Mark needs to double your cash.

Significantly, he’s providing to double it.

Not solely that, however he’s additionally providing you a bit of his firm.

Who is that this man? And is his supply value exploring?

Let’s have a look…

Meet Mark

That is Mark Samuel.

Mark is Founder & CEO of an organization known as Mark’s Snacks, which sells a line of wholesome, kettle-style potato chips.

His chips are created from American-grown potatoes and cooked in avocado oil.

There aren’t any hard-to-pronounce components and no synthetic flavors right here — simply easy kettle chips provided in three flavors:

Mark’s a lifelong well being and health fanatic. He’s additionally an achieved entrepreneur, the place he’s had notable success within the “healthy-eating” sector.

A began he launched that created meal-preparation kits was acquired. And in 2016, he based a snack firm whose merchandise are actually bought nationwide in Entire Meals, Wegmans, and Vitamin Shoppe.

Clearly, Mark’s discovered his calling.

And now he’s centered on a brand new product that’s exploding in recognition…

A $50 Billion Market

Final 12 months, snack-food gross sales within the U.S. surpassed $50 billion. Right this moment, salty snacks alone — popcorn, pretzels, and kettle chips like Mark’s — comprise a $33 billion market.

The factor is, customers aren’t simply snacking extra as of late; they’re snacking more healthy.

In accordance with Trax Retail, 71% of People say they’re selecting more healthy snacks. And 61% are keen to pay extra for better-for-you choices.

Information exhibits that greater than half of all customers search wholesome components of their snacks. Elements like sustainable components and clean-label credentials are essential, too.

This need for more healthy choices may clarify why acquisitions of health-focused snack manufacturers have ticked up, together with a couple of which have featured large worth tags. For instance:

- Final October, PepsiCo acquired Siete Meals, makers of a more healthy tortilla chip, for $1.2 billion.

- In January 2025, Easy Mills, makers of wholesome crackers, was acquired by Flower Meals for $795 million.

- 4 months later, Lesser Evil popcorn was acquired by Hershey’s for $750 million.

May Mark’s Snacks sooner or later be part of the listing of acquired manufacturers?

Gross sales Are About to Begin

Mark’s line of chips will hit retailer cabinets later this 12 months.

