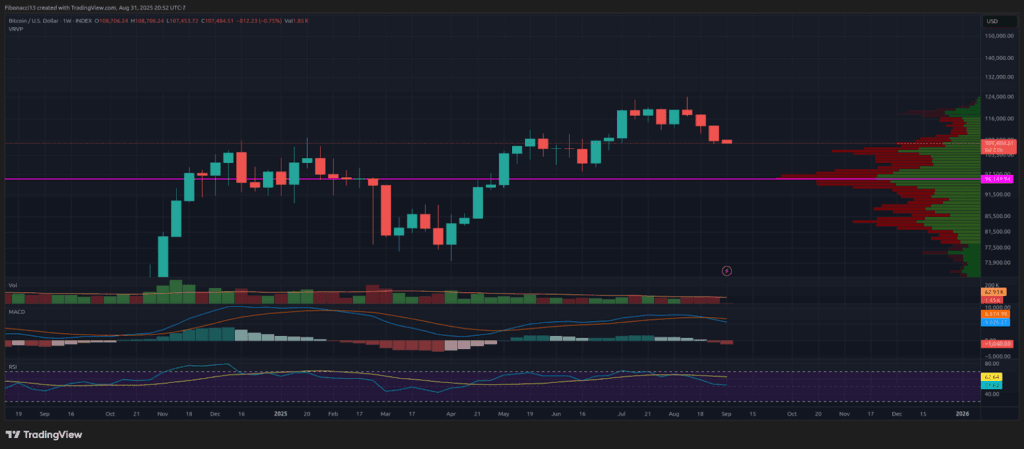

Bitcoin (BTC) begins September underneath strain after a brutal August shut — now all eyes are on $100K. Bitcoin closed the month of August with a disappointing week for the bulls. After making a brand new all-time excessive in mid-August at simply over $124,000, the bitcoin value has put in three purple candle closes in a row on the weekly chart. This previous week’s candle closed down close to the lows, swinging momentum clearly over to the bears.

The MACD oscillator confirmed a bearish cross on the weekly shut as properly, which ought to assist preserve downward strain coming into this week. RSI is now sitting in a comparatively impartial place simply above the 50 line, however at its lowest stage since mid-April.

This primary week of September will see bitcoin heading down to check the assist ranges from the Could-to-June value consolidation. Bulls shall be searching for the high-volume node round $104,000-105,000 to carry value, and ideally stop this week’s candle from closing beneath that stage. Bears shall be making an attempt to push the value down via this assist again to the important thing 1.618 Fibonacci extension stage from the 2022 bear market at $102,000. Closing this week within the $102k neighborhood or decrease can be very dangerous for the bulls, as it will threaten to interrupt beneath the notorious laser eyes stage of $100,000 and take a look at the final main swing low at $98,000.

Taking out $100,000 to the draw back would give loads of weight to the “long-term prime is in” thesis. $96,000 is mainly the final line of protection right here for the bulls if value manages to slide via all these higher assist ranges.

So heading into this week, search for patrons to attempt to step in and switch issues round on the $105,000 stage. Bulls shall be seeking to proper the ship this week and put in some form of reversal candle to show issues round. However for now, the bears are in full management and can look to proceed the promoting strain into September.

Terminology Information:

Bulls/Bullish: Patrons or traders anticipating the value to go greater.

Bears/Bearish: Sellers or traders anticipating the value to go decrease.

Assist or assist stage: A stage at which value ought to maintain for the asset,a minimum of initially. The extra touches on assist, the weaker it will get and the extra doubtless it’s to fail to carry the value.

Resistance or resistance stage: Reverse of assist. The extent which is prone to reject the value, a minimum of initially. The extra touches at resistance, the weaker it will get and the extra doubtless it’s to fail to carry again the value.

Fibonacci Retracements and Extensions: Ratios based mostly on what is called the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Oscillators: Technical indicators that change over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low stage (usually representing oversold situations) and a excessive stage (usually representing overbought situations). E.G. Relative Power Index (RSI) and Shifting Common Convergence-Divergence (MACD).

MACD Oscillator: Shifting Common Convergence-Divergence is a momentum oscillator that subtracts the distinction between 2 transferring averages to point development in addition to momentum.

RSI Oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the pace of the value and modifications within the pace of the value actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is beneath 30, it’s thought-about to be oversold.