05 Sep Chart Decoder Sequence: Common True Vary – The Volatility Software That Helps You Decide Targets and Take Income

Welcome again to the Chart Decoder Sequence, the place we translate our professional buying and selling instruments into methods you should use at this time.

Thus far, we’ve tackled:

At this time, we’re exploring ATR (Common True Vary), the indicator that solves certainly one of buying and selling’s largest puzzles: how a lot must you danger, and the place must you place your stops?

What ATR Actually Tells You

ATR was developed by J. Welles Wilder Jr. in 1978 as a part of his groundbreaking work on technical evaluation. In contrast to most indicators that target worth route, ATR measures one factor solely: volatility.

ATR solutions an important query: “How a lot does this market usually transfer?”

The calculation: ATR appears to be like on the “True Vary” for every interval, which is the most important of:

- Present Excessive – Present Low

- |Present Excessive – Earlier Shut|

- |Present Low – Earlier Shut|

Then it takes a transferring common of those True Vary values over your chosen interval (14 is the usual on Bitfinex, however you possibly can modify it to any interval you want)

Absolutely the values guarantee ATR all the time exhibits optimistic numbers, no matter whether or not gaps happen up or down.

Why ATR Issues:

ATR goes past context. It shapes how merchants handle danger, measurement positions, and set exits. Quite than counting on only a intestine feeling, it supplies goal measurement of market behaviour that instantly informs each buying and selling choice.

1. Smarter Cease Losses

Putting stops with out ATR is mainly guesswork. ATR exhibits you what counts as “regular” motion, so that you’re not thrown out by on a regular basis swings.

- Scalping stops (0.5× ATR): Utilized by high-frequency merchants who need fast exits on the first signal of bother. Solely efficient throughout low-volatility durations when market motion is predictable

- Customary stops (1× ATR): Gives sufficient room for regular worth fluctuations while sustaining affordable danger management

- Place stops (2× ATR): For merchants holding multi-day positions who have to survive regular each day volatility cycles with out untimely exit

2. Measurement Your Place Appropriately

Skilled danger administration is about sustaining constant danger publicity no matter market circumstances. As an alternative of buying and selling the identical measurement in each situation, you adapt smaller positions when volatility is excessive, bigger ones when it’s calm.

3. Recognizing Volatility Breakouts

A breakout accompanied by increasing ATR exhibits institutional participation and real directional conviction. When worth breaks key ranges however ATR stays flat, it typically signifies weak follow-through and better likelihood of reversal. Probably the most highly effective setups happen when worth breaks important ranges with ATR growth, confirming each route and momentum.

4. Set Revenue Targets

ATR multiples present a rational framework for setting practical revenue targets, serving to you step away from guesswork and towards consistency.

