We have highlighted all of the warning indicators as this bull market section has appeared to close an exhaustion level. We shared bearish market tells, together with the dreaded Hindenburg Omen, and the way main development shares have been demonstrating questionable patterns. However regardless of all of these indicators of market exhaustion, our growth-led benchmarks have been pounding even greater.

This week, Nvidia’s blowout earnings report appeared to by gasoline on the hearth of market euphoria, and the AI-fueled bullish frenzy seemed to be alive and nicely going into the weekend. As different areas of the fairness markets have proven extra constructive worth conduct and volatility has remained pretty low, the query stays as to when and the way this relentless market advance will lastly meet its peak.

I might argue that the bearish implications of weaker breadth, together with bearish divergences and overbought situations, nonetheless stay largely unchanged even after NVDA’s earnings report. The seasonality charts for the S&P 500 verify that March is in truth one of many weakest months in an election yr. So will the Nasdaq 100 comply with the conventional seasonal sample, or will the energy of the AI euphoria push this market to even additional heights into Q2?

By the best way, we carried out an analogous train for the Nasdaq 100 again in November, and guess which situation truly performed out?

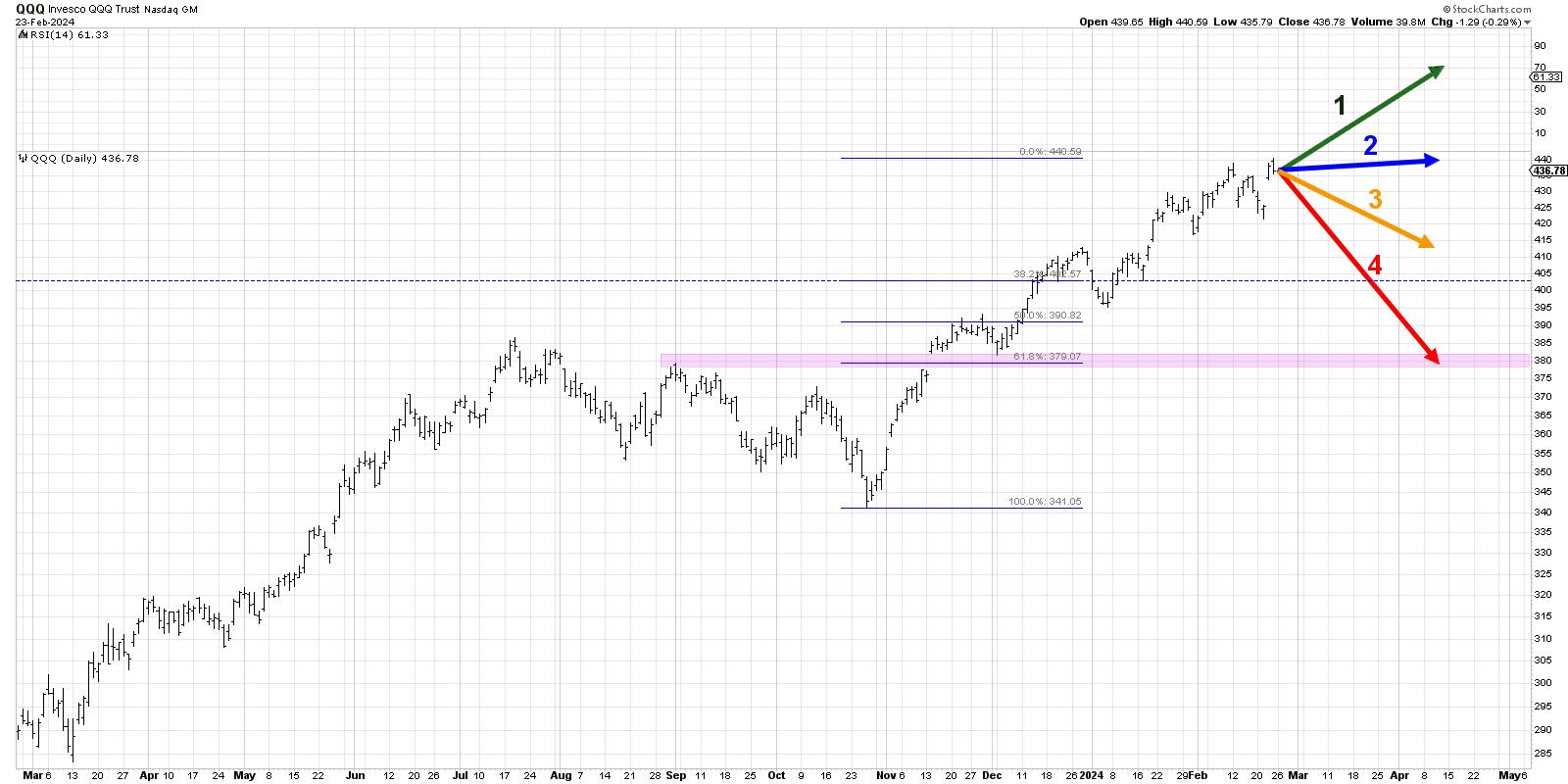

As we speak, we’ll lay out 4 potential outcomes for the Nasdaq 100. As I share every of those 4 future paths, I am going to describe the market situations that might probably be concerned, and I am going to additionally share my estimated likelihood for every situation. And bear in mind, the purpose of this train is threefold:

- Contemplate all 4 potential future paths for the index, take into consideration what would trigger every situation to unfold when it comes to the macro drivers, and assessment what alerts/patterns/indicators would verify the situation.

- Resolve which situation you’re feeling is more than likely, and why you suppose that is the case. Remember to drop me a remark and let me know your vote!

- Take into consideration how every of the 4 eventualities would impression your present portfolio. How would you handle threat in every case? How and when would you are taking motion to adapt to this new actuality?

Let’s begin with probably the most optimistic situation, involving much more all-time highs over the subsequent six-to-eight weeks.

Choice 1: The Very Bullish State of affairs

Probably the most optimistic situation from right here would imply the Nasdaq principally continues its present trajectory. That may imply one other 7-10% achieve into April, the QQQ could be threatening the $500 stage, and main development shares would proceed to guide in an enormous means. Nvidia’s sturdy earnings launch fuels extra shopping for, and the market does not a lot care about what the Fed says at its March assembly as a result of life is simply that good.

