Precision Buying and selling: Introducing Our MT5 Indicators for Optimum Market Insights

Precision Buying and selling: Introducing Our MT5 Indicators for Optimum Market Insights

We now have set a premium value for our MT5 indicators, reflecting over two years of improvement, rigorous backtesting, and diligent bug fixing to make sure optimum performance. Our confidence within the precision and accuracy of our indicators is such that we often showcase them in real-time market situations by way of every day content material on our social media channels.

Our perception in buying and selling simplicity, adhering to the precept of shopping for low and promoting excessive (or vice versa), is echoed in our indicators’ clear show of potential entry and exit factors. We persistently present every day content material demonstrating our indicators in motion. Moreover, we provide merchants the chance to hire our indicators for $66 monthly. This enables merchants to check the indicator for one month with their chosen buying and selling pair earlier than committing to a yearly subscription.

We’re dedicated to monitoring consumer suggestions intently and making obligatory enhancements to our indicators ought to any bugs come up, making certain that merchants have entry to the best instruments for his or her buying and selling endeavours.

Liquidity Finder – CLICK HERE TO BUY

Compatibility:

Liquidity Finder works with all monetary devices forex pairs, indicies, commodities and cryptocurrencies

The Liquidity Finder pin factors liquidity zones in any monetary instrument, together with forex pairs, cryptocurrencies, commodities and indices. The Liquidity finder reveals earlier and present liquidity zones, down to the current minute, offering important details about your chosen buying and selling pair, when conducting chart evaluation or initiating trades.

The Liquidity Finder lets you observe the place value consolidates, retraces, resists, or settles inside help areas. It pinpoints areas the place market individuals are more likely to react to cost actions, offering real-time insights into market dynamics. Moreover, the Liquidity Finder gives a visible illustration as the value approaches potential liquidity zones, enabling customers to make fast and knowledgeable selections.

Certainly one of its standout options is its potential to determine bullish and bearish momentum. The colour-coded value ranges change dynamically in real-time, visually indicating bullish or bearish momentum, in addition to when a value degree is impartial.

The Liquidity Finder shops your entire day’s exercise as a CSV file inside an inner folder on MT5, making historic knowledge simply accessible for future evaluation. Please check with our hooked up YouTube video for useful insights into the performance and detailed breakdown of how the Liquidity Finder presents important info, helping merchants view charts with readability.

What’s liquidity?

Liquidity refers to when traders are actively shopping for or promoting at a selected value degree, inflicting the value to stay comparatively secure over a sure interval. Excessive liquidity signifies a considerable presence of each consumers and sellers actively collaborating in forex buying and selling, leading to slim bid-ask spreads and secure market costs. Quite the opposite, low liquidity might result in broader spreads and heightened value volatility resulting from a diminished variety of market individuals.

Key Options

- Assessment value motion for the present week, final week and final month.

- Monitor value motion for your entire month down to the current second.

- Areas of liquidity are represented by the next numerical worth.

- Shows distribution of costs throughout totally different ranges to determine areas of concentrated buying and selling exercise.

- View dynamic value motion from M5 timeframe to H4.

- All tally’s replace on the shut of the candle inside their respective time frames.

- Dynamic highlighting system signifies the present value place relative to corresponding value ranges.

- Dynamic highlighting system additionally signifies when the value is approaching a liquidity zone.

- Shortly visualize bullish or bearish momentum at totally different value ranges from market open, by way of color illustration of numerical values.

- Choice to decide on which tally knowledge to show or conceal, whereas buying and selling or conducting chart evaluation.

- Choice to reposition the Liquidity Finder to both the left or proper facet of the chart.

- Save every day buying and selling exercise in a CSV file for future reference or chart evaluation.

- Provides an intuitive interface for simple interpretation and evaluation of incoming knowledge.

- Visible illustration of value motion resembling spikes, divergences or developments.

- Can be utilized along with different technical indicators for complete market evaluation.

- Allows customers to investigate historic value motion to determine previous areas of liquidity and developments for chart evaluation.

- Permits customers to personalize settings resembling font color, session choice, and time durations.

Numeric Worth Color Indication

- Blue Numerical Values – Bullish Momentum: Signifies a surplus of consumers and lack of sellers, pushing the value up from the corresponding value degree

- Crimson Numerical Values – Bearish Momentum: Signifies a surplus of sellers and lack of consumers, pushing the value down from the corresponding value degree

- Black Numerics – Impartial Momentum: Signifies an equal quantity of consumers and sellers at the corresponding value degree

Word: Any buying and selling determination made ought to be based mostly on unbiased evaluation and a radical understanding of fundamentals, moderately than solely counting on tally counts or the color of numerical values.

Tally Time-Frames

- Tally M5: The next numeric worth signifies higher liquidity at a particular value degree, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver by way of this degree simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value degree. This info usually updates on the shut of every 5-minute candle.

- Tally M15: The next numeric worth signifies higher liquidity at a particular value degree, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver by way of this degree simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value degree. This info usually updates on the shut of every 15-minute candle.

- Tally M30: The next numeric worth signifies higher liquidity at a particular value degree, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver by way of this degree simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value degree. This info usually updates on the shut of every 30-minute candle.

- Tally H1: The next numeric worth signifies higher liquidity at a particular value degree, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver by way of this degree simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value degree. This info usually updates on the shut of every 1-hour candle.

- Tally H4: The next numeric worth signifies higher liquidity at a particular value degree, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver by way of this degree simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value degree. This info usually updates on the shut of every 4-hour candle.

Extras

- Save CSV: Save complete day’s exercise as a CSV file inside an inner folder on MT5

*The hooked up GIF file showcases a 2.5-hour video of the Liquidity Finder in motion, condensed into just a few seconds.

