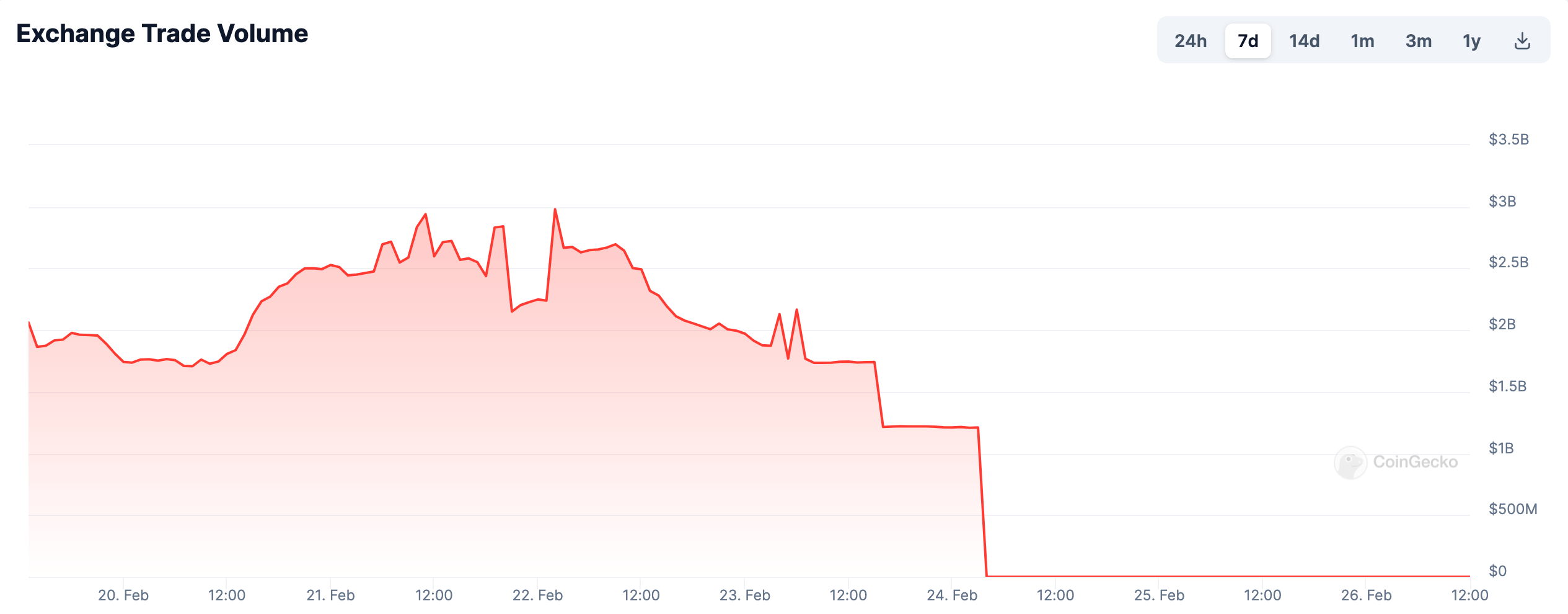

Hong Kong-based crypto trade BitForex seems to have gone fully darkish following the suspension of its web site and buying and selling utility on Feb 23. Customers have been unable to provoke withdrawals or entry the trade for a number of days, which boasted over $2 billion in buying and selling quantity as lately as Feb 24.

Information from CoinGecko reveals buying and selling quantity reducing from $2.5 billion to $1 billion between Feb 22 and Feb 24 earlier than flatlining. Nonetheless, normalized knowledge suggests the trade could have inflated its volumes by as much as 100 occasions. The normalized knowledge is the place “internet site visitors statistics are thought-about when contemplating the buying and selling quantity,” which was reported at simply $25 million for Feb 22.

On Feb 23, crypto investigator ZachXBT reported outflows of roughly $56.5 million from BitForex’s scorching wallets. Withdrawals subsequently ceased with out official communication from the trade. Additional evaluation of Bitforex’s holdings raises flags. The trade possesses a good portion of TRB and OMI token provides, particularly 18% of TRB and seven% of OMI.

As customers search solutions by way of platforms like Telegram, the timing of the firm’s CEO stepping down a month in the past raises extra suspicion. On Jan 31, CEO Jason Luo acknowledged,

“In the present day, I’ve determined to step down from the place of CEO, however my coronary heart stays deeply rooted within the BitForex household. A brand new management crew is poised to take the reins, and I consider they are going to information BitForex in direction of even higher horizons. I’ll proceed contributing my knowledge and energy to BitForex as a result of that is my everlasting dedication to this house.”

The abrupt management change at BitForex, at the side of the current occasions, now casts excessive doubt on the corporate’s stability.

