Within the ever-uncertain world of cryptocurrency, Solana (SOL) is producing renewed curiosity amongst analysts, with some predicting a possible comeback within the close to future. Nevertheless, the highway to restoration may be bumpy, as bullish alerts are countered by lingering resistance ranges and a cautious market sentiment.

Technical Evaluation Factors In direction of Bullish Reversal

Analyst Ali Martinez has garnered consideration together with his latest evaluation suggesting a bullish reversal for Solana. Based mostly on the Tom DeMark (TD) Sequential indicator, Martinez believes a four-candle rally for SOL/USDT is imminent. This optimism is additional bolstered by the Transferring Common Convergence Divergence (MACD) indicator, which at the moment sits in constructive territory, usually interpreted as an indication of bullish momentum.

The TD Sequential is a number one pattern reversal indicator, and its latest purchase sign is a big improvement, explains Martinez. This, mixed with the constructive MACD, means that patrons would possibly overpower the market and push SOL above the present resistance degree, he identified.

The TD Sequential indicator presents a purchase sign on the #Solana each day chart, suggesting a possible upswing that might span one to 4 each day candlesticks for $SOL. pic.twitter.com/LR0I9Y2diu

— Ali (@ali_charts) February 24, 2024

Assist Ranges And Resistance Hurdles

Regardless of the constructive indicators, Martinez acknowledges the presence of hurdles. The worth of SOL has confronted resistance at $104.67 in latest makes an attempt to climb increased. Moreover, a drop beneath the essential help degree of $102.08 might set off a decline to $99.81.

Solana (SOL) is at the moment buying and selling at $103.15. Chart: TradingView.com

Including one other layer of complexity is the present market sentiment. The Relative Energy Index (RSI), which measures market momentum, at the moment sits beneath 50, indicating a bearish sentiment. This implies that regardless of technical indicators pointing in direction of a possible upswing, traders would possibly nonetheless be hesitant to leap in.

SOL within the crimson within the final seven days. Will it be capable of break previous $103? Supply: Coingecko

Solana Founder’s Tweet Sparks Hypothesis

Additional including to the intrigue surrounding Solana is a latest tweet by its founder, Anatoly Yakovenko. The tweet, referencing Satoshi Nakamoto, the pseudonymous creator of Bitcoin, has left the crypto group scratching their heads. Whereas the precise that means of the tweet stays unclear, it has sparked hypothesis and will probably affect investor sentiment.

Satoshi additionally invented solana. She simply did a a lot better job protecting up her tracks this time. The reality is on the market https://t.co/bjfcGsHqOl

— toly 🇺🇸 (@aeyakovenko) February 24, 2024

Solana’s Future Hinges On A number of Components

Solana’s future trajectory will probably depend upon a confluence of things. The success of its ongoing improvement tasks, its capacity to beat technical hurdles, and the general efficiency of the broader cryptocurrency market will all play a big position in figuring out its worth actions.

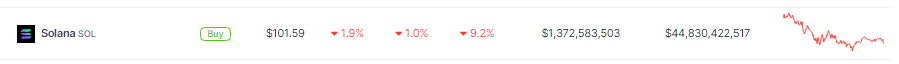

On the time of writing, SOL was buying and selling at $101.59 down .0% and 9.2% within the 24-hour and weekly timeframes, knowledge from Coingecko exhibits.

As analysts carefully monitor the cryptocurrency market, optimism surrounds Solana, indicating a possible main comeback on the horizon. The constructive alerts have led consultants to recommend the opportunity of a big breach, with expectations pointing in direction of the coveted $103 threshold.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual danger.