A lot fuss is being made this morning about the truth that the UK vitality worth cap is being diminished by roughly 12% to £1,690 every year for a typical dual-fuel family. It will save roughly £200 a 12 months for these households. The difficulty is that the remaining worth is completely exorbitant.

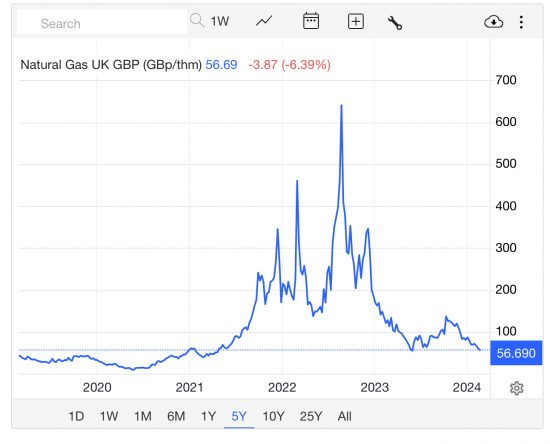

UK fuel costs have moved as follows during the last 5 years:

You’ll notice that the value is now again to ranges final seen in 2021. Additionally, you will notice the pattern in these costs, which is that they’re nonetheless transferring downward.

This desk signifies actions within the UK family vitality worth cap during the last 5 years:

What could be very clear is that when UK fuel costs have been final at their present ranges, the vitality worth cap was round £1200 every year.

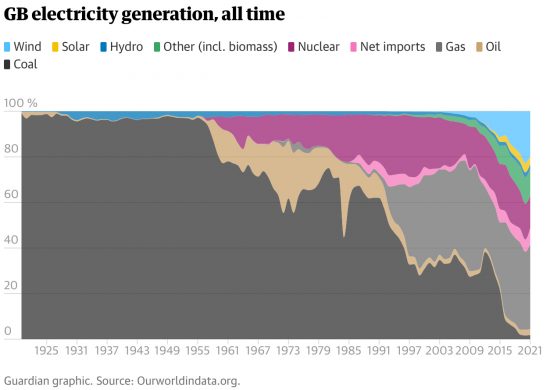

This chart from the Guardian exhibits the make-up of the vitality used to generate UK electrical energy. The costs of photo voltaic, wind, nuclear and coal haven’t modified in any important means since 2021, excepting the necessity to pay increased wages. Gasoline is again to the place it was.

What this proof makes clear is that excepting the influence of inflation on wages, which is an inevitable catch-up consequence of common worth rises, there isn’t a different cause for a change within the UK vitality worth cap between 2021 and the current second.

The Financial institution of England suggests that £11.79 now’s price what £10 was in 2021. Let’s assume that this may be a good fee of worth inflation for vitality because of this (ignoring the truth that the sector’s uncooked materials prices don’t justify any worth improve). Making use of this to the vitality worth cap that existed throughout 2021 would recommend that an vitality worth camp of about £1,400, or thereabouts, at current. That’s all that inflation may probably demand. We’re, nevertheless, going to get an vitality worth cap of £1,690 every year.

So, the query is, who will get the additional £290 a 12 months, or thereabouts?

There may be, in fact, just one reply: it’s the vitality corporations, who will take it straight to their backside line income.

If you wish to know why the UK economic system stays a multitude and why we’re nonetheless struggling inflation, it’s exactly as a result of we’re being exploited by massive corporations who’re exploiting the the unsure financial setting that the Financial institution of England has intentionally created to extract revenue from us all, and wholly unnecessarily. Regardless of that, the Financial institution of England continues to be claiming that it’s wage rises which might be troubling them.

They actually ought to cease speaking nonsense and switch their fireplace on the true brokers of inflation within the UK economic system, that are our massive corporations who’re imposing worth will increase of means above the present fee of inflation. The brand new may see some financial justice for a change.