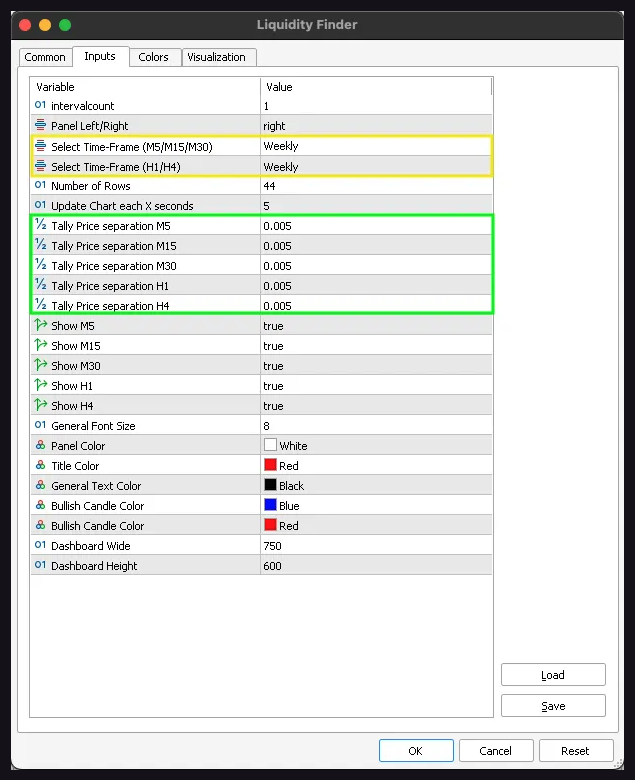

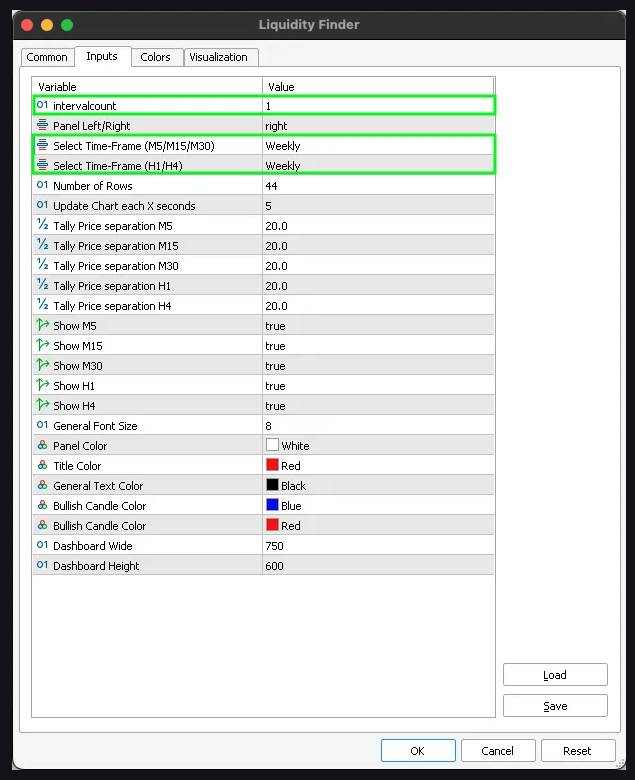

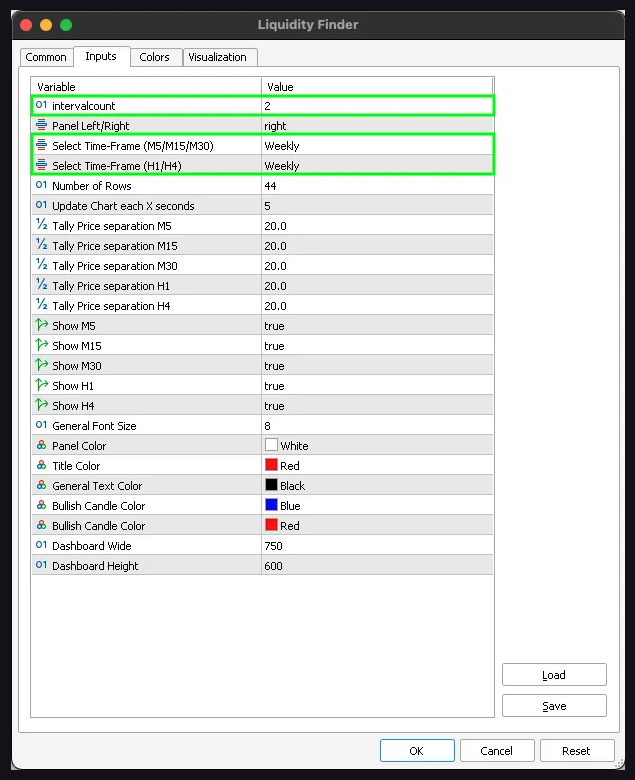

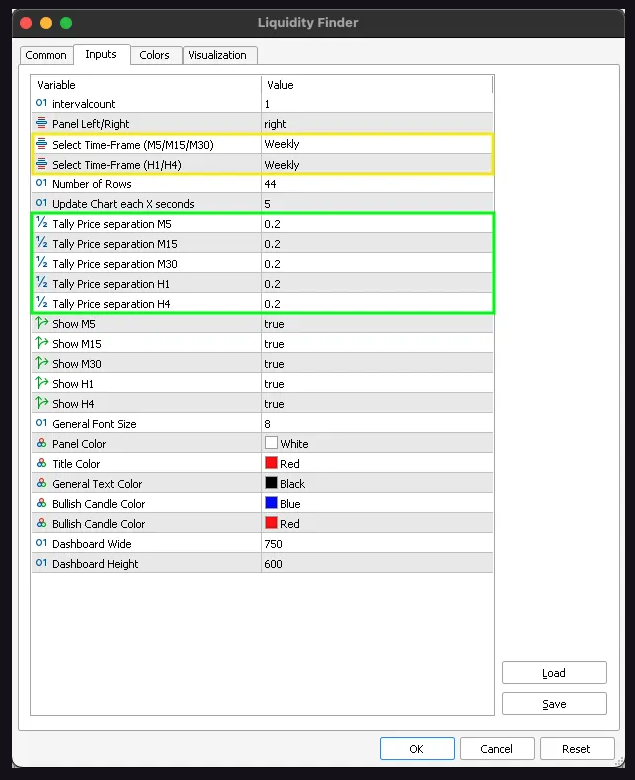

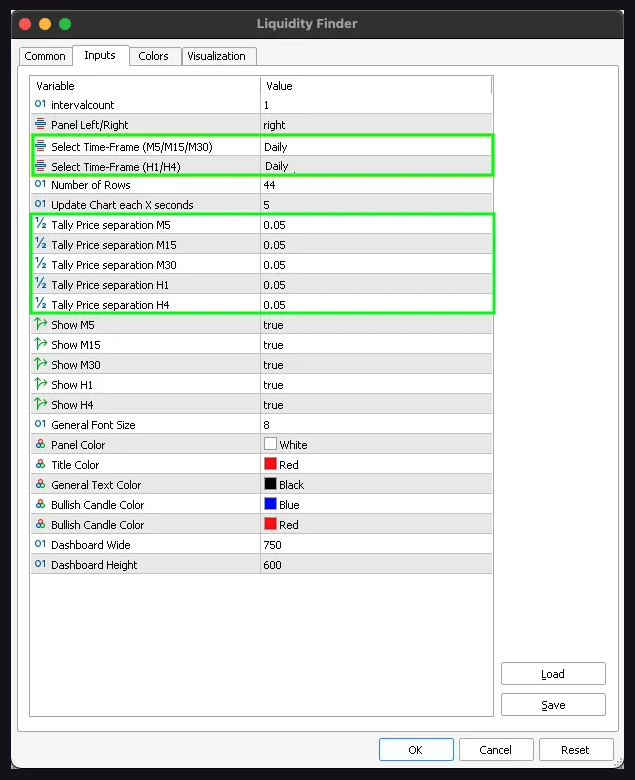

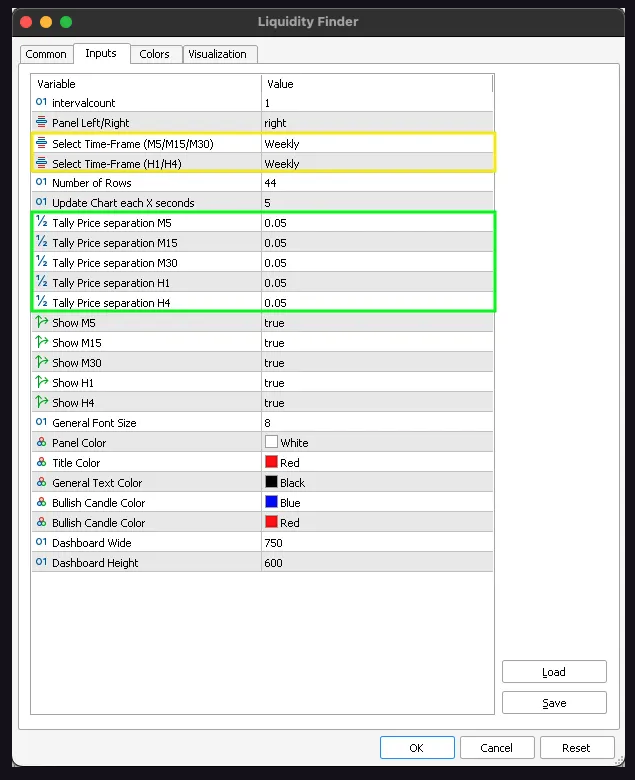

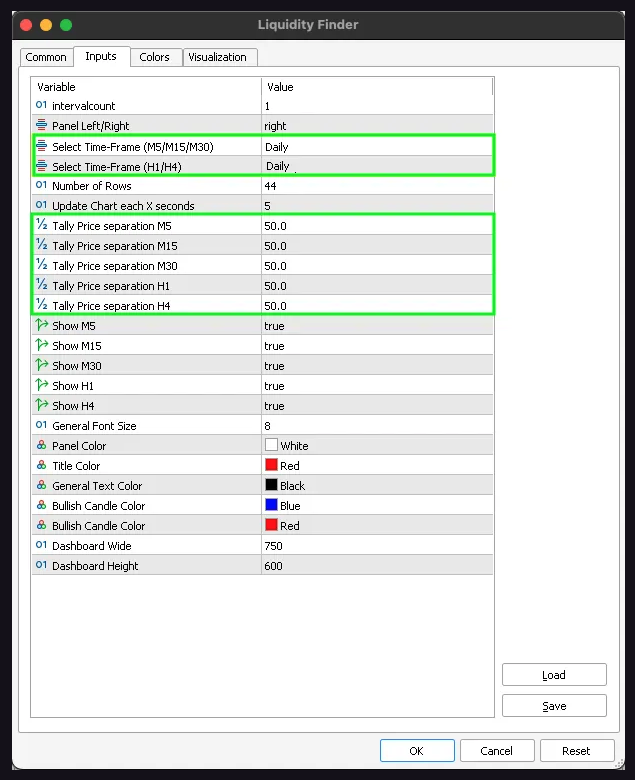

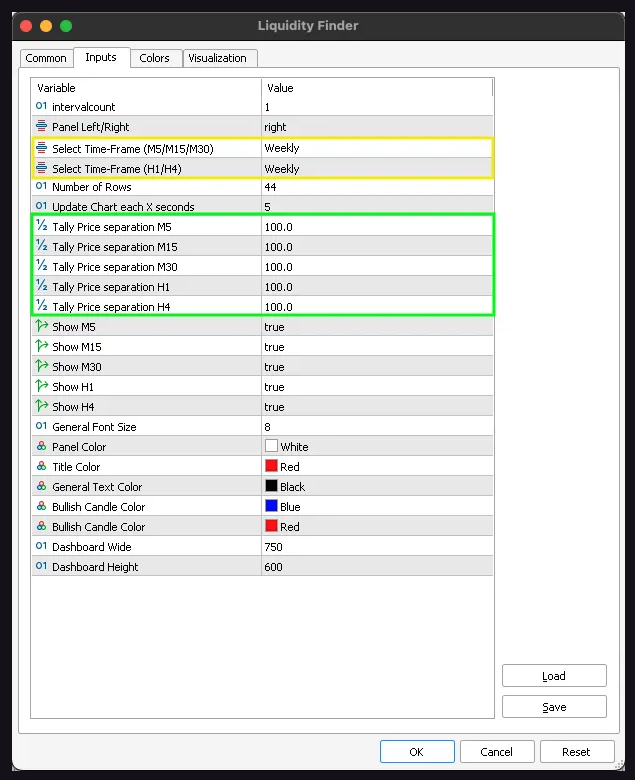

Liquidity Finder Settings

Interval depend: Specify the variety of durations you want to view, which relies on the chosen Time-Body, Instance: 1 day, 2 days, 3 days, 1 week, 2 week, and so forth.

Panel left/proper: You’ll be able to select to place the indicator both to the left or proper facet of the chart.

Replace chart every X seconds: The default setting for chart updates is configured to refresh each 5 seconds. This interval dictates how steadily the dashboard reveals new knowledge. You’ll be able to select to lower the replace interval to 1 second for real-time updates.

