What occurs after a mortgage defaults, and the way a lot is definitely recovered? That’s one of the vital essential questions for each buyers and debtors. On this put up, we clarify how Bondora works to steadiness restoration with equity and assist.

In our earlier article, we mentioned the main points of defaults and the way we use their knowledge to replicate and construct even stronger danger administration methods for a more healthy portfolio.

Recoveries play a vital position in long-term funding returns. Whereas defaults are a standard a part of lending, what really issues is how successfully we get better the unpaid quantities. At Bondora, we’ve developed a structured, multi-step course of that delivers outcomes whereas treating each buyer with equity and respect.

What are typical restoration outcomes?

Earlier than diving into the method itself, let’s take a look at the outcomes.

Right here’s how a lot principal is often recovered on a €1,000 mortgage that reaches default in these markets:

- Estonia: €667

- Finland: €689

- Latvia: €667

- Netherlands: €667

These projections are primarily based on a 10-year interval and historic restoration knowledge. In newer markets like Latvia and the Netherlands, we use comparable nation knowledge and early developments to estimate outcomes.

Cumulative restoration over time as a share of the defaulted principal quantity

Within the first three years after default, we sometimes get better between 31% and 54% of the excellent principal, relying on the nation. These repayments accumulate progressively, yr after yr, by our structured restoration efforts.

Whereas these figures are averages and might range by case, they provide a dependable benchmark for what to anticipate over time.

Whereas authorized steps could also be a part of the journey, many repayments are made by collaborative efforts over time. Consistency and endurance matter; recoveries usually take time, however they do add up.

Our 4-step restoration course of

We comply with a constant four-step course of to get better funds from defaulted loans. This ensures authorized compliance, efficient outcomes, and respectful remedy of credit score prospects in each market.

Step 1: Inner collections

We contact the shopper as quickly as a cost is missed, lengthy earlier than the mortgage is formally defaulted.

Our in-house workforce contacts the shopper by electronic mail, SMS, put up, or cellphone to supply assist, discover compensation choices, and assist them keep on monitor.

This early intervention is vital: in as much as 97% of circumstances, we assist prospects keep away from rapid default, which will increase the prospect of long-term restoration outcomes. It additionally provides our prospects the chance to get better financially, keep away from authorized motion, and regain stability.

Step 2: Debt Assortment Company (DCA) – amicable collections

If the mortgage reaches 90 days overdue and the contract is terminated, it strikes into default. At this stage, we switch the case to a trusted Debt Assortment Company (DCA).

This respected third-party accomplice then reestablishes contact with the shopper, utilizing native experience and market presence to encourage compensation.

The aim stays to resolve the state of affairs by open communication and a practical, manageable cost plan that aligns with the borrower’s monetary state of affairs.

If reaching an settlement isn’t potential, the case transitions to the following restoration section. This transition is dealt with fastidiously, guaranteeing that the shopper’s circumstances are thought of whereas persevering with to maneuver the case ahead responsibly.

Step 3: Court docket

If different decision makes an attempt don’t succeed, we could proceed with courtroom filings as a final resort, all the time contemplating the borrower’s rights and the authorized framework in every nation.

The timeline varies by nation, however on common, a courtroom determination is reached in 2–6 months.

Step 4: Bailiff

As soon as we obtain a courtroom ruling, we hand the case over to a neighborhood bailiff. They function inside strict authorized tips and assist handle repayments in a structured, regulated method that considers the borrower’s earnings and private circumstances.

Restoration efforts deal with the shopper’s accessible earnings and property, all the time respecting authorized tips and protections. We obtain common updates to watch progress and make sure the case stays lively.

How does this course of range by nation?

Whereas the 4 fundamental levels apply throughout all markets, every nation’s authorized system influences how the restoration course of unfolds. Right here’s a more in-depth look:

🇪🇪 Estonia

As soon as a mortgage defaults, circumstances are shortly taken to courtroom. Most recoveries are then dealt with by bailiffs, who function below a structured authorized framework. Because of the effectivity and authority of the bailiff system, over 80% of recoveries in Estonia occur at this stage.

🇫🇮 Finland

Instances transfer swiftly by the restoration course of. Loans are despatched to a DCA a couple of days after default. To take care of momentum within the restoration course of, circumstances sometimes transfer ahead inside a couple of weeks if no settlement is reached, although we all the time purpose to resolve points amicably first. This quick tempo helps hold restoration lively and environment friendly.

🇱🇻 Latvia

After default, loans are first dealt with by DCAs. If no decision is discovered, the case goes to courtroom (sometimes inside two months) after which on to enforcement if needed. Whereas newer, the Latvian course of is aligning with these in different mature markets.

🇳🇱 Netherlands

Most circumstances are at present managed by DCAs. Over 70% of defaulted loans are below lively DCA administration. On the identical time, we’re refining our technique to maneuver extra circumstances into authorized restoration as techniques mature.

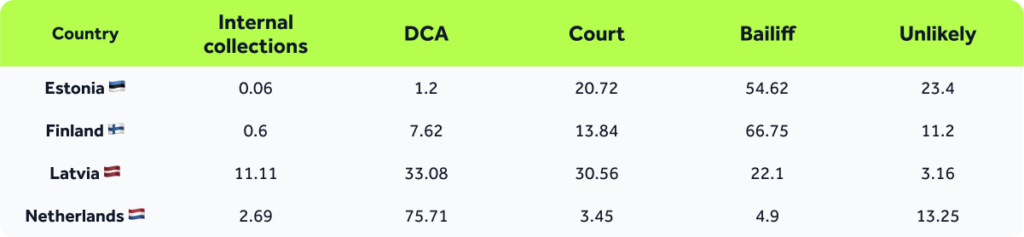

How loans are at present distributed by stage

Right here’s a snapshot of the place defaulted loans stand as we speak within the restoration journey:

*Unlikely circumstances embrace bankruptcies, deceased debtors, or long-term restructurings. These are nonetheless monitored, however restoration outcomes are more durable to foretell.

Why this issues to your funding

At Bondora, recoveries are by no means nearly numbers; they’re about defending your funding with a technique that’s respectful, constant, and tailor-made to native legal guidelines. Simply as importantly, we purpose to assist our credit score prospects handle their funds responsibly, keep away from authorized challenges, and discover sustainable options. We deal with each particular person’s state of affairs with care, respect, and empathy, as a result of behind each mortgage is an actual particular person.

Our method helps make sure that even when defaults occur, you proceed to earn secure returns as repayments are recovered within the background.

Transparency, equity, and long-term considering are on the coronary heart of how we handle each case.

📣 Have a query about defaults or our statistics?

Share your ideas through the suggestions kind and assist form what we share subsequent.

If you’re a buyer going through cost difficulties, please don’t hesitate to contact us. Our workforce is right here to pay attention and work with you to discover a appropriate answer. Yow will discover our contact data on our web site or in your account.