Tax season is upon us – and it seems totally different from years prior. With main federal tax legislation adjustments affecting 2023 returns, many people will possible ask why their refund wasn’t as giant this 12 months. To assist minimize by means of the perplexity, use our sliced-up infographic to search out solutions to this 12 months’s high tax season questions.

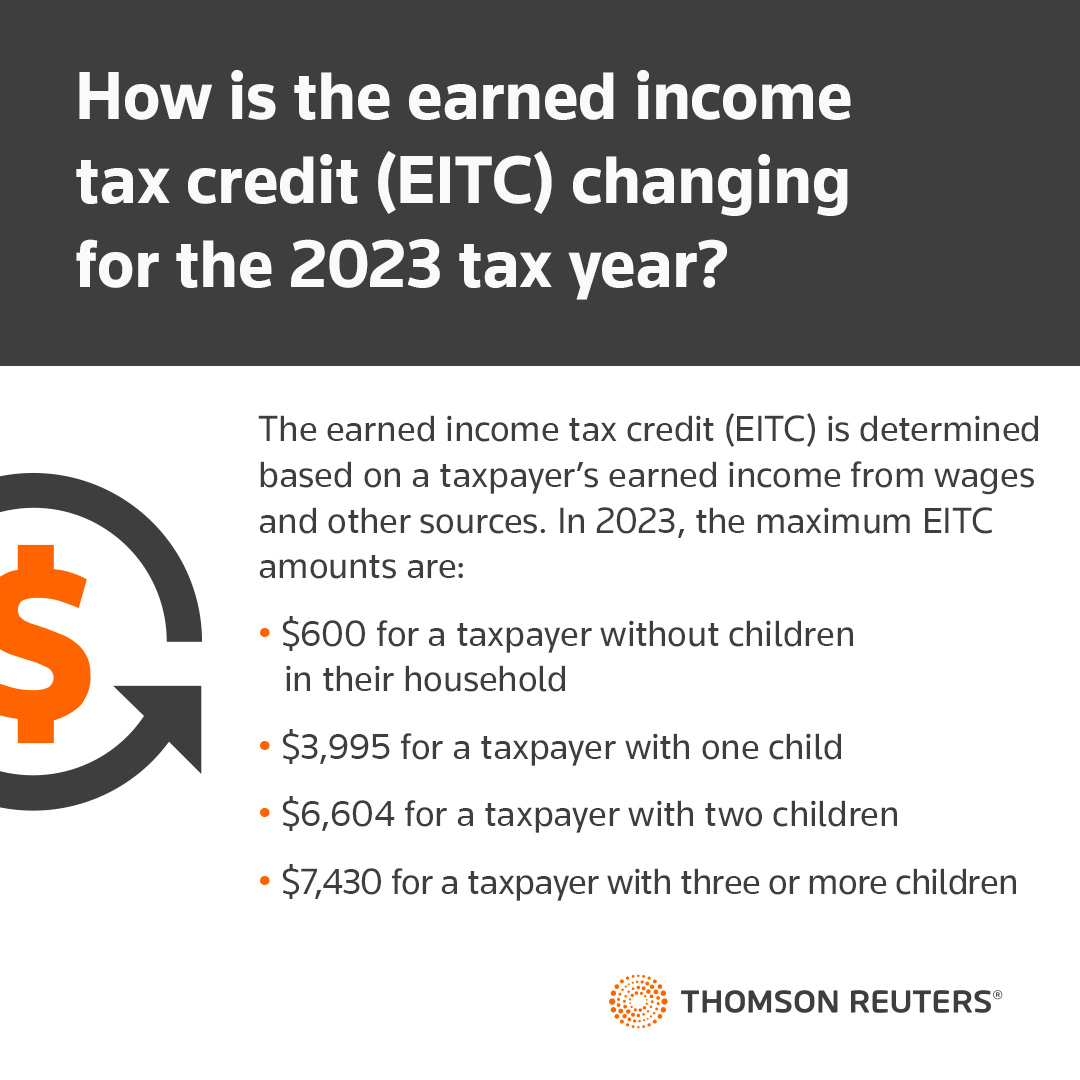

The earned earnings tax credit score (EITC) is decided primarily based on a taxpayer’s earned earnings from wages and different sources.

How is the EITC altering?

