Whats up and welcome to The GTMnow E-newsletter – the media model of VC agency, GTMfund. Construct, scale and make investments with one of the best minds in tech.

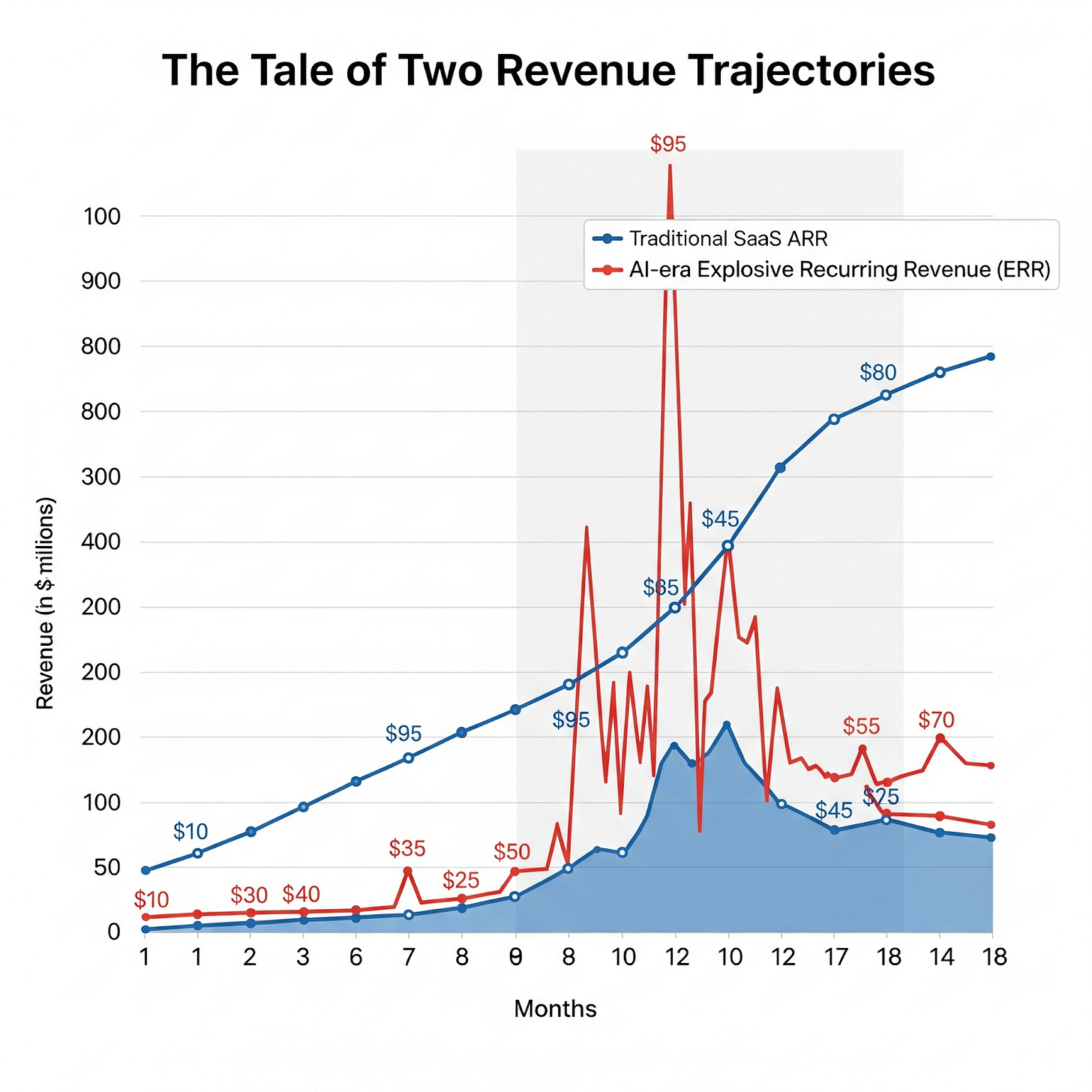

Contracts have modified within the age of AI, and meaning founders want to have a look at development numbers by a brand new lens. Going from $0 to $2M in six months could sound spectacular, however in apply that could possibly be based mostly on short-term pilots, with half of that income gone as soon as the trials expire.

