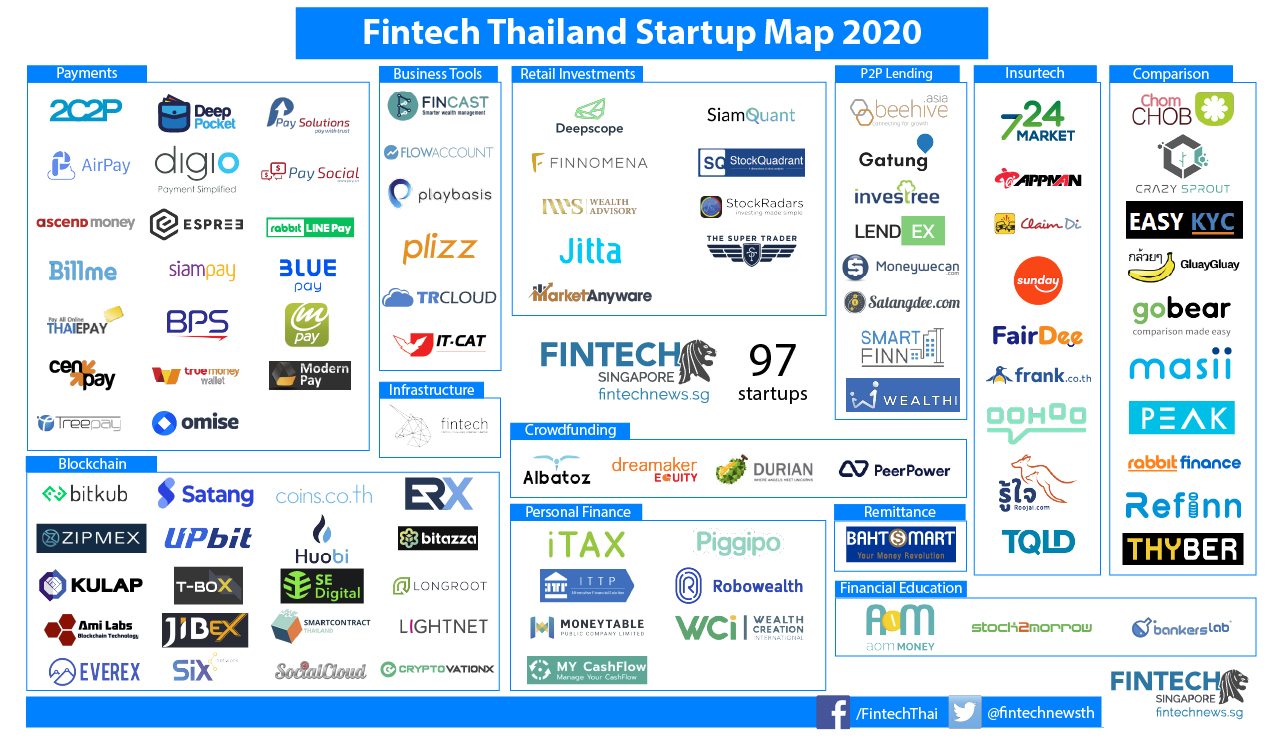

Over the previous years, the Thai fintech ecosystem has grown steadily, now boasting some 96 startups, based on Fintech Information’ newest Fintech Thailand Startup Map draft.

The map showcases the home fintech startup ecosystem which incorporates startups working in funds sector (20), blockchain (20), monetary comparability (10), insurtech (9), retail funding (9), peer-to-peer (P2P) lending (8), private finance (6), enterprise instruments (6), crowdfunding (4), monetary schooling (3), remittances (1) and monetary infrastructure (1).

As of July 2020, the Thailand Securities and Change Fee (SEC) had to this point authorised 13 crypto companies the license to function which incorporates cryptocurrency exchanges, brokers and sellers.

Notable homegrown fintech startups embody AmiLabs, which makes use of blockchain to digitise securities, commodities and currencies, MoneyTable, a human sources and monetary advantages platform for corporations and their workers, FlowAccount, a bilingual accounting platform, and Masii, a web based monetary comparability platform.

Small however rising robust

Inside ASEAN, the Thai fintech sector stays comparatively small compared with Singapore, Vietnam or Indonesia.

In 2019, Thai fintech startups represented simply 8% of all of ASEAN’s fintech companies, in accordance to a report by United Abroad Financial institution (UOB) produced in collaboration with PwC Singapore and the Singapore Fintech Affiliation. Funding raised by Thai fintech ventures accounted for just one.5% of all the cash that was raised that yr by ASEAN fintech startups.

2019 noticed notable buyers’ curiosity within the Thai insurtech and funding tech segments, with offers that included synthetic intelligence (AI) insurtech startup Sunday’s US$10 million Collection A, and monetary intelligence platform Jitta’s US$6.5 million pre-Collection A.

This yr, funding is selecting up, with notable rounds occurring in paytech and wealtech, amongst different segments.

Synqa, a Bangkok-based fintech startup previously referred to as Omise, raised a whopping US$80 million Collection C in June. Synqa offers a cost gateway that enables web sites to finish transactions with out sending consumers elsewhere, and has developed a decentralized monetary community that makes use of blockchain know-how to permit for the clear, quick and low-cost switch of digital property.

In January, fintech startup Lightnet raised US$31.2 million in a Collection A funding spherical to advance its blockchain platform. Based in 2018 and based mostly in Bangkok, Lightnet goals to turn into a “frictionless settlement hub for the East Asia area,” focusing on underbanked migrant employees with remittances providers.

Different offers this yr embody Finnomena’s US$10 million Collection B in January, and Digio’s US$4 million Collection B in Might.

Finnomena provides funding merchandise, monetary recommendation, evaluation instruments, and funding content material, and claims to have greater than 120,000 subscribers with over US$270 million in property below administration (AUM), whereas Digio is a paytech startup that just lately secured a cost facilitating providers license from the Financial institution of Thailand (BOT).

Authorities push

The Thai fintech ecosystem has grown on the again of a broader push by the federal government to develop the sector.

Legal guidelines such because the Digital Financial system and Society Council invoice has supported the expansion of fintech companies by enabling digital identification verification, amongst different issues, whereas funding promotion initiatives have been offering fintechs with company tax exemptions.

Regulators equivalent to BOT, the Securities and Change Fee (SEC) and the Workplace of Insurance coverage Fee have launched regulatory sandboxes to help the event of modern fintech and insurtech options, along with heading their very own fintech initiatives.

BOT, for instance, has been experimenting with blockchain and central financial institution digital foreign money (CBDC) by means of Venture Inthanon. Most just lately, it signed a Memorandum for Understanding (MoU) with the UK to speed up fintech adoption and help sustainable finance.

Fintech Thailand Startup Map 2020

As that is the launch of our first Thailand fintech map, chances are you’ll submit your title for consideration if you weren’t featured on our record.