-

- For 2023, the utmost earned earnings credit score is $7,430 for these with three or extra qualifying kids.

- For 2023, the utmost quantity of earned earnings on which the earned earnings tax credit score will likely be computed is $7,840 for taxpayers with no qualifying kids, $11,750 for taxpayers with one qualifying youngster, and $16,510 for taxpayers with two or extra qualifying kids.

- For 2023, the phaseout of the allowable earned earnings tax credit score will start at $16,370 for joint filers with no qualifying kids ($9,800 for others with no qualifying kids), and at $28,120 for joint filers with a number of qualifying kids ($21,560 for others with a number of qualifying kids).

- The quantity of disqualified earnings (typically funding earnings) a taxpayer could have earlier than dropping your entire earned earnings tax credit score is $11,000 for 2023.

Most EITC quantity

An eligible particular person is allowed an EITC equal to the credit score share of earned earnings (as much as an “earned earnings quantity”) for the tax 12 months, topic to a phaseout. The utmost EITC for 2023 is $600 (for taxpayers with no qualifying kids), $3,995 (one qualifying youngster), $6,604 (two qualifying kids), and $7,430 (three or extra qualifying kids).

SECURE 2.0 Act

- Whereas lots of the tax advantages associated to the COVID-19 pandemic have expired or reverted to their pre-pandemic ranges, expanded medical health insurance subsidies are prolonged by means of 2025. (Tax Planning and Advisory Information—Well being Care Reform—premium tax credit score growth)

- The SECURE 2.0 Act (the “Act”) was handed on December 29, 2022. Among the many key retirement provisions within the Act are: Increasing computerized enrollment in retirement plans; growing the age for the required starting date for necessary distributions; the next catch-up restrict to use at ages 60, 61, 62, and 63; and eliminating the extra tax on corrective distributions of extra contributions. The Act additionally consists of a number of smaller non-retirement tax provisions, together with adjustments to ABLE accounts beneath Code Sec. 529A and modifications to the principles governing charitable conservation easements beneath Code Sec. 170.

- Particularly for 2023, the Act:

- Will increase the age for the required starting date to start out taking necessary distributions. (Tax Planning and Advisory Information—Retirement Plans for Self-Employed—requires minimal distributions)

- Modifies the rule concerning the ten% early distribution tax because it pertains to firefighters and public security officers. For extra particulars on the Act’s adjustments to retirement planning for each 2023 and 2024, see the Retirement part beneath. (Tax Planning and Advisory Information—Retirement Plans for Self-Employed— exceptions to the early distribution tax).

Pupil mortgage curiosity deductions

- Curiosity paid on a professional pupil mortgage is deductible as much as $2,500 per return, apart from married taxpayers submitting separate returns, for whom it’s denied. This deduction phases out at larger earnings ranges. Taxpayers who may fall throughout the phase-out vary for the scholar mortgage curiosity deduction this 12 months ought to attempt to shift earnings to subsequent 12 months in order that their current-year earnings falls beneath the phase-out threshold.

- Pupil mortgage curiosity deductions is likely to be decrease this 12 months for some taxpayers attributable to COVID-19 reduction that lowered the curiosity on sure pupil loans to 0% and suspended sure pupil mortgage funds. Taxpayers ought to think about whether or not making extra pupil mortgage funds earlier than December 31 will allow them to totally make the most of the scholar mortgage curiosity deduction.

- The allocation of funds between principal and curiosity for functions of the deduction could not match the allocation acknowledged on Type 1098-E from the lender or mortgage servicer. A taxpayer might be able to declare a deduction for funds allotted to the principal by the lender to the extent the funds symbolize unpaid capitalized curiosity. For tax functions, a cost typically applies first to acknowledged curiosity that continues to be unpaid as of the date the cost is due, second to any mortgage origination charges allocable to the cost, third to any capitalized curiosity that continues to be unpaid as of the date the cost is due, and fourth to the excellent principal.

