This secular bull market advance is working over everybody making an attempt to get in its approach. It is why I all the time say by no means to guess in opposition to one. Making an attempt to quick any such bull market is the equal of economic suicide. I normally have music taking part in within the background whereas I am working and, on Friday, because the inventory market closed, Elton John’s “I am Nonetheless Standing” began taking part in. I believed, “WOW, that is well timed!” EVERYTHING has been thrown at this secular bull market and it is nonetheless standing, “higher than it ever did.”

Resiliency is a key factor of bull market strikes and we have actually witnessed that. However, bull market or not, we completely ought to decrease our bar of expectations proper now. I might undoubtedly stay totally invested, however simply strive to not develop too bearish after we inevitably enter a interval of consolidation or (gasp!) promoting. The primary half of calendar quarters 1-3 is traditionally MUCH extra bullish than the second half of calendar quarters 1-3. Through the present secular bull market that started in 2013, here is the S&P 500 breakdown by annualized returns by calendar quarters 1-3:

- 1st half of calendar quarters 1-3: +18.14%

- 2nd half of calendar quarters 1-3: -3.37%

That is a really massive discrepancy in efficiency and it is calculated over 11+ years of information. We all know what’s been driving our main indices larger. It has been the Magnificent 7 and buddies. In a 70-page Seasonality PDF that I’ve supplied to everybody on 16 of the biggest market cap firms, a TON of seasonal data was shared on every. Following the theme of 1st half vs. 2nd half of calendar quarters, let me share with you the annualized returns for each halves for every of those 16 firms:

1st Half of Calendar Quarters 1-3:

- AAPL: +50.54%

- MSFT: +37.67%

- GOOGL: +50.42%

- AMZN: +51.51%

- NVDA: +75.63%

- META: +56.44%

- TSLA: +62.69%

- AVGO: +18.26%

- COST: +25.50%

- ADBE: +33.82%

- CSCO: +18.85%

- AMD: +72.48%

- NFLX: +47.21%

- INTC: -1.11%

- AMGN: +21.81%

- SBUX: +17.13%

2nd Half of Calendar Quarters 1-3:

- AAPL: +9.52%

- MSFT: +12.35%

- GOOGL: -8.70%

- AMZN: +13.29%

- NVDA: +47.80%

- META: +8.93%

- TSLA: +40.41%

- AVGO: +40.21%

- COST: +9.64%

- ADBE: +20.37%

- CSCO: +2.69%

- AMD: +26.77%

- NFLX: +19.45%

- INTC: +13.98%

- AMGN: +2.52%

- SBUX: -4.05%

Of those 16 shares, solely AVGO and INTC carry out higher through the 2nd halves of quarters.

I intentionally ignored This fall, as a result of this quarter has an extended historical past of seeing appreciable power throughout each halves. However in quarters 1-3, we must always merely acknowledge the historic patterns and remember to decrease our expectations, particularly after such a big rally since late-October 2023.

