U2 is one in all my favourite bands and I can not assist however consider their music, “With or With out You”, once I take a look at an S&P 500 chart. This secular bull market is ready for nobody. You are both in it otherwise you’re not. There’s nothing improper with being a bit cautious infrequently, however remaining on the bearish aspect of the ledger or, worse but, shorting shares? In my view, it is monetary suicide. As cash rotates into value-oriented shares, there are fewer and fewer names not collaborating on this bull market. Looking for shares that may go down appears insane to me when the overwhelming majority preserve trucking greater.

What Ought to We Anticipate From The Financial system?

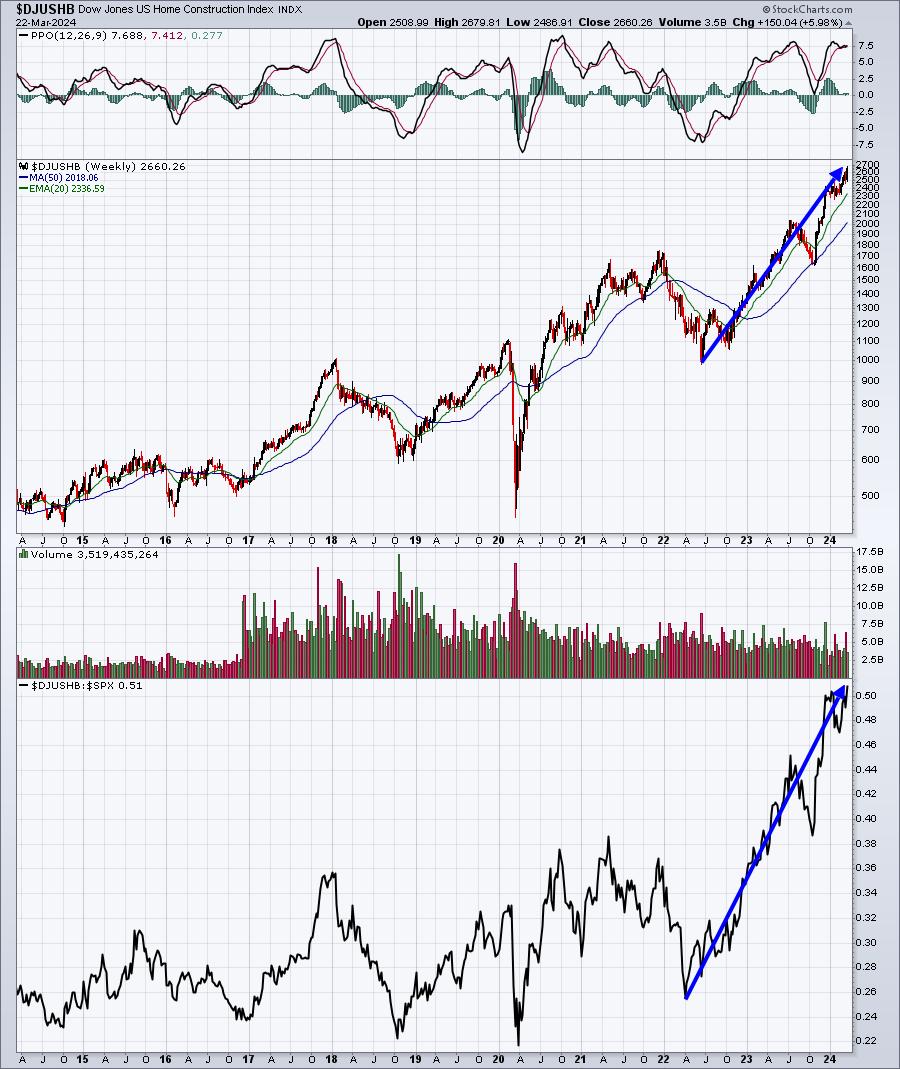

When you take a look at economically-sensitive areas, I discover most charts very encouraging, beginning with residence building ($DJUSHB). The DJUSHB was our best-performing business group final week. Try its efficiency each short-term and long-term:

DJUSHB – day by day

Since breaking out in late-November, the DJUSHB has been very robust on each an absolute and relative foundation (blue directional traces). However take a look at these blue circles in late-December. That was when the 10-year treasury yield ($TNX) hit its lowest stage simply beneath 3.80%. We noticed the TNX climb 57 foundation factors after that and it is STILL 44 foundation factors greater. But the DJUSHB has been pushing greater on an absolute and relative foundation with a a lot greater TNX. That tells me that the massive Wall Road corporations imagine charges can be heading decrease later in 2024 and into 2025.