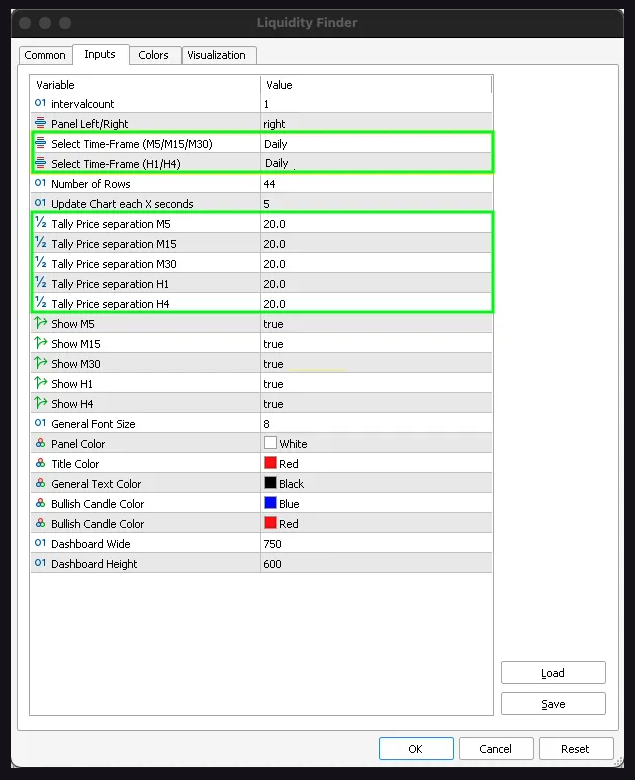

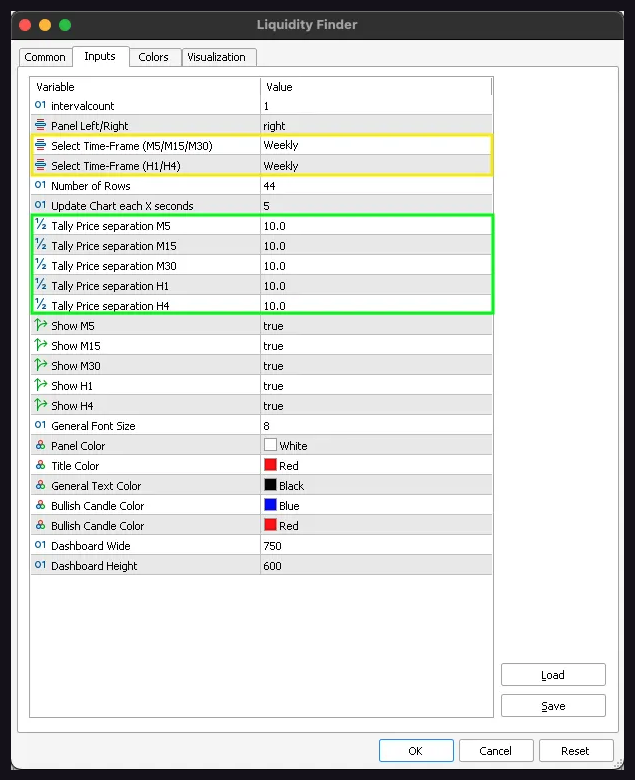

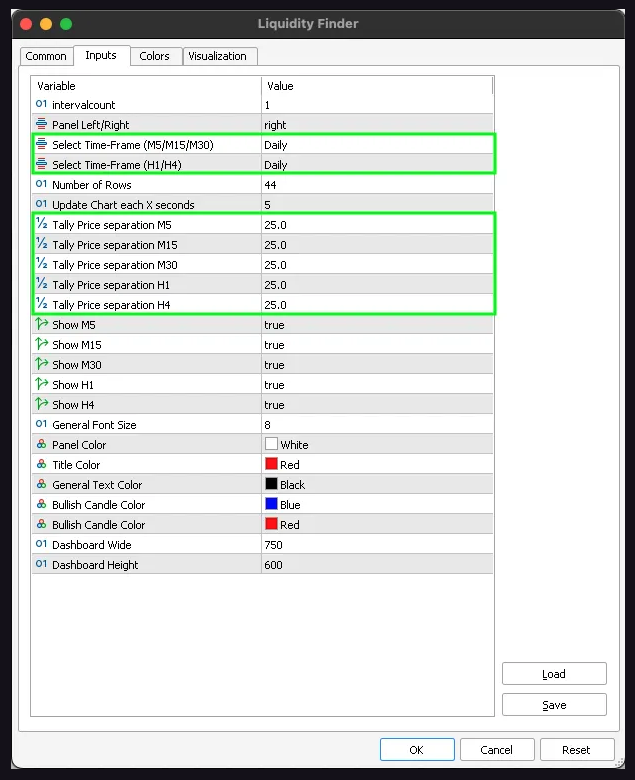

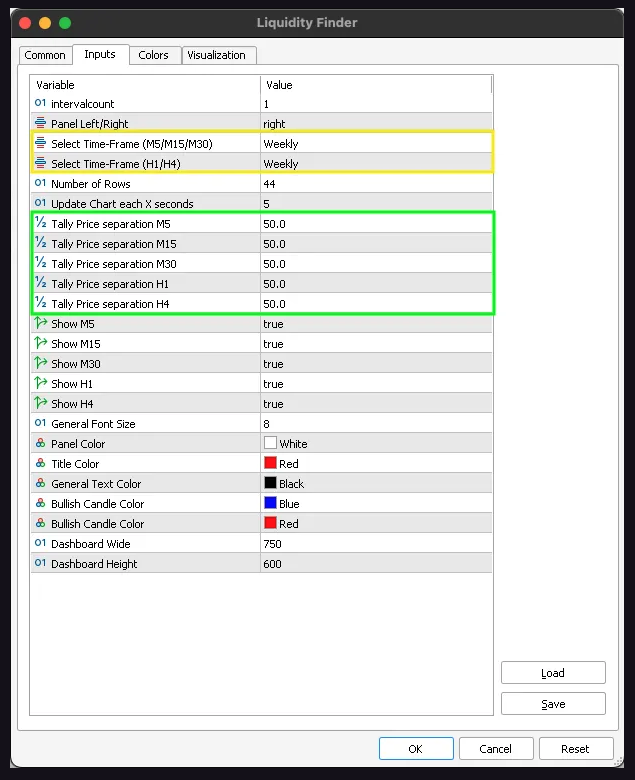

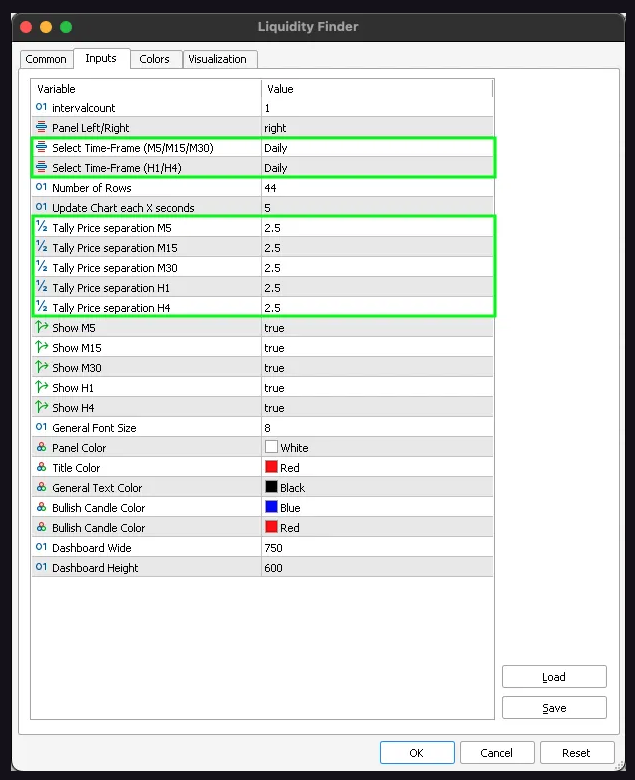

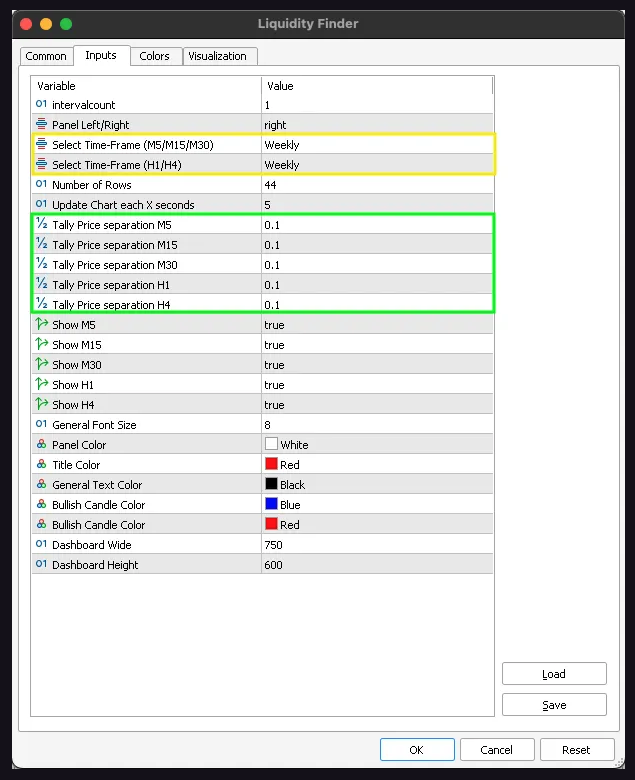

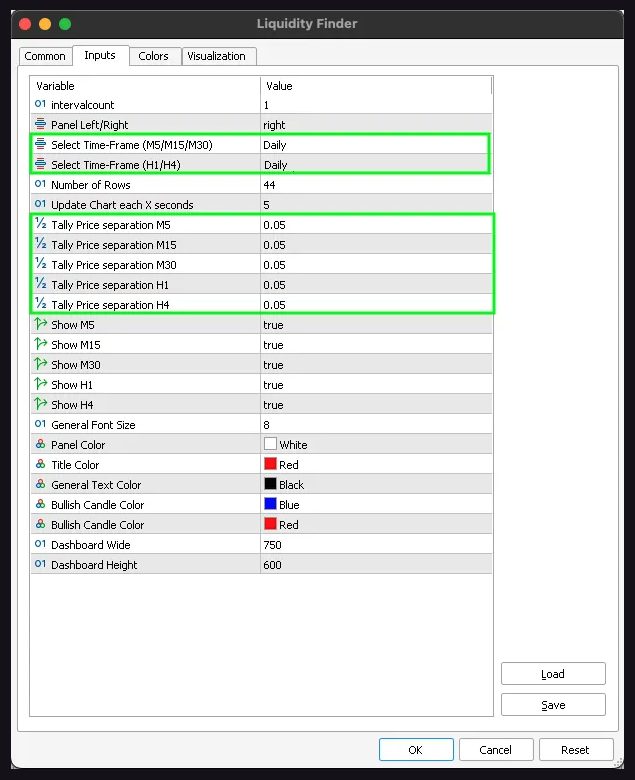

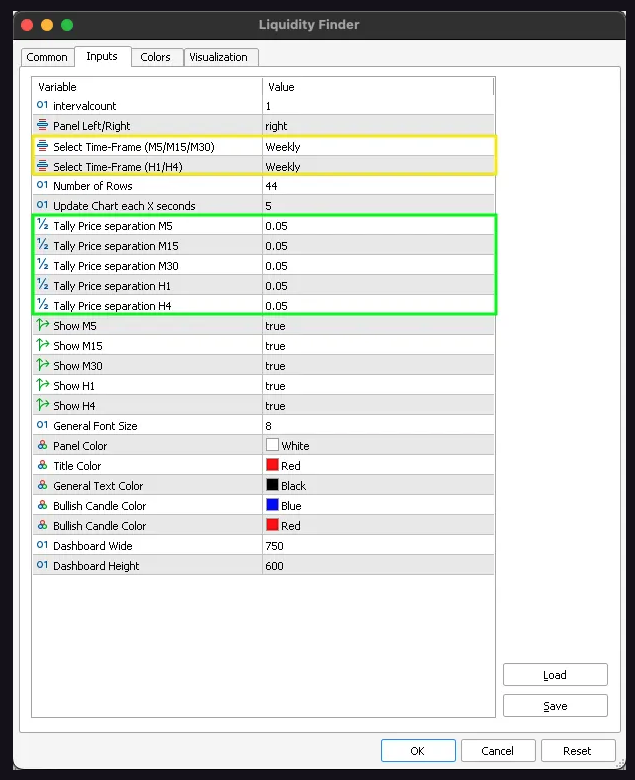

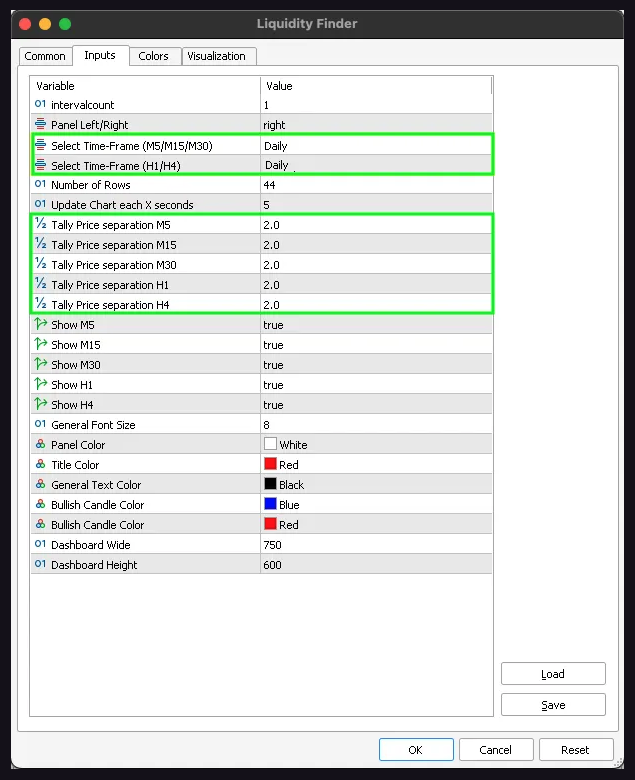

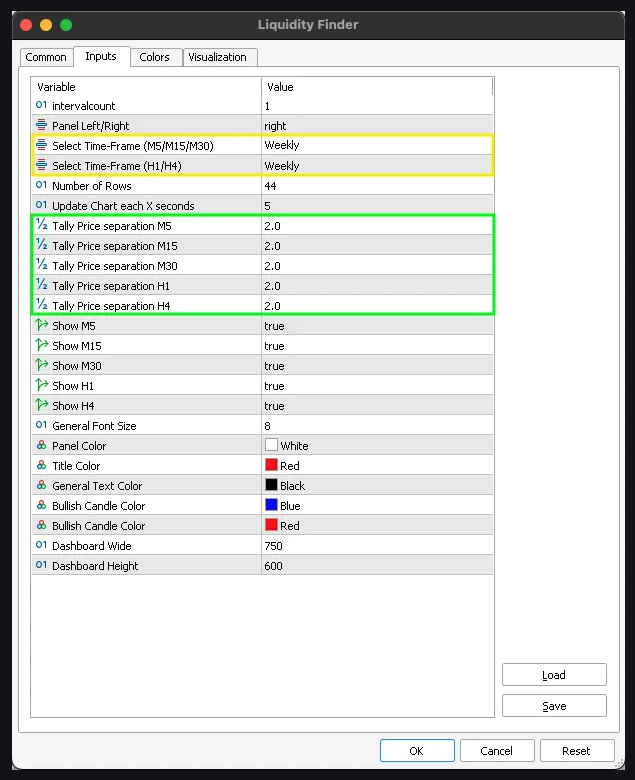

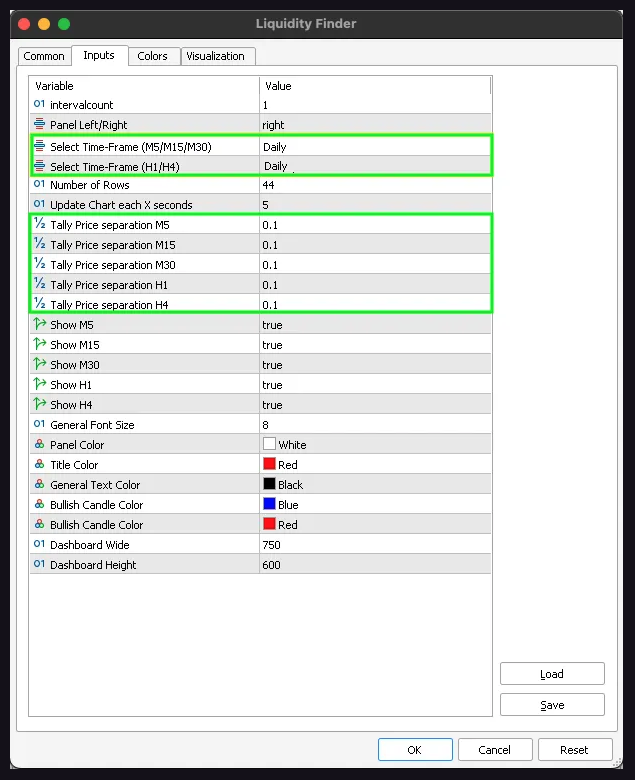

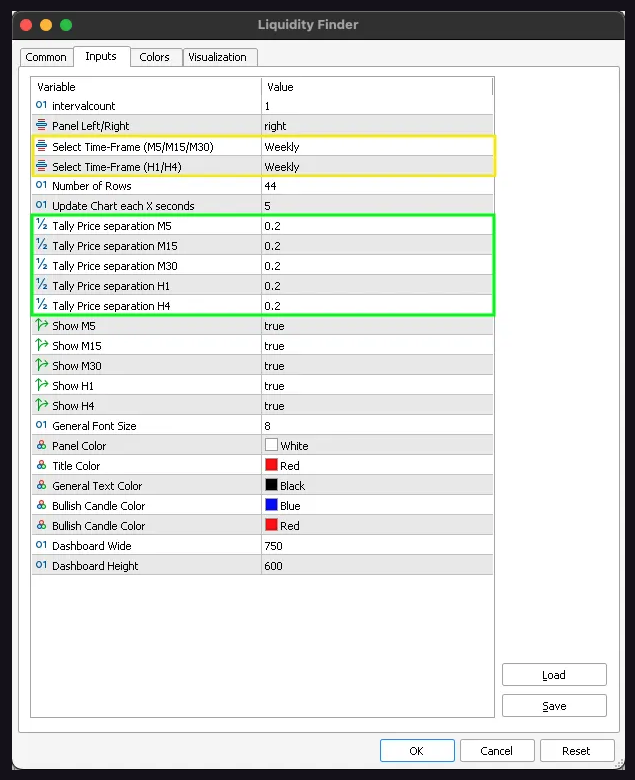

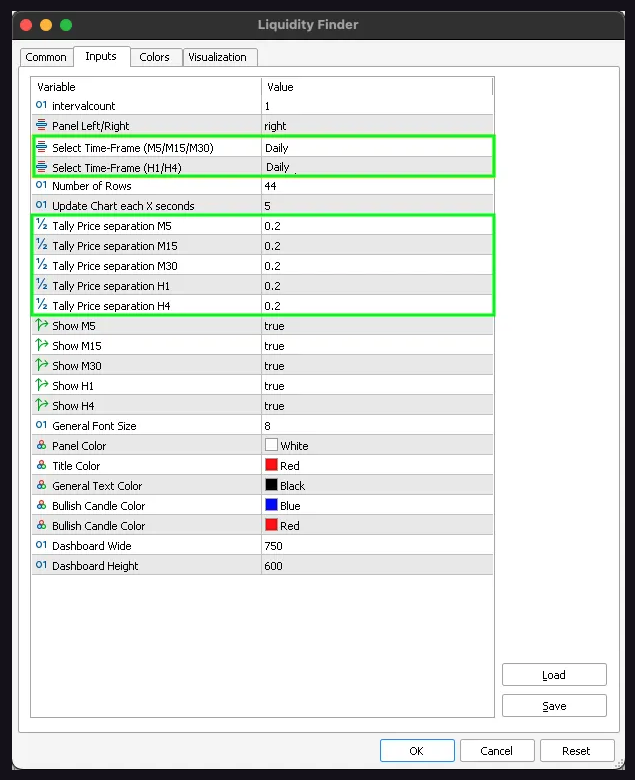

Tally value separation – M5, M15, M30, H1 & H4: These parameter represents the gap between costs, indicating the value ranges with the best liquidity. We now have performed again testing on the vast majority of buying and selling pairs, and under are the beneficial settings for optimum outcomes throughout most pairs.

Present – M5, M15, M30, H1 & H4: You’ve gotten the choice to decide on which era body you need to show whereas buying and selling or conducting chart evaluation. Setting it to “true” will present the chosen timeframe, whereas setting it to “false” will conceal the chosen timeframe.

Dashboard huge: You’ve gotten the choice to change the width of the liquidity finder, for those who discover the default setting obstructs visible illustration of the market knowledge. Growing the width from 750 to 800 usually resolves the difficulty.

Dashboard peak: You’ve gotten the choice to change the peak of the liquidity finder, for those who discover the default setting obstructs visible illustration of the market knowledge. Growing the peak from 600 to 800 usually resolves the difficulty.

Different settings: You’ll be able to maintain the remaining settings as default, they won’t have an effect on the indicator’s efficiency or visible illustration of the market knowledge.

