Through the top of the 2021-22 fintech VC increase, no sector was hotter than spend administration.

Firms like Brex, Ramp and Navan all raised huge rounds at multi-billion greenback valuations. Whereas the class has cooled off, like most areas of fintech, it’s nonetheless attracting capital from some huge names in enterprise capital.

Coast was based in 2020 and right now introduced a brand new spherical of funding: $25 million in fairness and $67 million in debt financing. However it’s not competing with the aforementioned huge names.

As an alternative, Coast is concentrated on what it calls “real-world” companies, those who have personnel and automobile fleets within the discipline like plumbers, HVAC companies, trucking firms and supply firms.

There’s actually much less competitors at that finish of the market and these firms might actually use innovative expense administration know-how.

It’s one other nice of instance of the verticalization of fintech.

Featured

> VCs double down on fintech Coast, which goals to be the Brex for ‘real-world’ industries

By Mary Ann Azevedo

The expense administration enviornment is a crowded one, with well-funded gamers corresponding to Brex, Ramp and Navan all clamoring for market share. These firms are usually targeted on tech startups and enormous companies. However a four-year-old contender, Coast, is pursuing a distinct kind of buyer.

From Fintech Nexus

> TruStage delivers Fee Guard Insurance coverage as digital lending insurance coverage resolution

By Craig Ellingson

Neither the lender nor the borrower desire a mortgage default, now with this revolutionary new resolution from TruStage the danger of default could be eliminated.

> Banking for the Unbanked: How BaaS is Driving Monetary Inclusion

By Nicky Senyard

For the unbanked and underbanked, BaaS means easy accessibility to monetary providers that meet their particular wants. By combining fintech’s method with the capabilities of conventional banks, BaaS fosters monetary inclusion.

Editorial Cartoon

Webinar

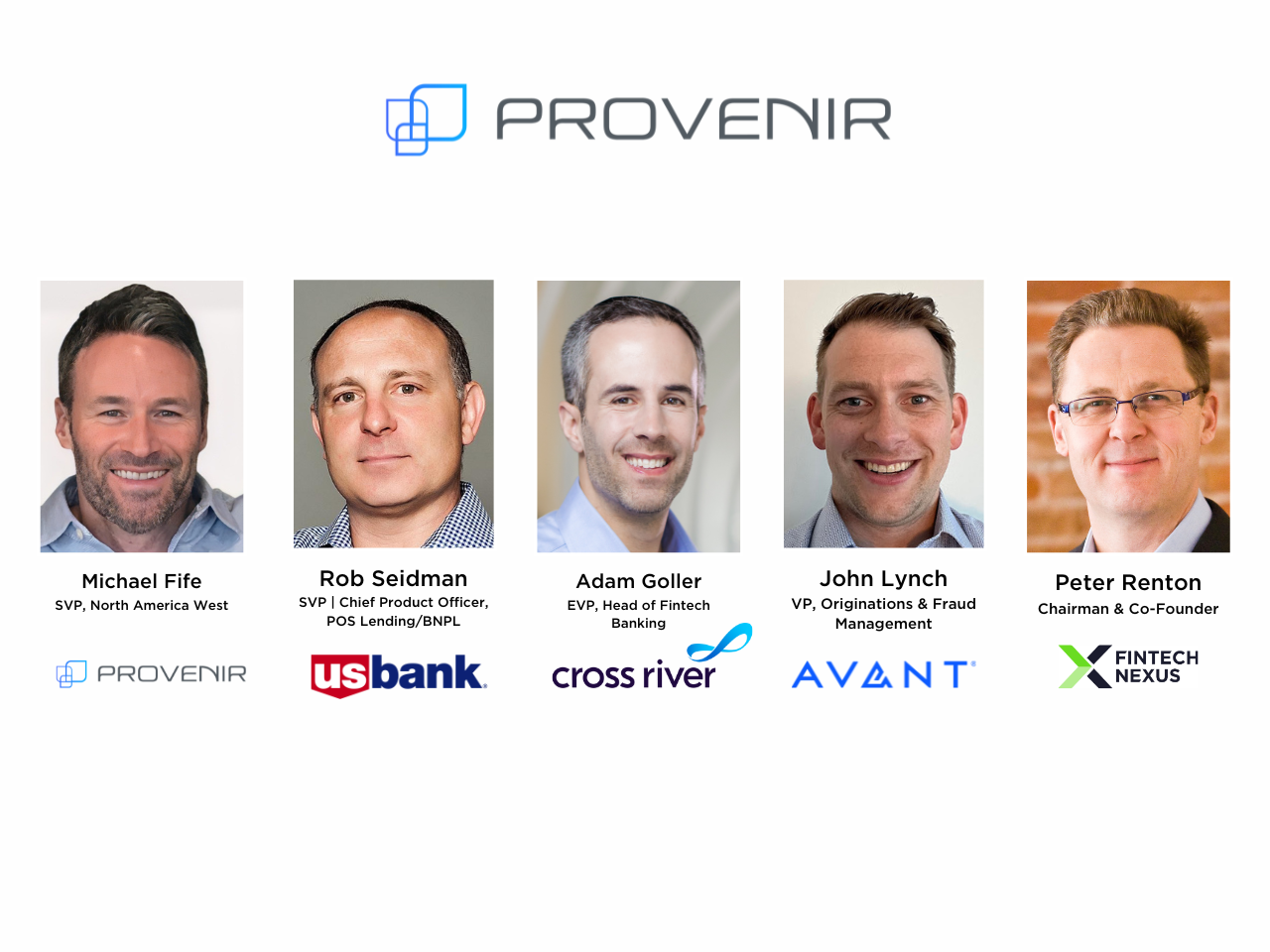

How Client Lenders Can Scale back Friction With out Compromising on Danger and Fraud Prevention

Mar 21, 2pm EDT

Buyer expertise is extremely vital to right now’s discerning shoppers, whether or not they’re searching for monetary providers…

Additionally Making Information

- USA: 8 of the largest points going through the banking trade right now

A serious shake-up within the funds world, a knowledge breach that’s opened up a debate on who’s finally chargeable for cyberattacks, and uncertainty about the way forward for the Basel III endgame proposal are among the many points banks want to look at.

- UK: UK set for hovering digital pockets adoption

The UK is approaching a seismic shift in how folks pay, with digital wallets set to comprise half of all e-commerce spend and practically a 3rd of POS transaction worth by 2027, in keeping with a report from Worldpay.

- USA: The Significance of Primacy in Banking

Within the face of accelerating acquisition challenges and rising attrition charges, retail banks should not solely give attention to buying new prospects but additionally on

To sponsor our newsletters and attain 275,000 fintech fanatics together with your message, contact us right here.