DJUSHB – weekly

The large transfer to the upside, once more each on an absolute and relative foundation, screams to me that the route of annual INFLATION had extra to do with DJUSHB efficiency than the route of the TNX. As soon as the annual Core CPI fee printed that double prime and rolled over, Wall Road couldn’t have cared much less about what the Fed (or CNBC) was saying. Decrease inflation meant a MUCH BETTER surroundings for interest-rate delicate areas.

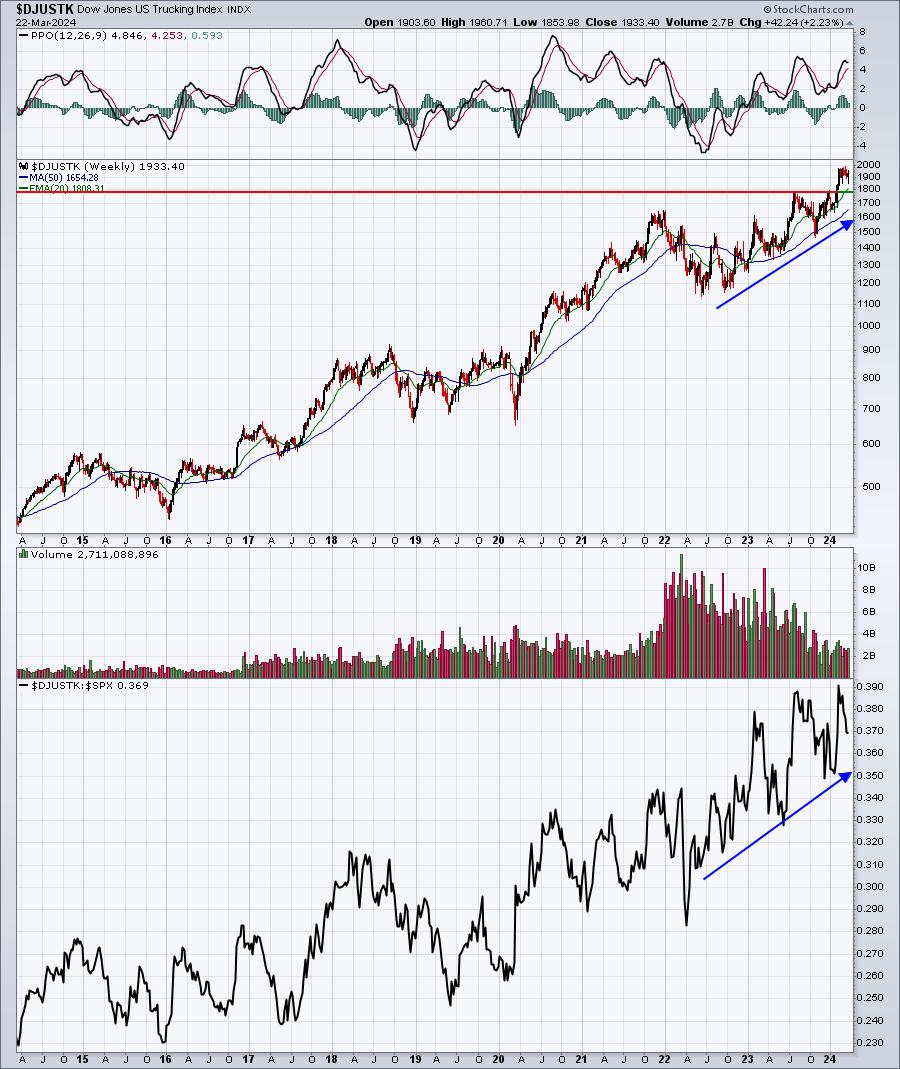

If we take a look at transportation shares ($TRAN), it wasn’t fairly so clear. Trucking ($DJUSTK) was similar to residence building, largely rising just lately, nevertheless it’s been a harder trip on the railroads ($DJUSRR). Try these two 10-year weekly charts:

Trucking ($DJUSTK)

Railroads ($DJUSRR)

Trucking is bullish and serving to to steer inventory costs greater. Railroads? Not a lot. It is worthwhile noting, nonetheless, that railroads look like printing the suitable aspect of a bullish cup with deal with continuation sample. What we have to see from this group is an final breakout of this sample above 3800 and a flip greater within the relative power panel, clearing the 0.72 relative resistance stage.

