After hitting its newest all-time excessive of $4,956 on August 23 on Binance, Ethereum (ETH) has been buying and selling in a good vary – oscillating between $4,200 to $4,500 – giving little clues about its subsequent potential path. Nevertheless, latest change knowledge recommend {that a} provide crunch could also be nearing for ETH.

Ethereum Value Secure Amid Trade Provide Decline

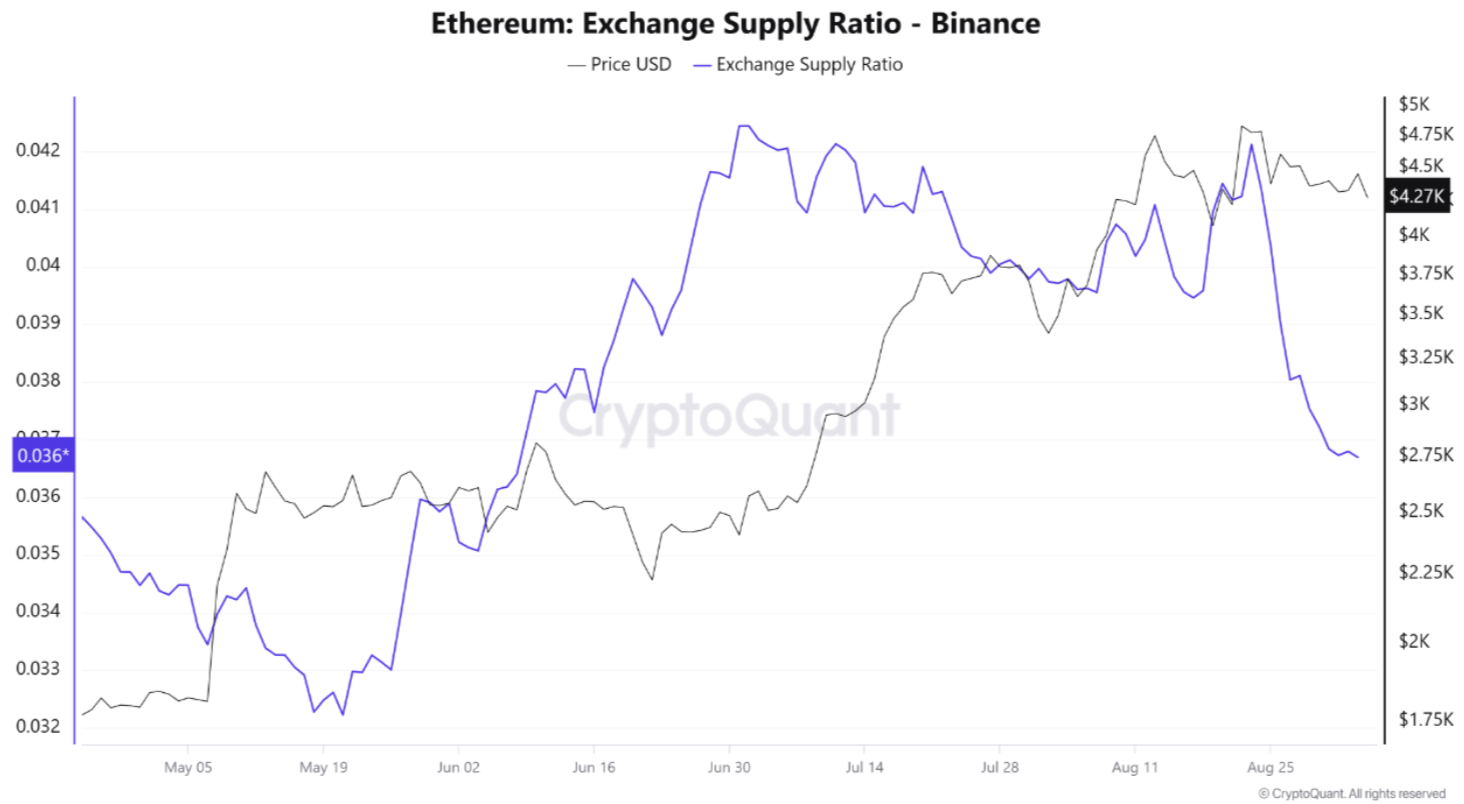

Based on a CryptoQuant Quicktake publish by contributor Arab Chain, in the course of the interval between August 16 to September 3, Ethereum’s Binance Trade Provide Ratio (ESR) noticed a sharp decline.

Associated Studying

Though ETH’s value has remained within the mid $4,000 vary, its ESR tumbled from 0.041 to 0.037 – marking the largest decline throughout the noticed interval – in a matter of simply two weeks.

It’s value highlighting that ETH’s value has remained secure all this time, buying and selling near $4,400 on the finish of the interval. Based on the CryptoQuant analyst, such value habits can clarify two issues.

First, it indicators that traders are withdrawing from exchanges – together with Binance – at an accelerated tempo. Additional, it additionally exhibits rising confidence amongst ETH holders as they go for self-custody in chilly wallets as an alternative of maintaining their holdings on exchanges.

Arab Chain remarked {that a} mixture of secure value, declining change provide, and wholesome exchange-traded fund (ETF) inflows confirms that sellable provide is dwindling whereas the demand for the digital asset stays sturdy. They added:

Declines in ESR have traditionally preceded sturdy upward strikes, as decrease change liquidity limits sellers’ skill to push costs down. The present ESR ranges have fallen again to pre-June figures, suggesting that the market has successfully “flushed out” earlier profit-taking exercise and is now reaccumulating provide into long-term wallets.

ETH Coming into A New Bull Cycle?

The analyst concluded by saying that if ETH’s ESR continues to fall with out a corresponding decline in value, then it will imply that the market is getting into a brand new, institutional investor-led bull cycle. Three metrics particularly assist this prediction.

Associated Studying

The ETH market has seen a latest drop in leverage, which means there are fewer merchants with speculative positioning. Additional, most perpetual futures markets present impartial funding charges for ETH contracts. Lastly, the on-chain exercise by ETH whales has additionally subsided, which means long-term holders will not be promoting.

Additionally value noting is that the Ethereum blockchain’s fundamentals proceed to enhance. Newest knowledge exhibits that as a lot as 36 million ETH has been staked on the ETH community, additional elevating the potential of an ensuing provide shock.

Lately, Ethereum each day transactions additionally hit a 12-month excessive. Amid these bullish developments, seasoned business specialists will not be shying away from giving formidable ETH value predictions. At press time, ETH trades at $4,295, down 1.7% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com