In a not-so surprising flip of occasions, Bitcoin (BTC) has surged to new heights, breaking the $57,000 barrier in the course of the early hours of Tuesday within the Asian market. This worth degree, not seen since November 2021, marks a major resurgence for the main cryptocurrency.

Bitcoin ETFs Expertise Unprecedented Exercise

Remarkably, the surge in Bitcoin’s worth has triggered substantial exercise in US-based spot Bitcoin ETFs, excluding Grayscale’s GBTC. In line with Bloomberg, these ETFs recorded a record-high $2.4 billion in buying and selling quantity on Monday. This surge in buying and selling exercise underscores the rising curiosity and involvement of institutional traders within the cryptocurrency market.

As of the time of publication, bitcoin had barely decreased to $56,437, however it was nonetheless up about 10% from yesterday. Because the starting of the 12 months, the worth of bitcoin has risen by greater than 30%, persevering with a protracted surge that has additionally spurred curiosity in smaller currencies like Ether and Solana, amongst speculators.

The demand for Bitcoin will not be confined to identify buying and selling alone; a considerable inflow of roughly $5.6 billion has poured into lately launched Bitcoin ETFs within the US, which started buying and selling on January 11. This inflow of funding alerts a broadening curiosity in Bitcoin, extending past the standard base of digital asset fans.

It’s official..the New 9 Bitcoin ETFs have damaged all time quantity file right now with $2.4b, simply barely beating Day One however about double their latest day by day common. $IBIT went wild accounting for $1.3b of it, breaking its file by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Bitcoin’s Rally Outshines Conventional Property

Surprisingly, Bitcoin’s rally this 12 months has outpaced conventional belongings reminiscent of shares and gold. The ratio evaluating Bitcoin’s worth to that of the valuable metallic has reached its highest degree in over two years, indicating a shifting choice amongst traders in the direction of digital belongings.

The general worth of digital belongings, together with numerous cryptocurrencies, now stands at a staggering $2.2 trillion, a considerable improve from the lows skilled in the course of the bear market of 2022 when the market worth dipped to round $820 billion. This resurgence demonstrates the resilience and rising prominence of digital belongings within the monetary panorama.

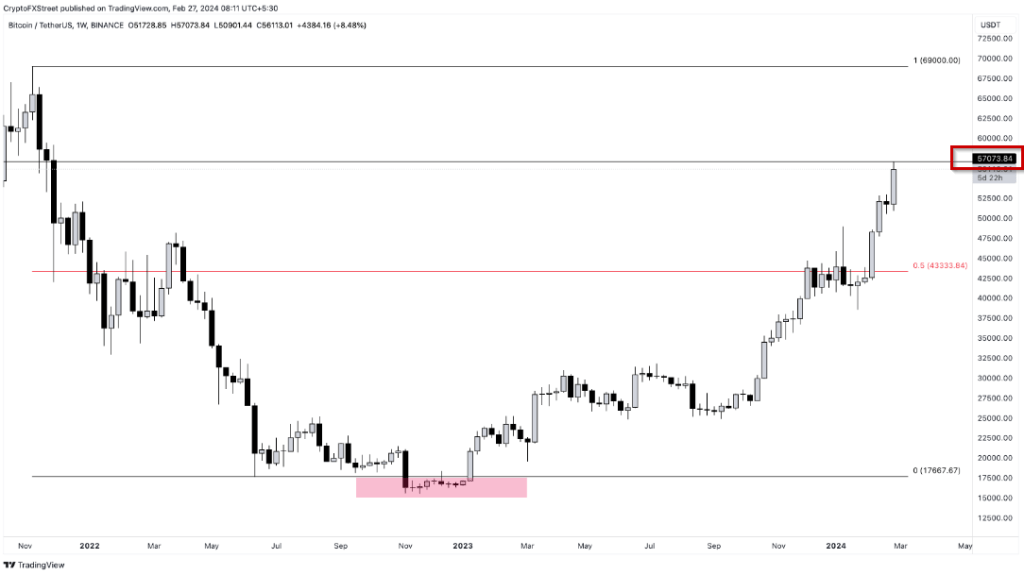

BTCUSD buying and selling at $55,799 on the day by day chart: TradingView.com

Opposite Market Indicators Fail To Deter Crypto Momentum

In an intriguing improvement, regardless of an increase in US Treasury yields, which generally alerts expectations for tighter financial coverage, the bullish momentum within the cryptocurrency market stays resilient. Digital tokens like Bitcoin are experiencing notable upward actions, defying standard market indicators.

Fundstrat World Advisors’ Head of Digital-Asset Technique, Sean Farrell, famous in a latest assertion that the “bullish momentum in crypto is unfolding regardless of an uptick in charges,” highlighting the distinctive dynamics influencing the cryptocurrency market.

MicroStrategy Boosts Company Bitcoin Holdings

Within the midst of this ongoing rally, MicroStrategy, a notable enterprise software program agency acknowledged for incorporating Bitcoin into its company technique, has introduced a major addition to its cryptocurrency holdings.

The corporate revealed that it had bought an extra 3,000 Bitcoin tokens this month, bringing its whole Bitcoin holdings to roughly $10 billion. This strategic transfer by MicroStrategy highlights the rising acceptance of cryptocurrencies as a priceless asset by company entities.

Featured picture from, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site completely at your individual threat.