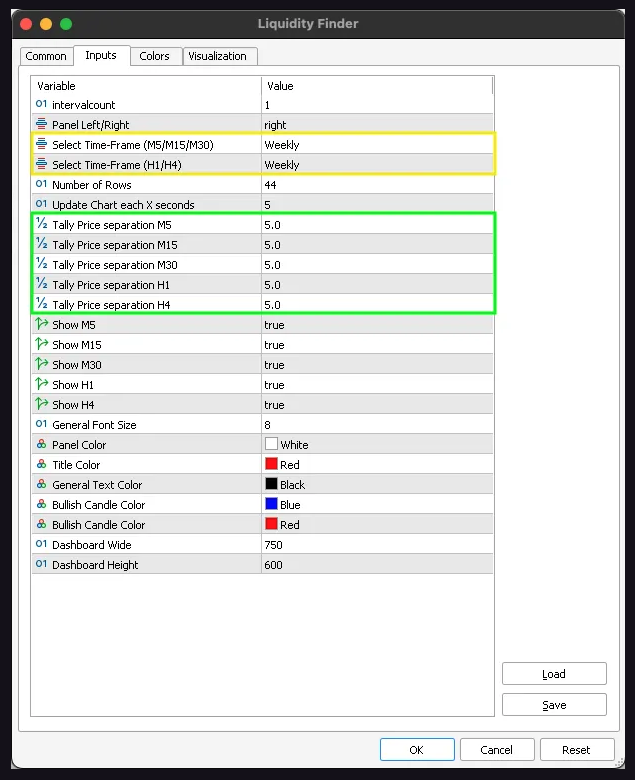

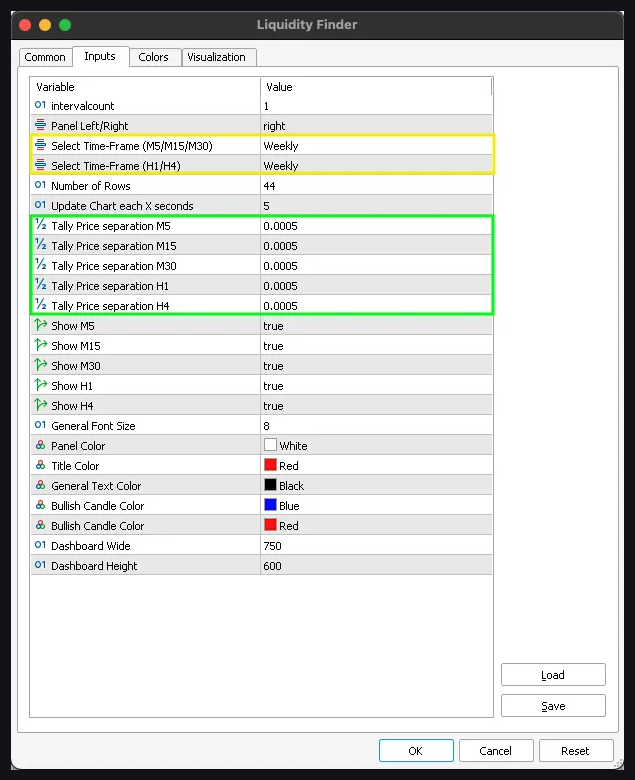

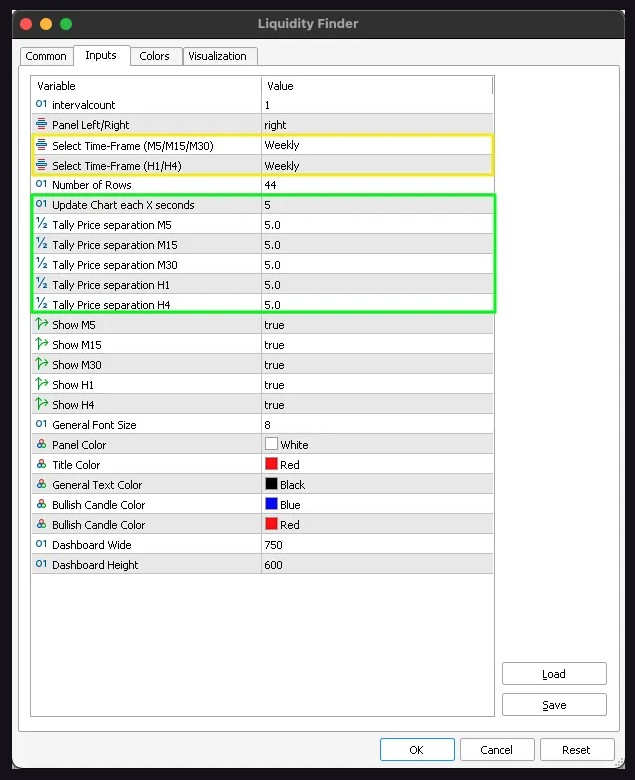

Chart Evaluation: Conduct weekly chart evaluation by adjusting the time frames of M5, M15, M30, H1, and H4 to show weekly knowledge, with the interval depend set to 1. This can assist determine areas of help, resistance, and liquidity for the current week.

Chart Evaluation: It’s also possible to alter the time frames of M5, M15, M30, H1, and H4 to show weekly knowledge, with the interval depend set to 2. This can assist determine areas of help, resistance, and liquidity for the current & earlier week.

