Nearly each Bitcoin investor is anticipating a continued worth surge because the crypto continues to commerce across the $70,000 worth mark. On-chain knowledge has proven a big a part of this surge will be attributed to the accumulation by massive whales.

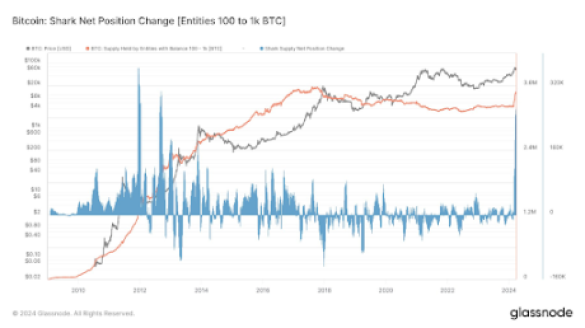

Bitcoin is undoubtedly house to loads of these whale addresses holding lots of of tens of millions of {dollars} and with transactions that may transfer the market. Nevertheless, on-chain knowledge has additional revealed that the buildup development has additionally flowed into the following cohort of merchants. These merchants, often known as “Sharks,” are addresses that maintain between 100 BTC and 1,000 BTC. In keeping with Glassnode knowledge, shark pockets addresses have accrued 268,441 BTC prior to now 30 days, which is the largest web place change since 2012.

Elevated Accumulation Of BTC

In keeping with a Glassnode chart shared on social media by crypto analyst James Van Straten, Bitcoin accumulation by shark traders shot up in 2024 to reverse a multi-year consolidation since 2020. Because of this, these addresses elevated their holdings by 268,441 in 30 days, roughly changing to $18 billion.

Whereas these sharks do not need as a lot particular person energy over worth motion as very massive whales, their collective conduct remains to be price monitoring as additionally they relate to the sentiment amongst traders. Consequently, this huge accumulation development may result in extra shopping for which might sign a continued worth surge for Bitcoin.

Supply: Glassnode

The surge in accumulation shouldn’t be actually shocking, because the launch of Spot Bitcoin ETFs within the US has ushered in a much bigger wave of accumulation sentiment from all cohorts of Bitcoin traders. As one other analyst identified on social media, this shark accumulation may’ve been as a result of ETFs buying large quantities of Bitcoins from Coinbase OTC desks.

Bitcoin whales (addresses holding greater than 1,000 BTC) have additionally upped their exercise prior to now few days, signaling strategic positioning available in the market. Numerous transaction alerts from Whale Alerts have proven strategic motion from whale addresses.

Notably, the crypto whale transaction tracker has revealed $1.3 billion price of BTC exchanged between whale addresses prior to now 24 hours. Amongst these massive BTC actions was a notable switch of three,599 BTC price $252 million between two unknown wallets. One other notable transaction was the switch of three,118 BTC from an unknown pockets to Coinbase Institutional.

Bitcoin To $100,000?

Knowledge from IntoTheBlock has additionally reiterated this accumulation development with its web switch development from exchanges. Knowledge from ITB’s platform reveals a $16.18 billion outflow from exchanges as in opposition to a $15.76 billion influx prior to now seven days. Bitcoin is now buying and selling at $67,931 and has didn’t stabilize above the $70,000 mark once more.

Nevertheless, the buildup by whales and sharks, rising mainstream curiosity from institutional traders via Spot Bitcoin ETFs, and the approaching halving all level to the opportunity of substantial worth appreciation to $100,000.

BTC worth at $70,000 | Supply: BTCUSDT on Tradingview.com

Featured picture from BBC, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site completely at your individual danger.