The worth of Bitcoin has been on a tear in latest weeks, surging over 30% and breaching the $50,000 mark. On the time of writing, Bitcoin was buying and selling at $52,377, up 1.3% and eight.8% within the day by day and weekly timeframes, knowledge from Coingecko exhibits.

This bullish momentum has ignited contemporary optimism amongst buyers, with many questioning if the world’s main cryptocurrency is poised for one more assault on its all-time excessive of $69,000.

Analysts level to a number of key technical elements that might propel Bitcoin in the direction of new heights within the coming months. Listed here are three of essentially the most distinguished:

Halving Frenzy

April 2024 marks the following Bitcoin halving, a extremely anticipated occasion that happens roughly each 4 years. Throughout this occasion, the block reward for miners, at present 6.25 BTC, is slashed in half, successfully decreasing the speed at which new Bitcoins enter circulation. This engineered shortage has traditionally triggered important value rallies, and analysts predict an analogous end result this time round.

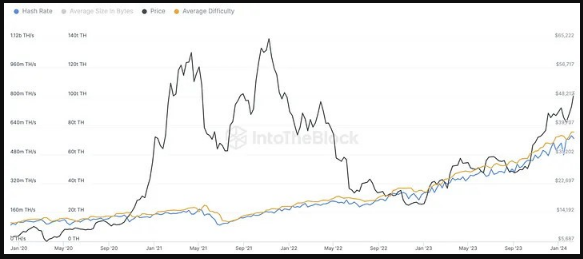

Supply: IntoTheBlock

IntoTheBlock, a quantitative crypto evaluation agency, estimates a surge to a brand new all-time excessive only one month after the halving. They cause that miners, higher ready for the halving’s influence this time, will maintain onto their rewards, limiting promoting stress and probably boosting the worth. Moreover, the halving reduces Bitcoin’s inflation price from 1.7% to 0.85%, additional enhancing its store-of-value attraction.

We give Bitcoin 85% odds of hitting all-time excessive within the subsequent 6 months. Curious what’s behind this prediction? learn our newest e-newsletter👇https://t.co/acx2Fbi1Dw

— IntoTheBlock (@intotheblock) February 17, 2024

The CEO of Sound Planning Group and an funding adviser consultant, David Stryzewski, gave an evidence of his perception that the worth of bitcoin is about to expertise a big upswing on the Schwab Community on Thursday.

He clarified that the triggers for the rising value momentum for bitcoin are the upcoming halves of the cryptocurrency and the lately launched spot exchange-traded funds (ETFs) that the U.S. Securities and Trade Fee (SEC) authorised final month.

Macroeconomic Tailwinds

The Federal Reserve’s dovish financial coverage stance, geared toward combating deflationary pressures, is one other issue buoying Bitcoin’s prospects. The anticipation of rate of interest cuts and elevated liquidity injections into the monetary system may gain advantage Bitcoin alongside different danger property.

Bitcoin market cap stays within the $1 trillion territory. Chart: TradingView.com

ETF Explosion

The long-awaited approval of Bitcoin Trade-Traded Funds (ETFs) in late 2023 has opened the floodgates for institutional buyers to enter the crypto market. These funding autos, which monitor the worth of Bitcoin with out requiring direct possession, have already attracted billions of {dollars} in inflows. This surge in institutional participation is predicted to proceed in Q2 2024, probably pushing the worth of Bitcoin even greater.

The Impression Of US Elections

Moreover, the upcoming US presidential election in November 2024 might present an extra tailwind. If a Bitcoin-friendly candidate emerges victorious, it might result in insurance policies that speed up cryptocurrency adoption and additional legitimize Bitcoin as an asset class.

Not With out Dangers

The exceptional surge of Bitcoin because it tries to go a notch greater to the vaunted $70,000 stage will be attributed to a convergence of key technical elements, propelling the cryptocurrency into uncharted territory. The relentless development of the hash price, improved scalability options, and ongoing developments within the blockchain ecosystem are collectively fueling this rally.

Featured picture from Freepik, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal danger.