- Conservative: 1.5 × ATR

- Customary: 2 × ATR

- Aggressive: 3 × ATR

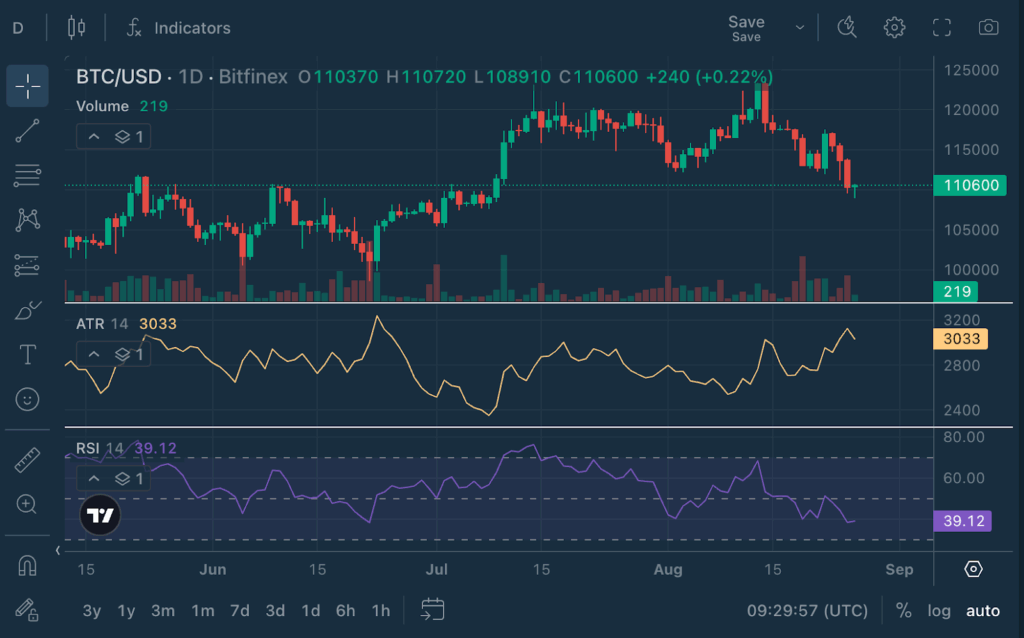

Actual Instance: BTC/USD Evaluation

Value: $110,500

ATR (14): 3,033

What this tells us:

Bitcoin’s latest common each day motion is about $3,033. This provides merchants clear context:

- A $3,000 transfer isn’t distinctive, it’s proper according to 1× ATR

- Cease loss round $3,000 (1× ATR) present regular respiratory room

- Revenue targets of $4,500–$6,000 (1.5–2× ATR) are practical for swing trades

- ATR at this degree indicators a reasonably risky market that calls for cautious place sizing and danger administration

ATR + Different Indicators:

ATR turns into much more highly effective when mixed with different instruments:

ATR + Bollinger Bands: When worth hits Bollinger Band extremes with excessive ATR, the transfer has extra conviction. Low ATR on the bands may recommend the intense gained’t maintain.

ATR + RSI: RSI oversold circumstances with rising ATR typically mark important bottoms. The excessive volatility exhibits actual promoting strain, making the oversold studying extra significant.

ATR + MACD: MACD crossovers with increasing ATR are extra dependable than these with contracting ATR. Volatility confirms the momentum shift has conviction.

ATR + Quantity + OBV: The triple mixture: OBV exhibits sensible cash route, Quantity exhibits quick conviction, ATR exhibits how a lot motion to count on. When all align, you might have high-probability setups.

Bonus Learn: ATR + RSI in Motion

Value: $110,600

ATR (14): 3,033

RSI (14): 39.12 (close to oversold)

What this tells us:

- RSI at 39 is under impartial (50) however above the oversold threshold of 30, displaying bearish momentum with out but being excessive.

- ATR at 3,033 exhibits each day volatility is elevated, which means swings are massive.

For merchants:

- Bearish RSI + excessive ATR = promoting strain is energetic and backed by volatility.

- If RSI approaches 30 whereas ATR stays excessive, the market is not only drifting decrease however being offered with pressure. Oversold circumstances would carry extra weight.

- If RSI begins climbing again up while ATR stays excessive, any bounce is prone to have some actual energy behind it, not only a weak restoration.

ATR Limitations to Bear in mind:

Lagging Indicator

ATR relies on previous worth motion. It tells you what volatility was, not essentially what it will likely be.

No Directional Bias

ATR doesn’t let you know which manner the market will transfer, solely how a lot motion is typical.

Smoothed Information

Like all transferring averages, ATR may be sluggish to react to sudden volatility modifications.

Market Context Issues

ATR throughout trending markets behaves otherwise than throughout sideways markets. All the time contemplate the larger image.

Professional Ideas for ATR:

1. Use A number of Timeframes

- Every day ATR: For swing buying and selling and place sizing

- 4-hour ATR: For day buying and selling setups

- 1-hour ATR: For exact entry timing

2. Financial Calendar Integration

ATR typically spikes round main information occasions. Plan your place sizing and cease placement accordingly.

3. Weekend Impact

Crypto markets commerce 24/7, however volatility patterns typically change on weekends. Take into account separate ATR calculations for weekdays vs. weekends.

Strive It on Bitfinex:

- Log in to Bitfinex

- Select any main buying and selling pair

- Add ATR indicator (Begin with the usual 14 durations. Size may be adjusted inside the ATR settings)

- Observe how ATR modifications throughout completely different market circumstances

- Follow utilizing ATR for cease loss placement

- Discover correlation between ATR and main worth strikes

Bitfinex. The Authentic Bitcoin Alternate.