As a substitute of the 12-month commitments that outlined SaaS for the final decade, many consumers are actually asking for brief pilots with simple opt-outs. These offers sign experimentation greater than conviction, and in consequence, an enormous share of AI income right this moment is what’s being referred to as Experimental Runrate Income (ERR).

ERR is actually unstable income from quick pilots, opt-out contracts, or offers that solely depend as soon as they convert. It might probably spike shortly as pilots stack up however simply as simply collapse when these trials don’t flip into long-term commitments. That’s why contracting self-discipline issues greater than ever. To show experiments into sturdy income, you might want to construction the deal the proper means after which handle the method to make sure conversion.

This problem is one that each AI firm is going through, but it’s not often coated within the broader dialog. This version breaks down each side.

Harmonic helps you uncover one of the best startups means forward of the competitors. We use it at GTMfund, as do hundreds of traders at corporations like USV and Perception. GTM groups at corporations like Notion and Brex additionally depend on the platform to remain forward.

Harmonic tracks tens of millions of startups and allows you to search utilizing easy filters or pure language to match precisely what you’re on the lookout for, so you possibly can shortly consider and perceive if it’s a match.

At GTMfund, we also have a personal Slack channel referred to as #companywatchlist powered solely by Harmonic.

ARR vs. ERR: Why each greenback isn’t equal

New benchmarks are circulating, comparable to a16z’s newest development knowledge for early-stage corporations, however topline income numbers don’t inform the complete story. Within the AI period, contracts look very completely different, which adjustments how we should always take into consideration Annual Recurring Income (ARR).

When you don’t want a refresher on ARR, it’s price underlining why it issues: retention and recurrence. True ARR is predictable and straightforward to forecast. It turns into extra worthwhile over time as prospects – who have been costly to accumulate – flip into secure, recurring money circulate.

That is the place contracts in right this moment’s AI panorama are impacting ARR. As a substitute of signing clear, 12-month commitments that outlined SaaS for the final 15+ years, consumers are actually asking for brief pilots with simple opt-outs. The usual we’re seeing is a 3-month pilot with a pre-defined conversion to an annual contract. The shopper can stroll away at any time inside the trial interval with no penalty.

This new actuality presents two key challenges:

-

How income will get reported. Many groups are reserving pilot income as ARR in decks and updates, even when the client isn’t paying full worth but and might churn in 12 weeks. It’s not shocking to see corporations go from $0 to $1M ARR in 3 months with no visibility on how a lot is actual ARR versus pilot {dollars}.

-

How prospects see their dedication. From the customer’s perspective, this isn’t ARR but, it’s a trial balloon. They’re below stress to check AI instruments shortly, in order that they signal a number of pilots, run them throughout groups, and solely preserve those that stick.

This income is being framed as Experimental Runrate Income (ERR). ERR is inherently unstable – it may possibly spike shortly as pilots stack up however can simply as shortly collapse when these trials don’t convert.

The chance for founders is assuming ERR behaves like ARR. Pilots don’t assure long-term retention. Till they convert, deal with ERR as a number one indicator of demand, not the sturdy basis you possibly can scale headcount and burn towards. The market pull for a few of these AI instruments is in contrast to something we’ve seen earlier than, and that urgency is a big benefit for each startup.

The go-forward technique

The talk between ERR and ARR will not be as thrilling as chasing historic development charges, however it adjustments how offers are received, measured, and sustained. Income dynamics are shifting in methods founders and operators can’t afford to disregard.