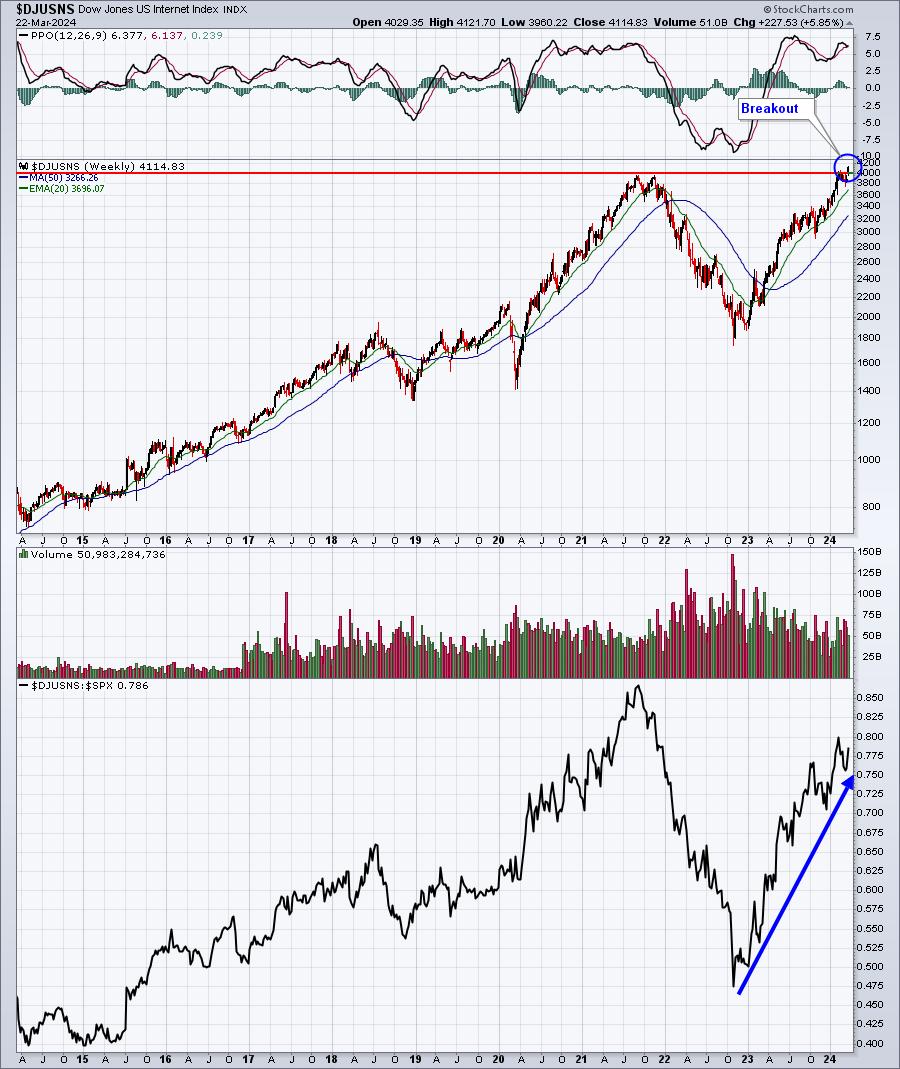

The Ordinary Suspects

Semiconductors ($DJUSSC), software program ($DJUSSW), and web ($DJUSNS) shares have offered regular market management since early 2023, however progress had fallen out of favor the previous few weeks to some months, relying on which chart you take a look at. The web group, although, rallied to a make a breakout to an all-time excessive, even supposing its relative power line is not additionally at an all-time excessive:

Weekly Market Recap

Key alerts are telling me to trip this bull greater! I talk about a number of of these alerts and greater than a dozen particular person shares exhibiting super power on this week’s episode of EB Weekly Market Recap. CLICK HERE to look at the video and please go away me feedback. It will additionally assist me for those who may hit that “Like” button and subscribe to our channel as a way to be notified once I publish a video.

Thanks a lot!

Completely happy buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Day by day Market Report (DMR), offering steering to EB.com members each day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as nicely, mixing a novel ability set to strategy the U.S. inventory market.