prices could be lowered by legalization. Present analysis estimates counsel that hashish, the place authorized and taxed, is commonly overtaxed, stopping authorized markets from capturing extra of the market exercise that occurs in black markets.[11]

2. The income potential from authorized marijuana markets is critical. These revenues might take years to materialize after legalization, nevertheless, and revenues can be unstable, notably if taxes are levied advert valorem as an alternative of advert quantum.

Desk 2 summarizes the marijuana tax revenues (leisure plus medical) collected by states in 2022. The desk additionally presents an estimated tax potential for states utilizing the typical income per marijuana-using resident ($171) from states that had operational leisure marijuana markets for a full 12 months in 2022—Alaska, Arizona, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Montana, Nevada, Oregon, and Washington.

In 2022, states collected practically $3 billion in (medical plus leisure) marijuana tax revenues. The most important and longest-established markets generated essentially the most income in California, Washington, and Colorado. Within the first quarter of 2023, 10 states—Arizona, Colorado, Maine, Massachusetts, Michigan, Montana, Nevada, New Mexico, Oregon, and Washington—generated extra income from hashish than from both alcohol (9 states) or tobacco (Washington).

Marijuana revenues generated a couple of p.c of whole revenues in 5 states—Alaska, Colorado, Montana, Nevada, and Washington—within the first quarter of 2023, with marijuana revenues comprising practically 2 p.c of all income collected in Colorado.

3. Tax design consistency throughout jurisdictions is necessary.

Whereas state hashish operations stay siloed, variations in tax coverage throughout states are inconsequential. Nonetheless, as soon as interstate commerce is permissible, alternatives for tax arbitrage can be substantial if present state tax designs usually are not reformed. Tobacco markets illustrate the big alternatives for tax arbitrage when the one distinction in tax design is the tax price, and hashish tax designs have considerably better variations than solely tax charges.[12]

Producers in states that tax solely uncooked product, for instance, might doubtlessly face double taxationDouble taxation is when taxes are paid twice on the identical greenback of earnings, no matter whether or not that’s company or particular person earnings.

of their merchandise if exported into states that tax solely remaining retail gross sales. However, product exported in states with solely retail taxes into states with solely uncooked materials taxes might go untaxed altogether.

Any federal taxes would pyramid on prime of state taxes, compounding the consequences of taxation. Additional, for states that elect to make use of a distinct methodology of taxing hashish than that which the federal authorities finally makes use of (e.g., if the federal authorities applies an advert valorem tax, however the state applies an advert quantum tax), compliance prices will improve considerably.

These points mustn’t function a deterrent to federal legalization or the introduction of interstate commerce. Relatively, states ought to put together to regulate their tax designs as wanted.

Greatest Practices for Hashish Taxation

Taxing marijuana is advanced, partially as a result of an array of marijuana consumption merchandise exists. Marijuana will be smoked, with completely different strands having completely different efficiency ranges of THC, or liquid hashish extracts and concentrates can be utilized within the creation of edible or drinkable merchandise, with various ranges of THC.

The answer to marijuana taxation is to tax by efficiency the place doable, and weight the place THC content material is impractical to measure. The load-based strategy would seize hurt derived from using smokable merchandise. Finally, when product testing for THC content material in plant supplies turns into more cost effective, merchandise taxed by weight can transition into being taxed by efficiency. Within the brief time period, a weight-based strategy captures externalities higher than an advert valorem system and is easy sufficient to permit new merchandise to enter the market with out prohibitively excessive boundaries to product testing merely for tax functions.

A hybrid weight-potency tax might allow greater tax charges for stronger merchandise with a restricted variety of classes. This may permit for greater tax charges on stronger merchandise whereas limiting the prices of testing. A base tax price may very well be set by weight for hashish merchandise containing lower than 10 p.c THC; that price might double for merchandise with 10 p.c to 25 p.c THC after which double once more for merchandise containing 25 p.c THC or extra.

Taxes by efficiency develop as THC content material will increase within the product, making extra concentrated merchandise costlier and yielding extra income, reflecting greater societal prices related to stronger merchandise. A particular, separate class needs to be created for edibles and concentrates as they’re simpler to check. Neither weight nor efficiency are good, however each are considerably higher proxies than price-based taxes.

Moreover, hashish taxes needs to be levied early within the worth chain, much like alcohol and tobacco excise taxes, to restrict the variety of taxpayers. Excise tax income needs to be appropriated to related spending priorities associated to the exterior harms created by marijuana consumption, corresponding to public security, youth drug use training, and cessation applications.

Authorized markets for hashish merchandise are nonetheless of their infancy, as are the tax insurance policies utilized to these markets. A easy, low-rate, and low-cost tax system has the potential to boost vital quantities of income, whereas concurrently lowering social harms from hashish by bringing illicit market transactions right into a authorized market framework.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

[1] Adam Hoffer, “World Excise Tax Purposes and Traits,” Tax Basis, Apr. 7, 2023, https://taxfoundation.org/analysis/all/international/global-excise-tax-policy-application-trends/.

[2] David G. Kraenzel, Tim Petry, Invoice Nelson, Marshall J. Anderson, Dustin Mathern, and Robert Todd, Industrial Hemp as an Various Crop in North Dakota, North Dakota State College, Jul. 23, 1998, https://www.researchgate.web/publication/23514402_Industrial_Hemp_As_An_Alternative_Crop_In_North_Dakota.

[3] N. NicDaéid and Okay.A. Savage, “Classification,” in Encyclopedia of Forensic Sciences (Second Version), ed. Jay A. Siegel, Pekka J. Saukko, Max M. Houck (Educational Press, 2013), 29-35.

[4] Anisha R. Turner, Benjamin C. Spurling, and Suneil Agrawal, “Marijuana Toxicity,” in StatPearls (2023), https://www.ncbi.nlm.nih.gov/books/NBK430823/.

[5] Pat Oglesby, “Colorado’s Loopy Marijuana Wholesale Tax Base,” Heart for New Income, Mar. 27, 2014, https://ssrn.com/summary=2351399.

[6] Adam Hoffer, “World Excise Tax Purposes and Traits,” Tax Basis, Apr. 7, 2023, https://taxfoundation.org/analysis/all/eu/global-excise-tax-policy-application-trends/.

[7] Todd Nesbit, “Excise Taxation and Product High quality Substitution,” in For Your Personal Good: Taxes, Paternalism, and Fiscal Discrimination within the Twenty-First Century (Arlington: Mercatus Heart at George Mason College, 2018).

[8] “Might Revision, 2022-23,” State of California, Might 13, 2022, https://ebudget.ca.gov/2022-23/pdf/Revised/BudgetSummary/FullBudgetSummary.pdf.

[9] Pablo Valdes-Donoso, Daniel A. Sumner, and Robin Goldstein, “Prices of hashish testing compliance: Assessing obligatory testing within the California hashish market,” PloS one 15: 4 (2020), https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7179872/.

[10] This brief video summarizes a number of the primary points round hashish taxation in the USA: https://taxfoundation.org/hashish/.

[11] Jason Childs and Jason Stevens, “The state should compete: Optimum pricing of authorized hashish,” Canadian Public Administration 62:4 (2019): 656-673.

[12] Adam Hoffer, “Cigarette Taxes and Cigarette Smuggling by State, 2020,” Tax Basis, December 2022, https://taxfoundation.org/knowledge/all/state/cigarette-taxes-cigarette-smuggling-2022/.

Share