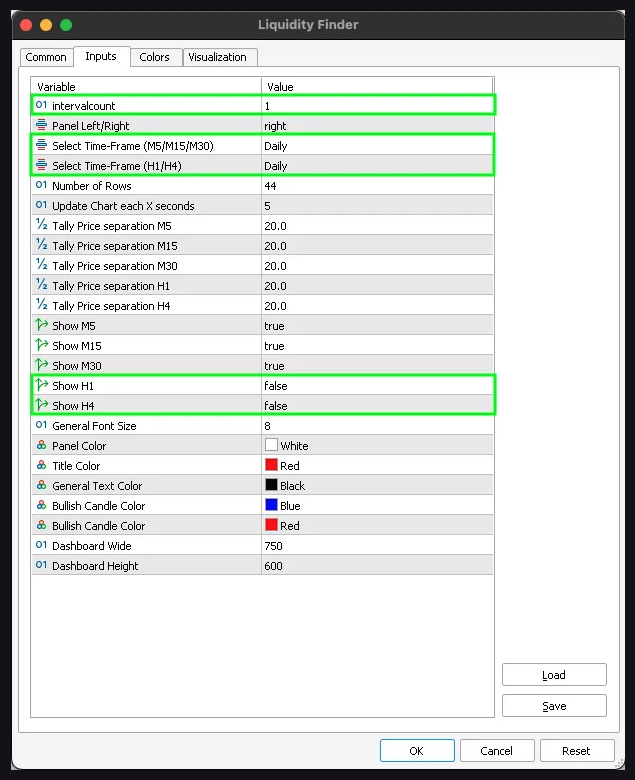

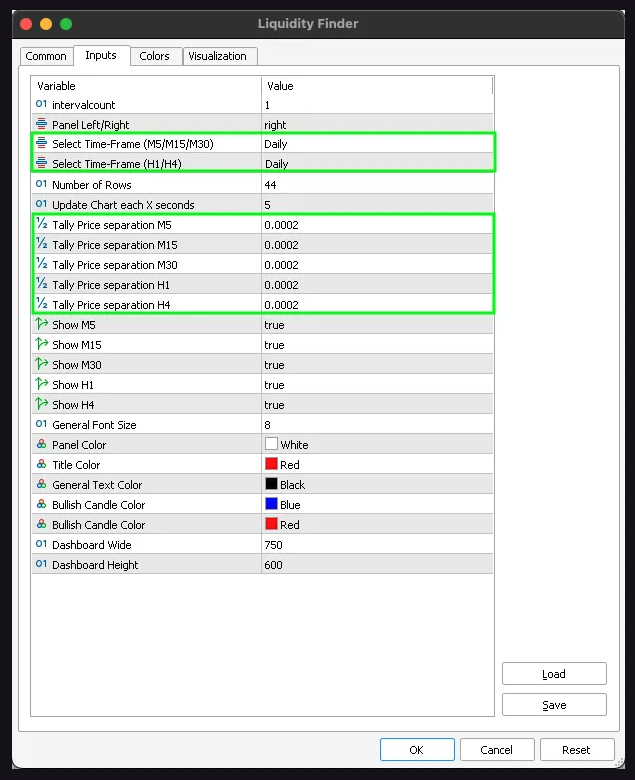

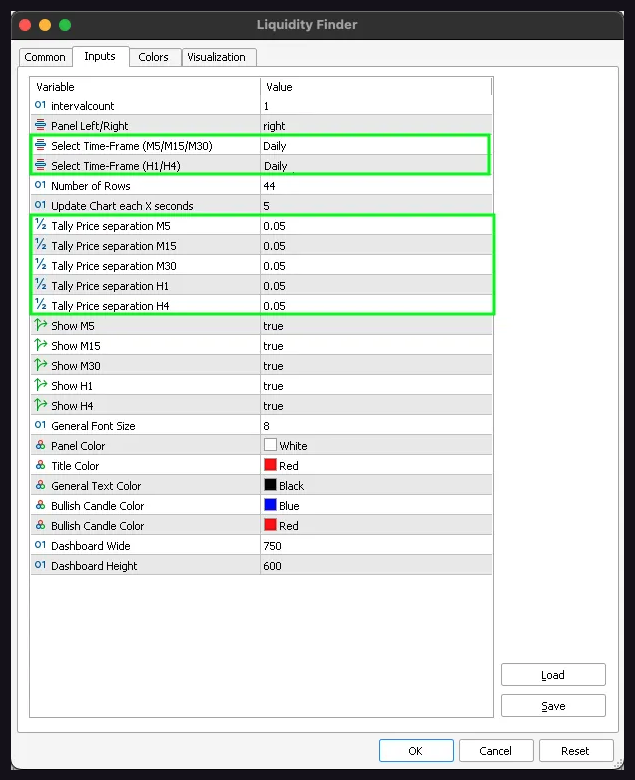

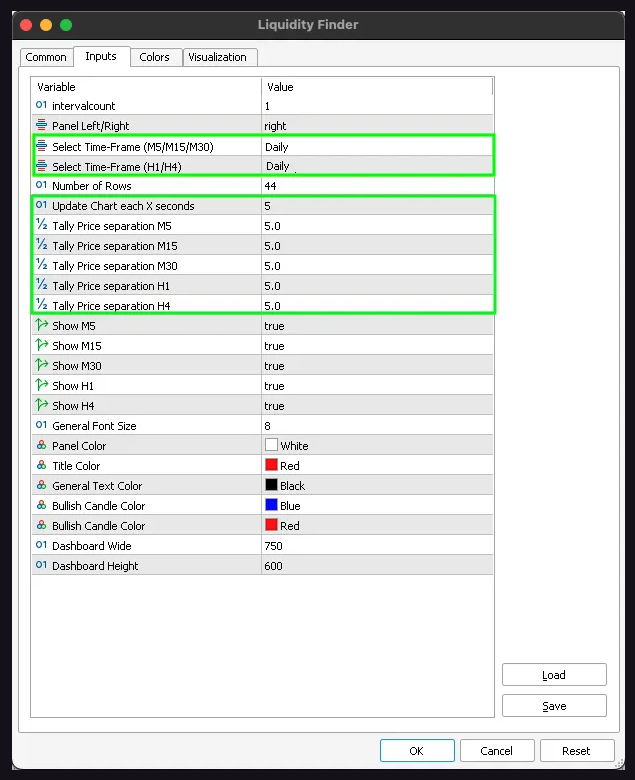

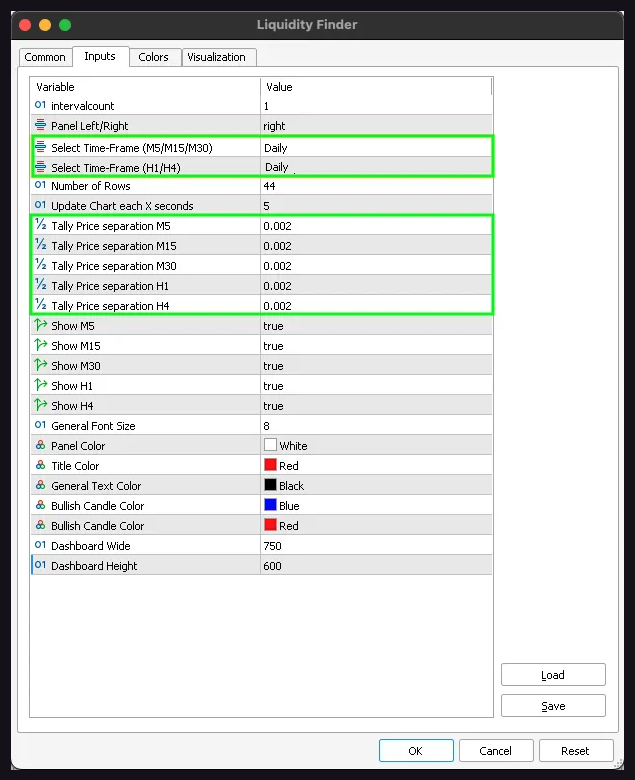

Day Buying and selling Settings: Regulate the time frames of M5, M15, and M30 to show Day by day knowledge, with the interval depend set to 1. Disable the show of H1 and H4 time frames. This configuration will present the help, resistance, and liquidity ranges for the current day.

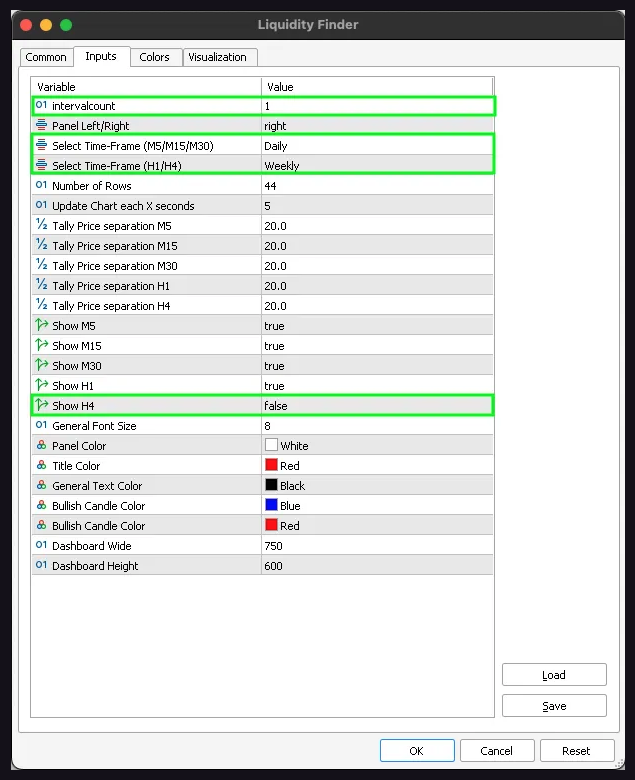

Day Buying and selling Settings: Regulate the time frames of M5, M15, and M30 to show Day by day knowledge, H1 and H4 to show weekly knowledge with the interval depend set to 1. Disable the show of H4 timeframe. This configuration will present the help, resistance, and liquidity ranges for each the current day and the current week on the H1 timeframe.

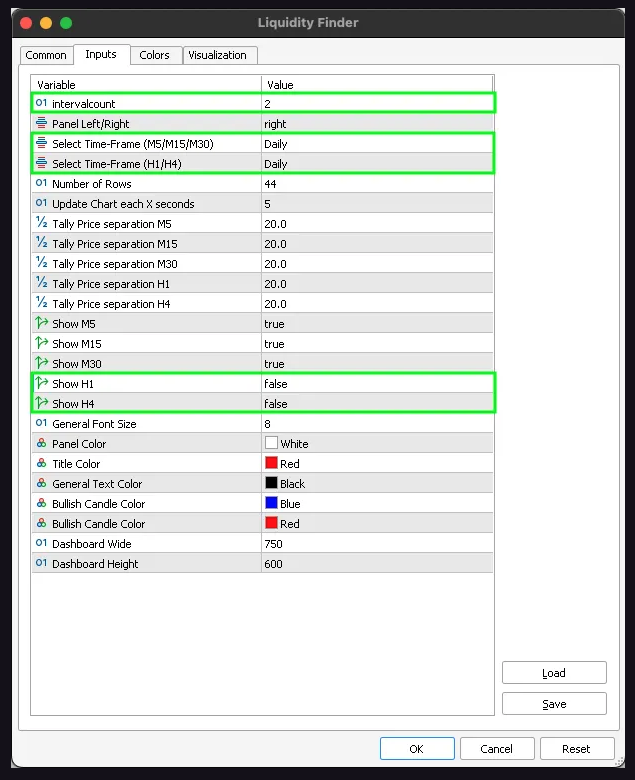

Day Buying and selling Settings: Regulate the time frames of M5, M15, and M30 to show Day by day knowledge, with the interval depend set to 2. Disable the show of H1 and H4 time frames. This configuration will present the help, resistance, and liquidity ranges for the current and former day.