On-chain exercise for the trade’s native BF token has been restricted, with roughly $2,000 moved throughout the previous 11 days. The final replace to CoinmarketCap’s knowledge for the trade was over 65 hours in the past, displaying round $280 and $175 million in Ethereum and Bitcoin buying and selling quantity, respectively.

The trade’s X account has had no exercise since Feb 21, when it posted, “What are the highest encryption tasks in 2024?🤔.”

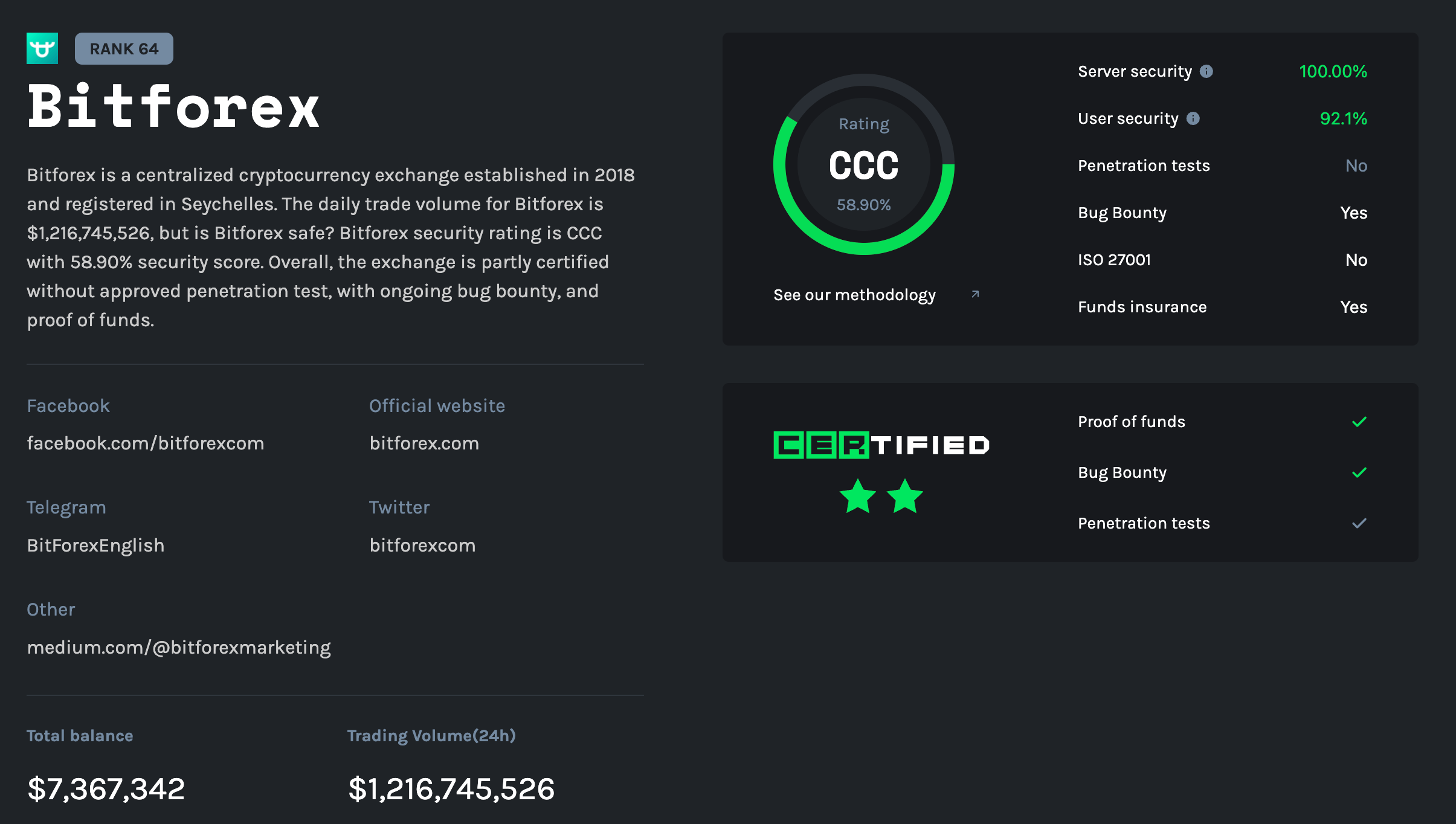

A safety ‘CCC’ ranking by Licensed suggests the trade had an insurance coverage coverage, however no particular particulars can be found.

The corporate’s official Telegram channel continues to run with none exercise from admins. One admin, known as Hazel_BitForex, has deleted their account. Different admins haven’t replied to any posts since at the least Feb 21 as of press time. The group, with 23,413 members, at the moment has over 1,000 customers on-line awaiting a response from the trade.

Information out there at this stage suggests a darkish actuality for BitForex customers. The dearth of communication throughout a number of platforms, akin to its web site, X, and Telegram accounts, means customers with funds caught on the trade could have simply motive to fret.