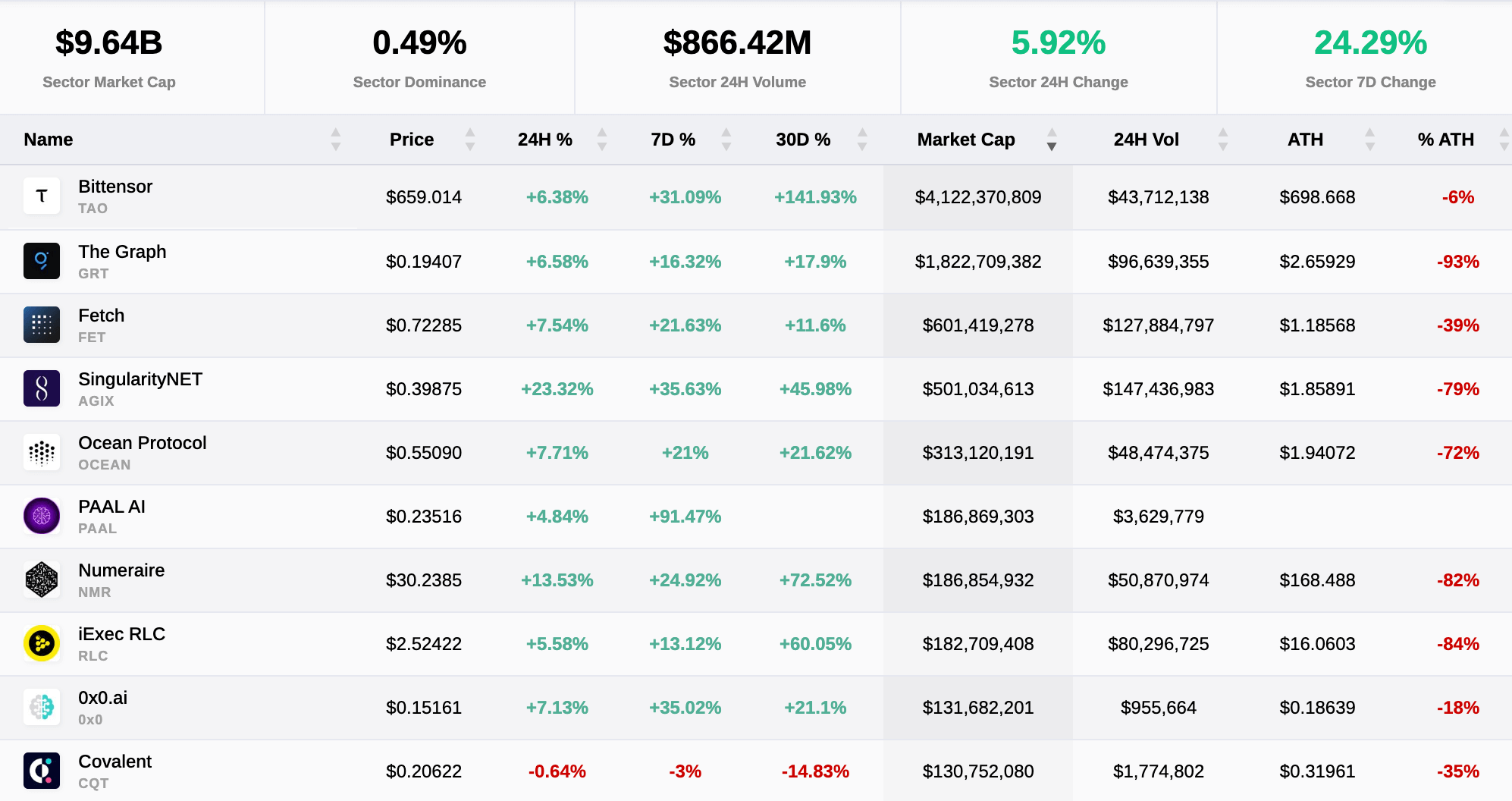

The AI blockchain sector is closing in on a $10 billion market cap following the meteoric surge of Bittensor, which is up 140% over the previous 30 days. Native token TAO surpassed $4 billion in market cap, reaching an all-time excessive on Feb. 15 of $698 earlier than retracing to round $659 as of press time.

The highest 5 AI crypto tasks by market cap are Bittensor, The Graph, Fetch.ai, SingularityNET, and Ocean Protocol. All 5 are up over 10% within the final seven days, with Bittensor and SingularityNET up 31% and 35%, respectively.

