The method for IRS catastrophe reduction declarations, present submitting deadlines for states this fall, and how you can make the method simpler.

Highlights

- In 2025, the IRS has supplied tax reduction for federal catastrophe areas in twelve states.

- There are various kinds of catastrophe tax reduction supplied by the IRS.

- Key submitting dates for particular states are September 25, November 3, and February 2.

Sadly, pure disasters occur. After they strike, persons are left to regain a way of normalcy as they work to rebuild their lives, houses, and companies. This contains serving to shoppers entry any tax reduction for pure disasters they qualify for.

In recent times, the frequency and prices of pure disasters have been rising. Between 1980 and 2024, the U.S. skilled 403 climate and local weather disasters, every inflicting damages and prices of $1 billion or extra, in response to NOAA’s Nationwide Facilities for Environmental Data (NCEI). The overall value of those 403 billion-dollar occasions? Greater than $2.915 trillion.

When these tragedies happen, the IRS makes it a precedence to assist people and companies in want, working carefully with different federal businesses and sometimes issuing catastrophe tax reduction to taxpayers.

For accountants, it’s vital to assist their shoppers work via the mandatory types and guarantee compliance because the modified tax deadlines draw close to. These shoppers are already underneath sufficient stress, and professional steerage means one much less factor they should fear about.

Leap to ↓

What are the various kinds of catastrophe tax reduction?

Present tax reduction for pure disasters

What are the deadlines to file tax returns for pure disasters?

Figuring out eligible shoppers

simply file pure catastrophe returns with UltraTax CS

What are the various kinds of catastrophe tax reduction?

When the president indicators both an emergency measures declaration or a significant catastrophe declaration providing “Particular person Help” in at the least one county named within the declaration, the IRS will then present administrative catastrophe tax reduction to all areas specified within the declaration.

The reduction grants additional time for people and companies impacted by a federally declared catastrophe to file returns, pay taxes, and meet different tax deadlines. Right here’s a breakdown of the various kinds of catastrophe tax reduction supplied by the IRS:

Extra time to file and pay taxes

If a taxpayer’s handle of document is in an space qualifying for IRS catastrophe reduction, they routinely obtain additional time from the IRS to file returns and pay taxes with out penalties or curiosity. Usually, the reduction applies to particular person earnings and enterprise tax returns, payroll and excise tax deposits, estimated tax funds, and different deadlines.

Particular retirement plan distributions and contributions

The IRS may present reduction to impacted taxpayers who take part in a retirement plan or particular person retirement association (IRA). For instance, your shopper could possibly take a particular catastrophe distribution that may not be topic to the extra 10% early distribution tax and unfold that earnings over three years. They might even be eligible for a hardship withdrawal.

Exclusion from gross earnings

Certified catastrophe reduction funds are typically excluded from gross earnings. This implies your shopper may have the ability to exclude from their gross earnings cash they obtained from a authorities company for private, household, residing, or funeral bills, in addition to for the restore of their house, or for the restore or substitute of its contents.

Casualty loss tax deductions

People and companies in a federally declared catastrophe space who suffered uninsured or unreimbursed disaster-related losses could qualify to assert a casualty loss tax deduction. They will declare this on their present or prior-year tax return, which may lead to a bigger refund.

It must be famous that state businesses could or could not adhere to the IRS catastrophe reduction provisions, so consulting with the related state company for steerage is vital.

Present tax reduction for pure disasters

Annually, the IRS points a number of main catastrophe reduction measures. For example, in 2024, the IRS granted tax reduction for federal catastrophe areas in roughly 40 states.

Thus far in 2025, the IRS has supplied tax reduction for federal catastrophe areas in at the least a dozen states, and there’s a superb likelihood we’ll see extra because the yr progresses. A few of the most up-to-date examples embody:

West Virginia

Starting on June 14, 2025, elements of West Virginia have been hit by extreme storms, straight-line winds, flooding, landslides, and mudslides. The IRS introduced that these taxpayers now have till Feb. 2, 2026, to file numerous federal particular person and enterprise tax returns and make tax funds. This additionally applies to estimated earnings tax funds, payroll, excise tax returns, and different deadlines.

New Mexico

Starting on June 23, 2025, elements of New Mexico have been affected by extreme storms, flooding, and landslides. The IRS introduced that people and households residing or having a enterprise in Chaves, Lincoln, Otero, and Valencia counties are eligible for tax reduction. They’ve till Feb. 2, 2026, to file numerous federal particular person and enterprise tax returns and make tax funds. This additionally applies to estimated earnings tax funds, payroll, excise tax returns, and different deadlines.

Texas

Since July 2, 2025, elements of Texas have been impacted by extreme storms, straight-line winds, and flooding. Consequently, people and households residing or having a enterprise in Burnet, Coke, Concho, Edwards, Hamilton, Kendall, Kerr, Kimble, Lampasas, Llano, Mason, McCulloch, Menard, Actual, Reeves, San Saba, Schleicher, Sutton, Tom Inexperienced, Travis, and Williamson counties qualify for tax reduction. These taxpayers have till Feb. 2, 2026, to file numerous federal particular person and enterprise tax returns and make tax funds. This additionally applies to estimated earnings tax funds, payroll, excise tax returns, and different deadlines.

