European core banking supplier Temenos is the newest sufferer of a Hindenburg Brief Report. The detailed report cites interviews with 25 former workers that allegedly uncovered manipulated earnings and accounting regularities.

Hindenburg is a monetary analysis agency that locations bets towards publicly traded corporations when it finds proof of wrongdoing. It has taken on many excessive profile corporations since its founding in 2017.

You could bear in mind it was virtually a yr in the past that Hindenburg attacked Block with an analogous report. Block’s shares tumbled the day that report was launched however had absolutely recovered by the summer time.

Predictably, shares of Temenos are down considerably right this moment however the firm has reacted shortly and already issued a press launch refuting the claims within the report.

Whereas these quick sellers can present priceless insights into the wrongdoing of public corporations, we should always take into account they don’t seem to be all the time proper.

Featured

> Temenos Sinks Most in 21 Years on Hindenburg Brief Report

The Swiss banking software program agency has misplaced $2.4 billion in market cap. The Hindenburg Report cites accounting irregularities, earnings manipulation.

From Fintech Nexus

> Lendbuzz makes use of AI to disrupt assessments, earns $219M AAA securitization

By Tony Zerucha

Lendbuzz blends its founders’ early experiences with AI to disrupt conventional evaluation strategies and widen the pool of credit-worthy people.

By David Finch

Fintechs seeking to obtain or preserve stability in 2024 have to focus of three key areas: price self-discipline, measured development and regulatory compliance.

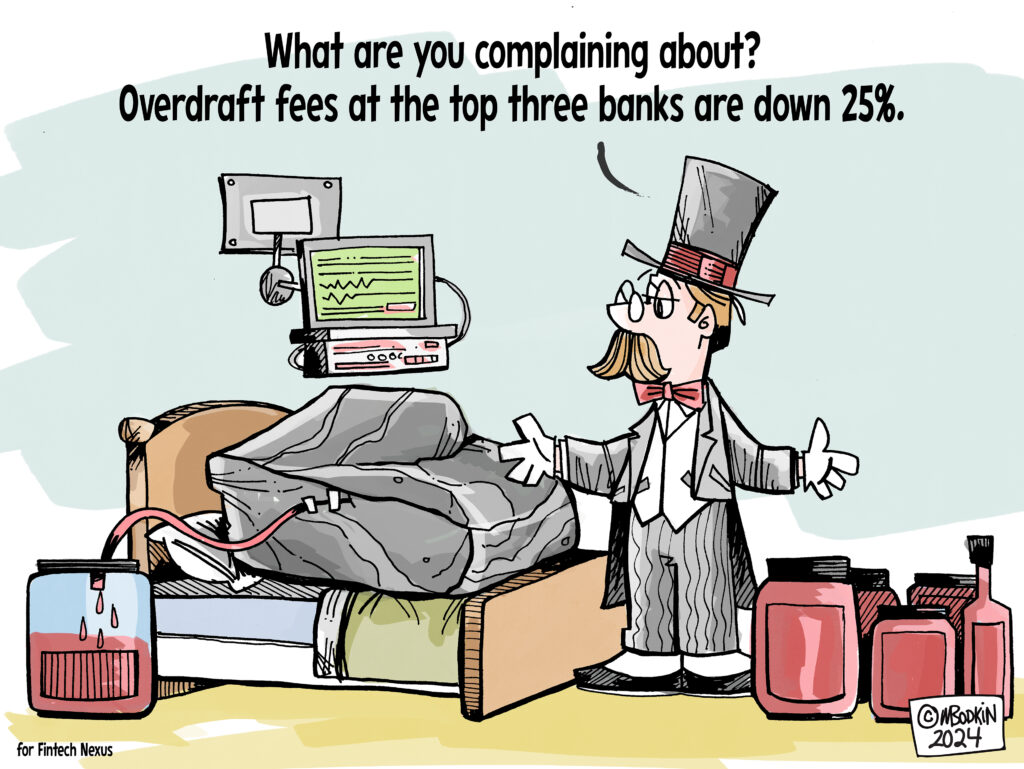

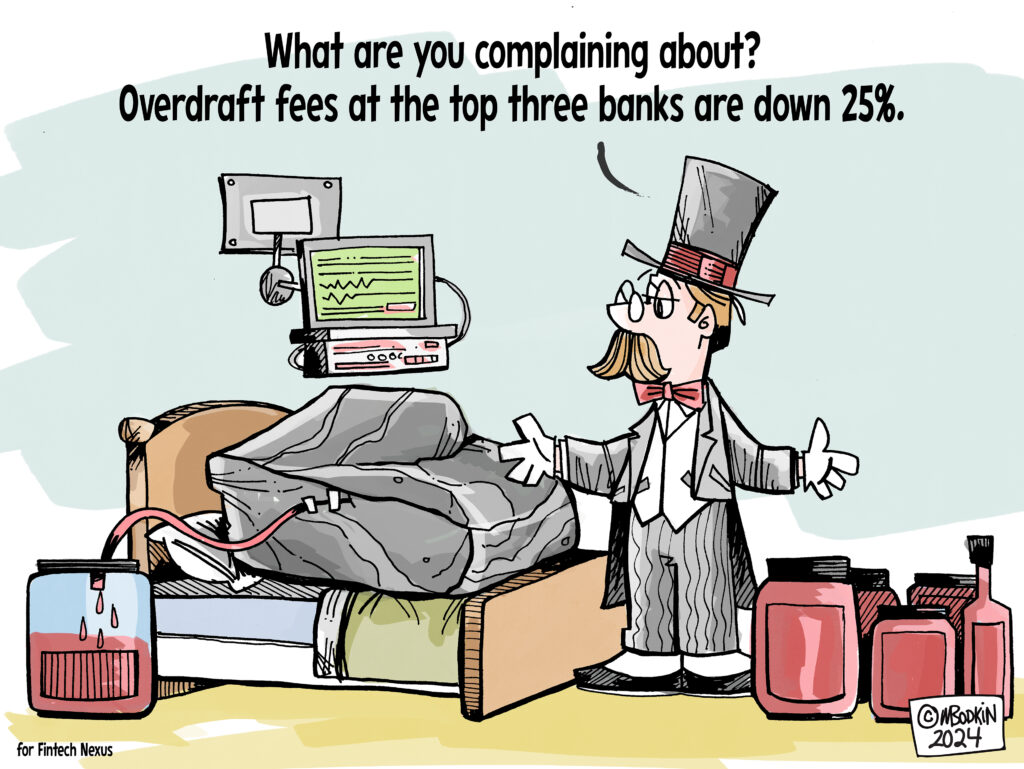

Editorial Cartoon

Additionally Making Information

- USA: SoLo Funds nears 2M customers

The peer-to-peer lending platform has confronted some regulatory backlash, however a research from London’s Centre for Economics and Enterprise Analysis reveals it’s cheaper than many different subprime choices.

To sponsor our newsletters and attain 275,000 fintech fanatics along with your message, contact us right here.