Bittensor (TAO)

Bittensor is a Polkadot substrate-based undertaking that merges blockchain know-how and AI to create a decentralized machine studying community. This initiative is designed to revolutionize the event and utilization of machine studying platforms by decentralizing the method and fostering a collaborative surroundings the place the collective intelligence of AI fashions will be harnessed and shared. On the coronary heart of Bittensor’s ecosystem is the TAO token, which incentivizes the contributions of builders and the standard of their fashions, primarily appearing as a measure of the community’s collective intelligence and information.

The Graph (GRT)

The Graph is designed for indexing and querying knowledge from blockchains, making it simpler to retrieve advanced info that’s tough to question immediately. It’s a crucial layer for decentralized functions (dApps) needing to entry blockchain knowledge effectively. The Graph makes use of GRT, its native token, to incentivize knowledge indexing and querying. Initiatives with intricate sensible contracts, comparable to Uniswap and varied NFT initiatives, profit considerably from The Graph’s capacity to facilitate advanced knowledge queries past primary blockchain-read operations.

Fetch.ai (FET)

Fetch.ai integrates synthetic intelligence to automate and optimize varied duties and processes throughout a number of sectors, together with transportation, provide chain, and healthcare. It goals to create a decentralized digital financial system powered by autonomous software program brokers. These brokers can carry out duties autonomously, facilitating a self-sustaining financial system. The FET token, an ERC-20 utility token, is used throughout the Fetch.ai ecosystem to energy transactions and computational providers. Fetch.ai’s know-how is related for a lot of industries, aiming to revolutionize them by leveraging AI and machine studying.

SingularityNET (AGIX)

SingularityNET is a decentralized AI market that enables for creating, sharing, and monetizing AI providers at scale. It makes use of AGIX, its utility token, for transactions, decentralized governance, and incentivizing the supply of platform liquidity. The platform helps a various vary of AI providers and allows builders to publish their AI providers, which might then be built-in into varied functions. SingularityNET goals to facilitate the event of Synthetic Normal Intelligence (AGI) to create a useful technological singularity. It emphasizes an ethics-first method, making AI applied sciences accessible and sensible for all.

Ocean Protocol (OCEAN)

Ocean Protocol seeks to democratize knowledge, making it accessible for people and companies to share and monetize their knowledge and data-based providers. The protocol offers a safe platform for knowledge change. It goals to unlock the worth of knowledge by enabling knowledge house owners to regulate their knowledge whereas making it obtainable for consumption. By facilitating a safe and clear data-sharing surroundings, Ocean Protocol goals to energy a brand new knowledge financial system the place knowledge will be freely shared and monetized, fostering innovation and driving development throughout varied industries.

International surge in AI investments continues

As NVIDIA, a crucial cog within the ‘AI hype wheel,’ approaches its earnings report on Feb. 21, anticipation for continued report returns is excessive amongst traders. NVIDIA has seen vital development over the previous yr, with its inventory worth growing by 230.23%. The corporate’s earlier earnings report exceeded expectations, with earnings of $4.02 per share in comparison with estimates of $3.36, reflecting a constructive earnings shock of 19.64%. The corporate is anticipated to report $4.52 per share for the upcoming earnings launch, representing a year-over-year improve of 413%.

Different AI-adjacent firms, comparable to these within the semiconductor sector, have additionally rallied all through 2024. For instance, Taiwan Semiconductor Manufacturing Firm (TSM), a serious element producer for AI know-how, is up 30% since Jan. 1.

Moreover, OpenAI revealed its new text-to-video mannequin, Sora, on Feb. 15, which showcased the flexibility to create lifelike video scenes of as much as 1 minute and a number of digital camera angles. The instance movies have been far past many present generative video options, suggesting one other big leap ahead for generative content material.

The fast development of centralized AI improvement could also be partly fueled by the resurgence in decentralized AI tasks as traders hope to maintain tempo.

Disclaimer: The creator has a small holding of TAO.

Bittensor Market Information

On the time of press 11:22 am UTC on Feb. 16, 2024, Bittensor is ranked #204 by market cap and the value is up 8.31% over the previous 24 hours. Bittensor has a market capitalization of $4.18 billion with a 24-hour buying and selling quantity of $44.6 million. Be taught extra about Bittensor ›

Crypto Market Abstract

On the time of press 11:22 am UTC on Feb. 16, 2024, the whole crypto market is valued at at $1.96 trillion with a 24-hour quantity of $88.24 billion. Bitcoin dominance is at present at 52.32%. Be taught extra in regards to the crypto market ›