Missouri

On Could 16, 2025, elements of Missouri have been struck by extreme storms, straight-line winds, tornadoes, and flooding. The IRS introduced that these taxpayers now have till Nov. 3, 2025, to file numerous federal particular person and enterprise tax returns and make tax funds. This additionally applies to 2024 contributions to IRAs and well being financial savings accounts for eligible taxpayers, estimated tax funds, payroll, excise tax returns, and different deadlines.

California

Earlier within the yr, starting Jan. 7, 2025, wildfires and straight-line winds ripped via elements of the state, leaving devastation and mass destruction in its wake. Following the catastrophe declaration issued by the Federal Emergency Administration Company (FEMA), people and households residing in or having a enterprise in Los Angeles County have been granted tax reduction. These taxpayers now have till Oct. 15, 2025, to file numerous federal particular person and enterprise tax returns and make tax funds. This additionally applies to estimated earnings tax funds, payroll, excise tax returns, and different deadlines.

What are the deadlines to file tax returns for pure disasters?

The submitting deadlines differ and could be additional postponed by the IRS due to lingering results, as was the case for victims in North Carolina.

Citing lingering results of Hurricane Helene, the IRS postponed a variety of tax deadlines till September 25, 2025, for particular person and enterprise taxpayers all through North Carolina. Beforehand, the postponed deadline had been Could 1, 2025, for Type 1040 filers, amongst others.

Extra key submitting deadline dates throughout a number of states embody:

- Nov. 3, 2025: Kentucky, West Virginia (counties impacted by a pure catastrophe that started on Feb. 15, 2025), Tennessee, Arkansas, Virginia, Missouri, Oklahoma, Texas, and Mississippi.

- Feb. 2, 2026: West Virginia (taxpayers impacted by a pure catastrophe that started on June 14, 2025), Texas, and New Mexico.

Figuring out eligible shoppers

Rapidly and effectively figuring out these shoppers who’re impacted by a pure catastrophe and eligible for tax reduction begins with having the proper instruments and assets in place.

Leveraging sturdy tax analysis instruments, for example, allows practitioners to remain updated on the newest information throughout the context of their analysis, and well timed information alerts can additional assist tax professionals keep knowledgeable.

Knowledge mining performance can even show useful because it allows tax professionals to shortly spot shoppers affected by new tax legal guidelines or adjustments.

simply file pure catastrophe returns with UltraTax CS

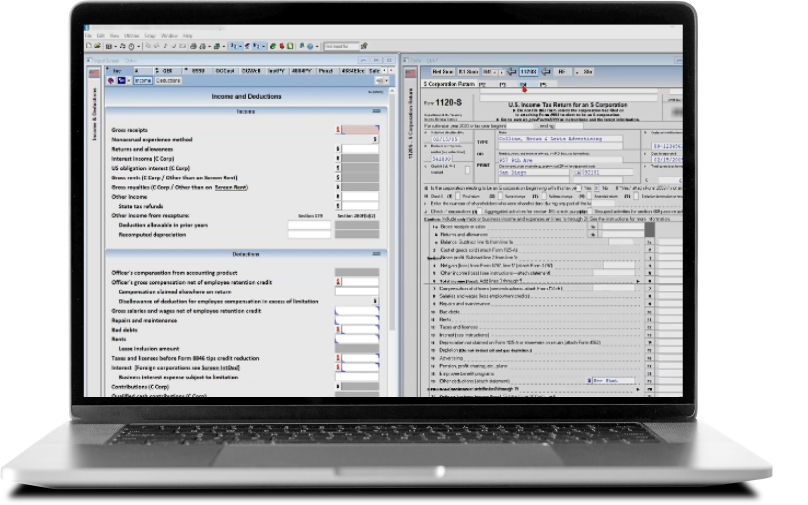

Companies can simply file tax returns for particular person and enterprise shoppers who’ve been affected by pure disasters with Thomson Reuters UltraTax CS. With options like information mining, superior diagnostics, and clever calculations, UltraTax CS ensures kind accuracy with calculations to deal with numerous ranges of complexity.

The multi-entity capabilities of UltraTax CS show notably invaluable when dealing with catastrophe returns for companies with a number of places or advanced organizational constructions affected by pure disasters. The software program’s centralized information administration system permits tax professionals to effectively coordinate disaster-related changes throughout associated entities, making certain constant remedy of casualty losses and catastrophe reduction advantages.

UltraTax CS additionally options sturdy documentation instruments that assist preserve detailed data of disaster-related transactions and supporting documentation, which is essential for audit protection and compliance with IRS necessities. Moreover, the platform’s digital submitting capabilities expedite the submission course of, serving to catastrophe victims obtain their refunds extra shortly throughout difficult restoration intervals.