Ceaselessly requested questions on adjustments to NOLs over the previous few years.

Leap to:

Web Working Losses (NOLs) play an important function within the monetary administration and tax planning of companies. Over the previous a number of years, there have been pandemic-era adjustments and subsequent returns to earlier variations of the NOL guidelines. Let’s have a look.

In 2017, the Tax Cuts and Jobs Act (TCJA) modified the principles for deducting internet working losses. Earlier than 2017, NOLs had been absolutely deductible and might be carried again two years and carried ahead 20 years.

Particularly, TCJA modified the NOL guidelines by:

- limiting NOL deductions to 80% of taxable revenue,

- disallowing NOL carrybacks, and

- lifting the 20-year restrict on NOL carryovers.

In 2020, the CARES Act briefly – and retroactively – offered for a particular 5-year carryback for taxable years starting in 2018, 2019 and 2020.

As we speak, most taxpayers now not have the choice to carryback a NOL. On the federal stage, companies can as soon as once more carry ahead their NOLs indefinitely, however the deductions are restricted to 80% of taxable revenue.

What’s an NOL?

An NOL is the surplus of a enterprise’s tax deductions for the tax yr over its taxable revenue for that yr.

Instance: For tax yr 1, Enterprise A has $100,000 of gross revenue and $125,000 of tax deductions. Enterprise A has an NOL of $25,000 for tax yr 1.

Why do NOL deductions matter?

Not all companies have constant revenue. Some companies expertise revenue volatility from yr to yr whereas different companies have constant revenue yr over yr. NOL deductions permit companies to easy out any year-to-year revenue volatility. With out the NOL deduction companies with risky revenue are taxed extra over time on the identical revenue than companies which have constant revenue.

Instance: Enterprise A has a $50,000 NOL in yr 1 ($0 taxable revenue) and $100,000 taxable revenue in yr 2. It pays no tax in yr 1 and tax of $21,000 in yr 2 (assuming a 21% company tax price). So, over two years, A has a $21,000 tax legal responsibility on $50,000 of revenue.

Enterprise B has revenue of $25,000 in each yr 1 and yr 2 for a complete of $50,000 of revenue. Enterprise B pays $5,250 in tax every year for a complete tax legal responsibility of $10,500 on $50,000 of revenue. On this state of affairs, A pays twice as a lot tax as B ($21,000 – $10,500 = $10,500).

Nevertheless, if A can use the $50,000 yr 1 NOL to offset $50,000 of its $100,000 revenue, then A has a tax legal responsibility of $10,500 on $50,000 of revenue similar to B.

Can NOLs be carried again?

No. Whereas the CARES Act briefly allowed NOL carrybacks, most taxpayers now not have the choice to carryback an NOL.

NOLs arising in tax years ending after 2020 can solely be carried ahead. The two-year carryback rule in impact earlier than 2018, usually, doesn’t apply to NOLs arising in tax years ending after December 31, 2017. Nevertheless, an exception applies to sure farming losses, which can be carried again 2 years. See part 172(b) and Pub. 225, Farmer’s Tax Information.

Does the 80%-of-income NOL limitation nonetheless apply?

Sure. NOLs in 2021 or later might not be carried again, and NOL carryforwards are restricted to 80% of the taxable revenue in anyone tax interval.

Can NOLs nonetheless be carried ahead indefinitely?

Sure. NOLs may be carried ahead indefinitely, nonetheless, they’re restricted to 80% of taxable revenue.

Concerning the Writer: Deborah Petro is a Senior Editor with Thomson Reuters Checkpoint. Earlier than becoming a member of Thomson Reuters in 2019, Deborah practiced tax legislation in Chicago. Deborah is a graduate of Vanderbilt College and earned her J.D. and LL.M. in Taxation from Chicago Kent Faculty of Regulation.

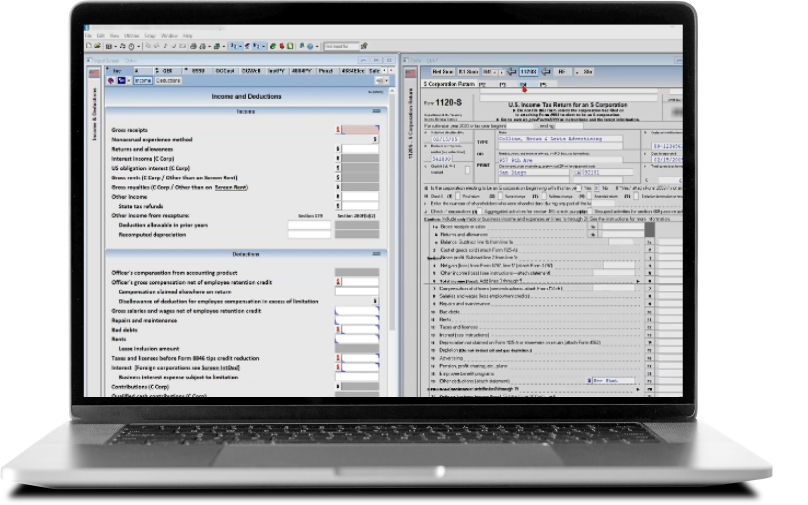

Software programUltraTax CS: Skilled tax preparation software program with a full line of federal, state, and native tax applications that may cut back tax workflow time for calculating carryback internet working losses. |

|