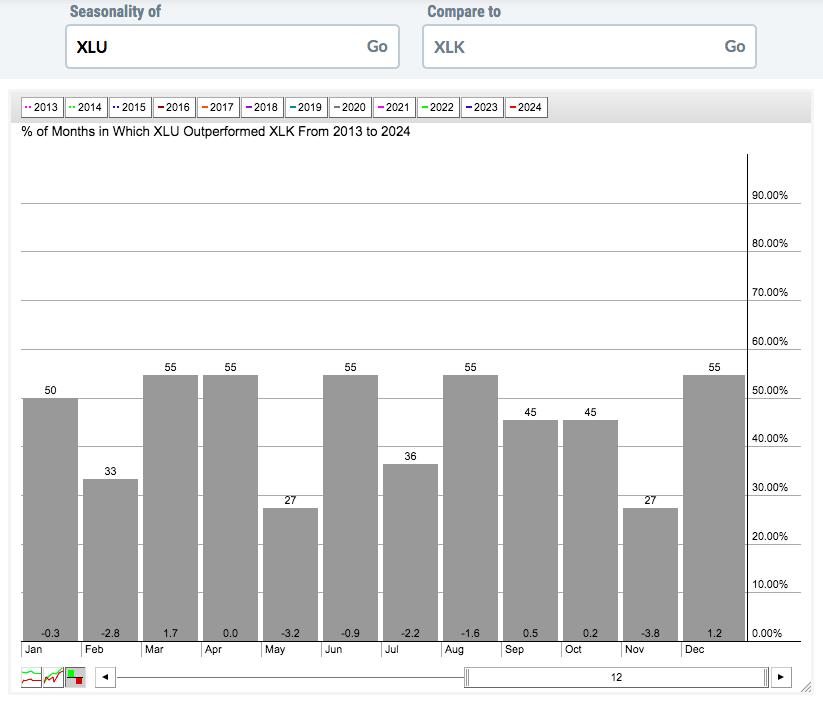

We’re nonetheless seeing a “danger on” market setting, which favors the bulls. If we start to see relative power in additional defensive sectors, that may very well be the sign to maybe tackle much less danger. Utilizing StockCharts.com’s seasonality device, we are able to examine defensive utilities (XLU) vs. ultra-aggressive know-how (XLK) since 2013:

Utilities do not outperform know-how fairly often, nevertheless it appears to occur considerably regularly within the third months of calendar quarters. Try March, June, September, and December above. March is one of the best calendar month for XLU outperformance vs. the XLK. However the second months, February, Could, August, and November, favor know-how in a HUGE approach!

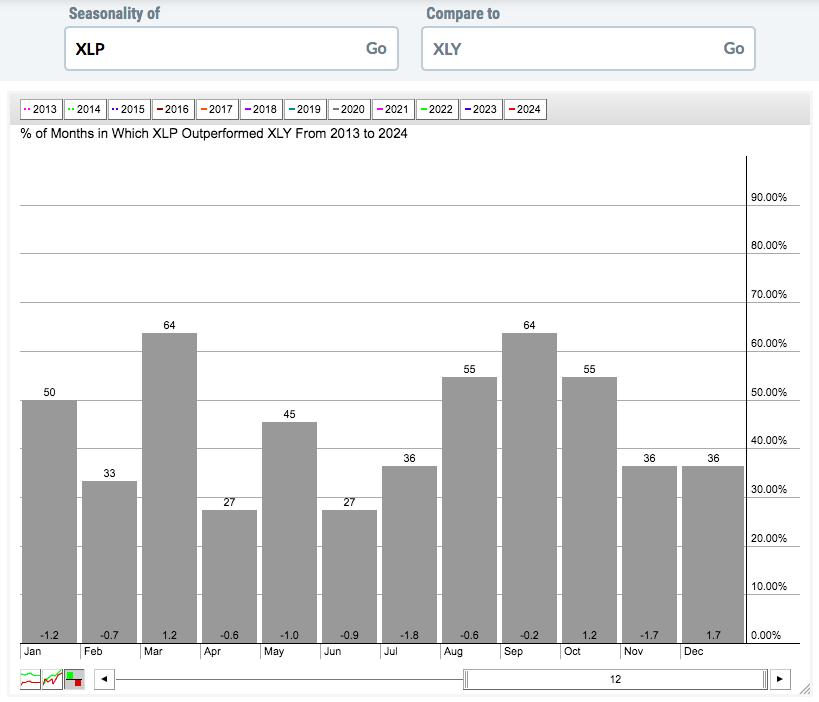

Now let’s take a look at client staples (XLP, defensive) vs. client discretionary (XLY, aggressive), utilizing the identical seasonality chart since 2013:

Once more, it is the third months of calendar quarters the place defensive areas present some relative power and the second months the place we have seen MASSIVE relative weak point. We have to acknowledge these seasonal patterns to grow to be higher merchants, realizing when it is applicable to tackle extra danger…..and when it is not.

Based mostly on all of this, it appears fairly prudent to me to be a bit extra cautious now. I am in no way saying that our main indices are primed for a giant fall. As a substitute, I am merely mentioning that we’re in a time of the yr when danger does escalate. It is as much as every particular person as to what which may imply in your individual buying and selling and/or investing.

By the best way, I’m nonetheless providing the “Bowley Pattern”, our seasonal PDF, for FREE. CLICK HERE and declare your copy!

Comfortable buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Every day Market Report (DMR), offering steerage to EB.com members daily that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as properly, mixing a novel ability set to strategy the U.S. inventory market.