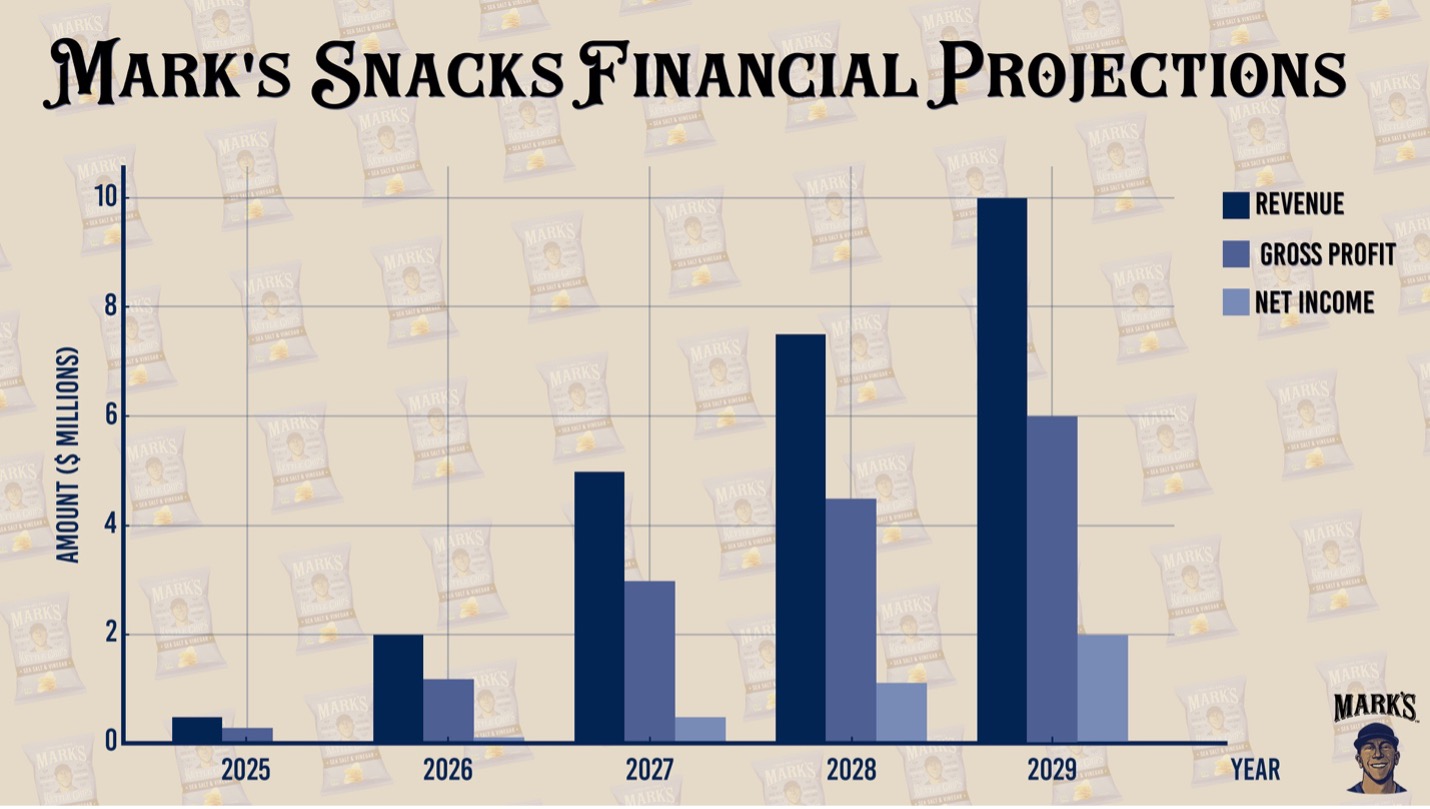

From there, gross sales are projected to start out climbing. Have a look:

Between 2025 and 2029, the corporate is forecasting whole gross sales of about $25 million (extra on this determine in a second). However earlier than these chips hit the market, the corporate wants capital to jumpstart manufacturing…

And also you’re invited to take a position.

Listed here are the main points.

Funding Alternative

This is a chance to earn fairness in a startup — and a bit of its future gross sales.

You see, Mark’s firm is providing what’s known as a revenue-sharing deal. Basically, you’ll mortgage the corporate cash, and it’ll pay you again straight from its revenues.

Particularly, buyers will earn 2% of the corporate’s gross revenues every quarter till they recoup twice their funding. In different phrases, it is a likelihood to double your cash.

However how lengthy will it take the corporate to pay you again?

Crunching the Numbers

Let’s assume the corporate raises the total $250,000 it’s searching for. In that case, the corporate would want to pay buyers again twice that quantity ($500,000) from 2% of its product sales.

For $500,000 to equal 2% of product sales, gross sales would want to achieve $25 million. (2% of $25 million is $500,000.)

If you happen to recall, the corporate goals to achieve $25 million in cumulative gross sales by 2030. So doubtlessly, you may double your funding in simply 5 years. That might equal an annualized return of greater than 14%.

With most revenue-sharing offers, as soon as your funding is paid in full, you’re not thought-about an investor within the firm. However on this case, along with a lower of revenues, you’ll additionally earn a bit of the corporate at a $5 million valuation.

In different phrases, if this firm turns into the following acquisition goal within the snacks market, you may earn your income shares… plus a windfall of earnings.

That is an thrilling alternative. But it surely’s not risk-free…

Know the Dangers

For starters, the corporate hasn’t began gross sales but.

Moreover, the competitors for wholesome snacks is fierce. Mark should do one thing distinctive to face out from the gang.

Lastly, $25 million in gross sales inside 5 years is only a projection — it’s not assured. The longer it takes for gross sales to climb, the longer it’ll take you to earn your 2x return. And that may affect your return on funding.

Nonetheless, when you’re intrigued by this line of wholesome snacks — and you want the thought of doubtless doubling your cash after which some — click on right here to be taught extra »

Completely satisfied snacking, and comfortable investing.

Greatest Regards,

Editor

Crowdability.com