01 Sep Bitfinex Alpha | BTC Slips, ALTs Stagnate

Bitcoin has slipped beneath $110,000, falling beneath its January 2025 peak of $109,590 and lengthening its drawdown to over 13 p.c from the All-Time Excessive of $123,640. Whereas this breakdown carries technical weight, historic drawdown patterns and seasonality counsel the market is definitely within the later levels of its corrective part, with $93–$95,000 rising as probably the most possible zone for a cyclical ground. On-chain knowledge confirms this: the present Quick-Time period Holder Realised Value at $108,900 is now performing as a key pivot, with any sustained buying and selling beneath this degree more likely to gasoline additional draw back. Trade order circulate metrics akin to Cumulative Quantity Delta additionally spotlight a neutralisation of spot sentiment, reinforcing the view that patrons are stepping again till stronger catalysts emerge.

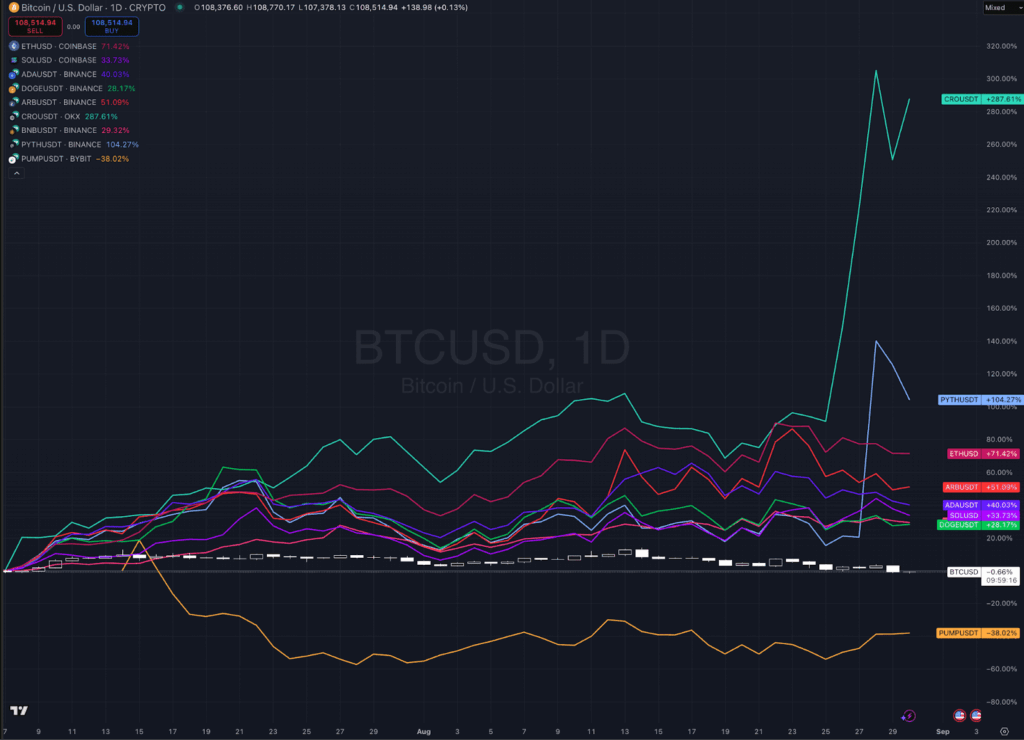

Altcoins have been faring worse, reflecting broad risk-off behaviour. ETH retreated 14 p.c after briefly posting new ATHs, whereas XRP, ADA, and DOGE noticed double-digit losses. But institutional demand stays resilient beneath the floor, with ETH treasuries and company patrons persevering with to increase holdings. Mid-cap names like CRO and PUMP outperformed by way of narrative-driven rallies, although this rotation got here on the expense of weaker names, not new inflows.

What’s rising is an Altcoin market cap that’s stagnating, with any motion in alts signalling capital rotation quite than growth. With ETF inflows seasonally muted and speculative extra flushed, September may mark the cyclical low level earlier than structural drivers reassert for a This fall restoration.

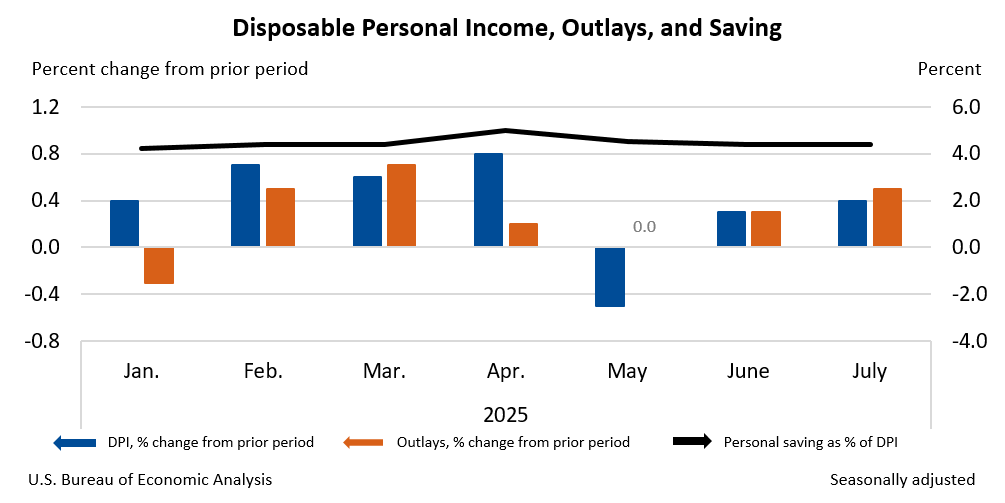

Within the closing week of August, US financial knowledge introduced a blended image for policymakers forward of the Federal Reserve’s September assembly. Shopper spending in July rose 0.5 p.c, the strongest in 4 months, however inflation pressures remained elevated, with core PCE advancing 2.9 p.c 12 months over 12 months. On the identical time, job creation slowed to a median of 35,000 per 30 days, although up to date benchmarks from the St. Louis Fed counsel fewer new jobs at the moment are wanted to maintain labour market stability. This recalibration lowers the brink for coverage easing, tilting expectations towards a September fee minimize regardless of inflation staying above goal. GDP knowledge added to the complexity: second-quarter progress was revised larger to three.3 p.c, fuelled by sturdy mental property and tools funding, but regional surveys such because the Chicago Enterprise Barometer signalled weakening enterprise exercise beneath the burden of tariffs and slowing confidence.

Alongside these macroeconomic shifts, regulatory and crypto market developments highlighted broader monetary help for the asset class. The Commodity Futures Buying and selling Fee reaffirmed the Overseas Board of Commerce framework, clarifying that offshore exchanges can re-enter the US market beneath established guidelines—an adjustment anticipated to enhance liquidity and cut back market fragmentation. Company adoption of digital property additionally accelerated, with BitMine Immersion Applied sciences reinforcing its place because the world’s largest Ethereum treasury firm, holding $8.82 billion in crypto and money whereas pursuing its ambition to amass 5 p.c of Ethereum’s whole provide.

In the meantime, El Salvador superior its sovereign Bitcoin technique by dispersing its $682 million reserve throughout a number of wallets to mitigate safety dangers, paired with a public dashboard aimed toward reinforcing transparency and positioning the nation as a benchmark in state-level crypto governance.