1. Scrutinize your contracts

Each greenback isn’t equal. A $1.7M “run-rate” headline means little if half of it may possibly evaporate subsequent quarter. Go line-by-line and ask: What portion is true ARR versus ERR? Which contracts are absolutely dedicated, and that are nonetheless pilots with opt-outs? At Seed and Collection A, traders are studying these fastidiously.

2. Strain take a look at the funds story

Ask prospects (and your self) the place the funds is coming from. Is that this spend locked in, or is it sitting in an “experimental AI” line merchandise which will disappear? That’s not essentially a foul factor (it’s usually the place adoption begins), however you might want to know what milestones transfer you from “experimental” to “important” within the purchaser’s funds.

3. Align internally on income recognition

What do you name ARR? When are you able to guide income, and the way will you acknowledge it throughout the contract? Many first-time founders are navigating this for the primary time. With extra variability in pricing and contract construction, getting income operations proper from day one is foundational.

The excellent news is there’s by no means been a extra thrilling time to construct. However with development and buyer pull come quirks like evolving contract buildings and experimental budgets. As these experimental budgets harden into “must-have” line gadgets, founders who deal with income recognition as a strategic self-discipline can be in one of the best place to scale sustainably.

Tag @GTMnow so we will see your takeaways and assist amplify them.

Paul Williamson (ex-Plaid, $3M → $300M ARR) on sequencing GTM bets, recognizing high-value shoppers, and constructing forward-compatible roadmaps.

Hear on Apple, Spotify, YouTube or wherever you get your podcasts by looking out “The GTMnow Podcast.”

Espresso simply made Salesforce and your GTM stack chat-native. With their new MCP interface, now you can use ChatGPT 5 or Claude to tug solutions instantly from Salesforce, HubSpot, Google Workspace emails and conferences, and any enrichment knowledge tied to your contacts and accounts. As a substitute of clicking by dashboards, you possibly can simply ask questions like, “Which offers in my pipeline are caught previous 30 days?” or “Present me all enterprise accounts with open help tickets.” The solutions come again immediately, proper inside your AI assistant.

AngelList’s H1 2025 report reveals enterprise slowly stabilizing after a turbulent few years. AI and Robotics proceed to dominate, drawing practically 60% of all capital. Seed rounds are holding regular at round $20M, Collection B has climbed to $400M, and whereas many COVID-era startups are nonetheless below stress, the 2023–24 AI cohorts are rising because the clear winners.

-

Supervisor, Gross sales Improvement – EMEA at Vanta (Hybrid – Dublin, Eire)

-

Director of Buyer Success at Vividly (Distant – USA)

-

Development Advertising and marketing Supervisor at Alt (Distant – USA)

-

Enterprise Buyer Success Supervisor at Gorgias (Distant – Vancouver)

-

Vice President, Gross sales at Amper (Distant – USA)

See extra prime GTM jobs on the GTMfund Job Board.

When you’re seeking to scale your gross sales and advertising groups with prime expertise, we couldn’t suggest our associate Pursuit extra. We work carefully collectively to have the ability to present the highest go-to-market expertise for corporations on a non-retainer foundation.

Upcoming occasions you received’t need to miss:

-

GTMfund Dinner (personal registration): September 10, 2025 (San Francisco, CA)

-

Pavilion GTM Summit: September 23-25, 2025 (Washington, DC)

-

Nationwide Mall Stroll with GTMfund: September 25, 2025 (Washington, DC)

-

Dreamforce: October 14-16, 2025 (San Francisco, CA)

-

GTMfund Dinner (personal registration): October 22, 2025 (Austin, TX)

-

GTMfund Dinner (personal registration): November 18, 2025 (Toronto, ON)

-

GTMfund Dinner (personal registration): November 19, 2025 (New York, NY)

-

GTM x Founder Occasion (personal registration): November 20, 2025 (New York, NY) – for those who’re an AI-focused founder in NYC, hit reply to get the small print

Some GTMnow group (founder, operator, investor) love to shut it out – we recognize you.