On this very bullish situation, value-oriented shares, together with Industrials, Power, and Financials, would most likely transfer greater on this situation, however would nonetheless most likely lag the expansion management that might pound even greater.

Dave’s Vote: 15%

Choice 2: The Mildly Bullish State of affairs

What if the market stays elevated, however the tempo slows means down? This second situation would imply that the Magnificent 7 shares would take a big-time breather, and extra of a management rotation begins to happen. Worth shares outperform as Industrials and Well being Care shares enhance, however for the reason that mega-cap development names do not lose an excessive amount of worth, our benchmarks stay fairly near present ranges.

Dave’s vote: 25%

Choice 3: The Mildly Bearish State of affairs

Each of the bearish eventualities would contain a pullback in main development names, and shares like NVDA would rapidly give again a few of their latest good points. Maybe some financial information is available in means stronger than anticipated, or inflation alerts revert again greater, and the Fed begins reiterating the “greater for longer” strategy to rates of interest by 2024.

I might consider this mildly bearish situation as which means the QQQ stays above the primary Fibonacci assist stage, simply over $400. That stage relies on the October 2023 low and in addition assumes that the Nasdaq does not get a lot greater than present ranges earlier than dropping a bit. We do not see defensive sectors like Utilities outperforming, however it’s clear that shares are taking a severe break from the AI mania of early 2024.

Dave’s vote: 45%

Choice 4: The Tremendous Bearish State of affairs

Now we get to the actually scary possibility, the place this week’s upswing finally ends up being a blowoff rally, and shares flip from bullish to bearish with a sudden and shocking energy. The QQQ drops about 10-15% from present ranges and retests the worth hole from November 2023, which might symbolize a 61.8% retracement of the latest upswing. Defensive sectors outperform and buyers attempt to discover protected havens because the market tracks its conventional seasonal sample. Maybe gold lastly breaks above $2,000 per ounce, and buyers begin to speak about how a break under the October 2023 low could also be just the start of a brand new bearish section.

Dave’s vote: 15%

What possibilities would you assign to every of those 4 eventualities? Take a look at the video under, after which drop a remark there for which situation you choose and why!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means symbolize the views or opinions of another individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases by technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor resolution making in his weblog, The Aware Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing threat by market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to establish funding alternatives and enrich relationships between advisors and shoppers.

Study Extra