Diminished Threshold for Required Digital Submitting

The Taxpayer First Act (TFA, PL 116-25) contained a provision that permitted the IRS to problem rules to scale back the 250-return threshold that triggers the digital submitting mandate of wage statements (Checkpoint Payroll Information ¶4261) and data returns (Checkpoint Payroll Information ¶4264). The IRS launched closing rules in February 2023 that lowered the e-filing threshold mandate from 250 returns of a single kind of knowledge return to 10 info returns in combination for the 2023 tax 12 months (2024 submitting 12 months). It is a vital lower and can set off extra digital submitting within the 2024 processing 12 months. Payroll-related types impacted by the lowered threshold embrace:

-

- Type W-2

- Type 1099 sequence, together with Type 1099-NEC, 1099-MISC, and 1099-R.

- Reasonably priced Care Act returns, together with Type 1094 sequence, Type 1095-B, and 1095-C.

- Types 3921 and 3922

- Type 5498

- Type 8027

Worker Retention Credit score Processing Moratorium

The IRS introduced a moratorium on the processing of latest Worker Retention Credit score (ERC) claims by means of December 31, 2023, in response to a surge in questionable claims ensuing from aggressive ERC promoters and advertising and marketing (Checkpoint Payroll Information ¶20,905). The ERC, now expired, was established in the course of the peak of the COVID-19 pandemic to offer reduction to companies and staff. New claims could also be filed, nonetheless, the IRS will likely be pausing processing till a minimum of 2024.

The IRS famous that the variety of fraudulent ERC claims has elevated. Nevertheless, for these taxpayers with respectable claims, the ERC could also be claimed for the 2020 tax intervals by April 15, 2024, and for the 2021 tax intervals by April 15, 2025, utilizing Type 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Declare for Refund.

“Employers and practitioners ought to revisit any ERC tax credit score claims to make sure eligibility. The IRS gives an ERC eligibility guidelines for help. If any questions come up, search for the longer term IRS steering on the withdrawal and settlement applications to assist navigate this sophisticated topic.”

– Christopher Wooden, CPP, Senior Editor

Worker Retention Withdrawal Course of and Settlement Initiative

The IRS will likely be introducing a withdrawal course of that permits taxpayers to withdraw a beforehand filed ERC declare. For companies that already acquired an ERC cost, the IRS is establishing a particular settlement program that may enable taxpayers to make repayments for the improperly acquired ERC cost. Particulars on the withdrawal course of and settlement initiative are forthcoming (Checkpoint Payroll Information ¶20,905).

FUTA Credit score Discount

Beneath the Federal Unemployment Tax Act (FUTA), employers typically pay FUTA tax on the primary $7,000 in wages for every worker annually. The FUTA tax price is 6.0%. Nevertheless, most employers profit from a 5.4% FUTA credit score, leading to a FUTA price of 0.6% on the primary $7,000 in wages per worker, annually (Checkpoint Payroll Information ¶4075).

Throughout the COVID-19 pandemic, a number of states took federal loans to maintain their unemployment belief funds solvent. States that default on these loans for 2 or extra consecutive years are topic to a discount in credit in any other case accessible towards the FUTA tax.

At present, California, Connecticut, Illinois, New York, and the U.S. Virgin Islands are listed by the U.S. Division of Labor as potential FUTA credit score discount states for 2023. These tax jurisdictions have till November 10, 2023, to repay their loans or their FUTA tax credit score will likely be lowered. All of those tax jurisdictions had been topic to a FUTA credit score discount for 2022.

Itemized deductions: charitable contributions

People could deduct contributions to charitable organizations as much as a sure % of their “contribution base” (typically, AGI). By 2025, that share is 60% for money contributions and 30% for noncash contributions.

For year-end planning, it’s helpful to evaluate whether or not a person has charitable contribution carryovers from a previous 12 months. If earnings will decline, care ought to be taken to make use of the carryovers earlier than they expire.

A person with low foundation, extremely appreciated inventory could wish to think about funding a charitable the rest belief with the inventory. The belief can promote the inventory with out incurring any earnings tax and make distributions over time to the present particular person beneficiary (or beneficiaries) that will likely be taxed on the then-current charges within the years of distribution. The donor can even declare a charitable deduction within the 12 months the belief is funded, equal to the worth of the charitable the rest curiosity, topic to limitations.

Excited by studying extra on year-end tax planning? Watch our latest 12 months-end Tax Planning Webcast or Obtain our latest White Paper “11 life adjustments to evaluate with accounting shoppers“.

On-Demand Webcast2023 12 months-end Tax Planning

|

|

White Paper11 life adjustments to evaluate with accounting shoppers

|

|