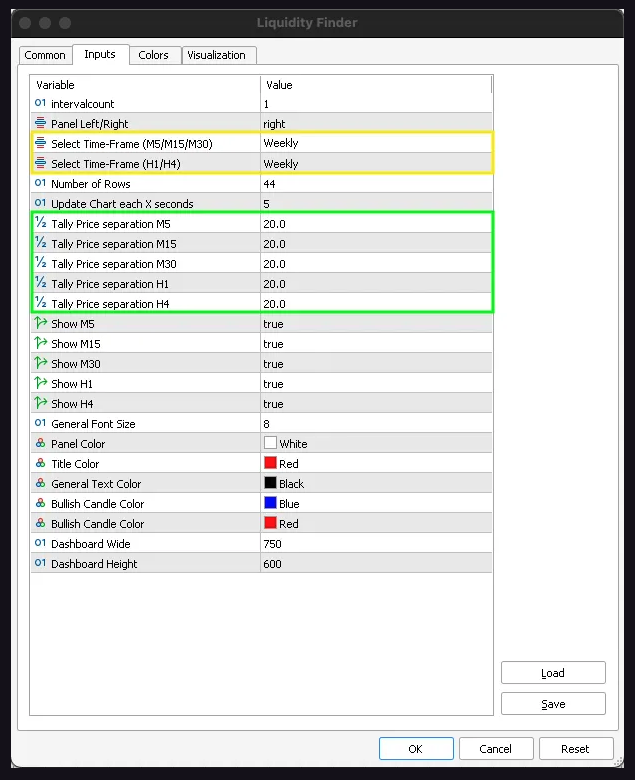

Tally Value Separation: 20.0 (Day by day & Weekly)

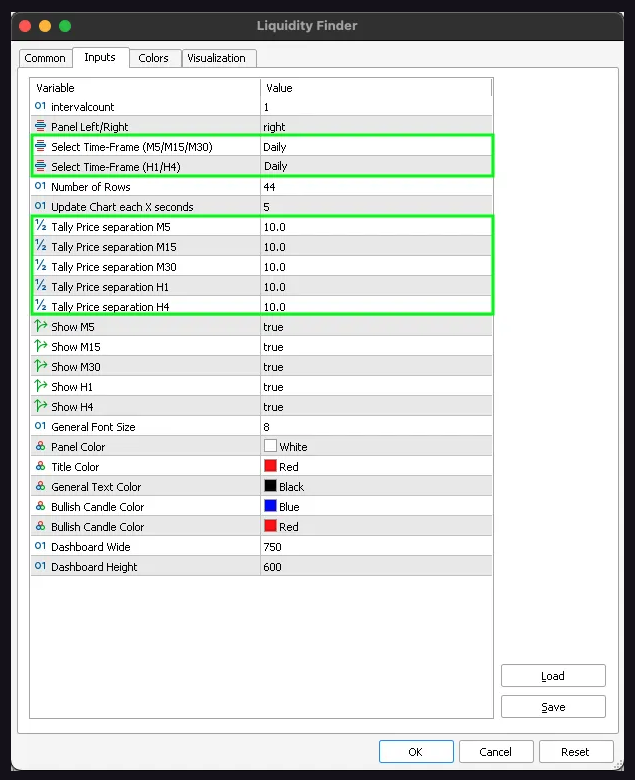

Tally Value Separation: 10.0 (Day by day)

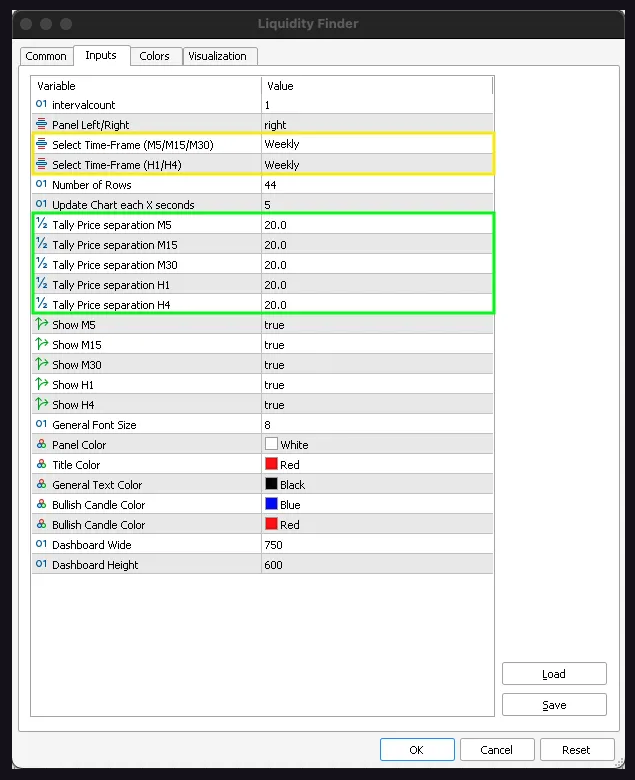

Tally Value Separation: 20.0 (Weekly)

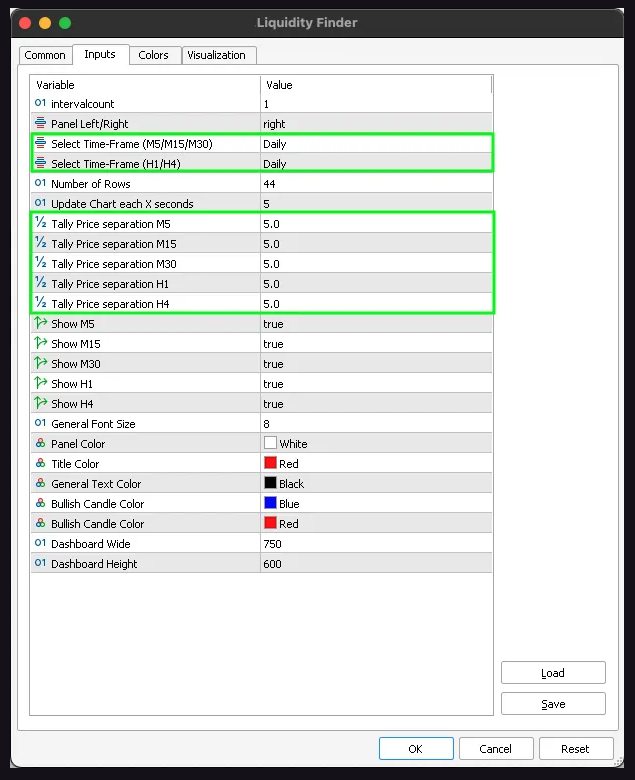

Tally Value Separation: 5.0 (Day by day)

Tally Value Separation: 10.0 (Weekly)

Tally Value Separation: 25.0 (Day by day)

Tally Value Separation: 50.0 (Weekly)

Tally Value Separation: 2.5 (Day by day)

Tally Value Separation: 5.0 (Weekly)

Tally Value Separation: 0.0002 (Day by day)

-

EUR/USD

-

GBP/USD

-

CHF/USD

-

AUD/USD

-

USD/CAD

-

NZD/USD

Tally Value Separation: 0.0005 (Weekly)

-

EUR/USD

-

GBP/USD

-

CHF/USD

-

AUD/USD

-

USD/CAD

-

NZD/USD

Tally Value Separation: 0.05 (Day by day)

Tally Value Separation: 0.1 (Weekly)

Tally Value Separation: 0.05 (Day by day & Weekly)

Tally Value Separation: 2.0 (Day by day & Weekly)

Tally Value Separation: 0.1 (Day by day)

Tally Value Separation: 0.2 (Weekly)

Tally Value Separation: 0.2 (Day by day & Weekly)

Tally Value Separation: 0.05 (Day by day & Weekly)

Tally Value Separation: 50.0 (Day by day)

Tally Value Separation: 100.0 (Weekly)

Tally Value Separation: 5.0 (Day by day & Weekly)

Tally Value Separation: 0.002 (Day by day)

Tally Value Separation: 0.005 (Weekly)