Uncover how AI can drive development by enabling advisory providers, optimizing workflows, and saving time, as outlined within the Way forward for Professionals report

Bounce to:

AI presents no scarcity of alternatives. In a method, tax and accounting professionals can attain their objectives with synthetic intelligence. For accounting professionals, there’s a shift within the trade to offering extra advisory providers to purchasers. AI may also help facilitate this transition by way of a number of inside and exterior efficiencies. As tax professionals incorporate extra AI into their tax planning workflows, they’ll be capable to convey extra providers in-house. This may change how human assets are managed, how time is allotted, how work is carried out, and the way communications are managed. With leaner groups and extra environment friendly and correct evaluation capabilities, tax professionals are positioned to capitalize on development alternatives each in profitability and in consumer acquisition and retention.

The Way forward for Professionals report highlights many of those development alternatives and the methods that should be applied to speed up and optimize AI adoption for development and innovation.

Enabling the expansion alternative

The survey revealed an optimistic outlook on the implementation of AI in attaining development, significantly within the skill to scale back friction in transferring to extra value-based advisory providers and pricing fashions. The analytical functionality of AI permits for an in depth overview of present purchasers highlighting essentially the most worthwhile niches for strategic planning functions.

As tax professionals think about transferring to extra specialised providers to exhibit experience, AI may also help determine the place they need to focus their energies and a spotlight based mostly on capabilities and profitability. In-house groups will transfer from price facilities to development enablers by zeroing in and growing key areas of experience as the inspiration of increasing into advisory providers. Through the use of predictive analytics and buyer segmentation, in-house groups can use lead scoring, qualification, and competitor evaluation to determine areas of development each by way of particular varieties of purchasers or specializations price pursuing but in addition use AI-generated aggressive evaluation for exploring new markets.

|

Way forward for Professionals ReportHow AI is the Catalyst for Remodeling Each Facet of Work

|

Tax planning with AI

How AI can drive operational enhancements

Synthetic intelligence is reshaping each side of tax and accounting work, which for the skilled is saving essentially the most worthwhile useful resource: time. AI adoption guarantees to provide professionals time again from duties that may be automated to allow them to concentrate on extra worthwhile and strategic ones. Routine duties reminiscent of tax compliance, reporting, calculations, evaluation, and planning which take up hours could be performed in minutes, even seconds. This frees up time for deeper evaluation, broader insights, and extra alternatives for tax professionals to ship higher recommendation and extra providers to their purchasers.

“In reviewing a return, I usually spend a considerable period of time… making an attempt to determine the easiest way to deal with a consumer’s taxes to scale back general taxes within the subsequent 5 years and never simply the present yr,” one tax skilled mentioned. “AI will significantly help in saving time in figuring out the easiest way to deal with sure massive deductions and revenue streams by displaying the long run tax outcomes.”

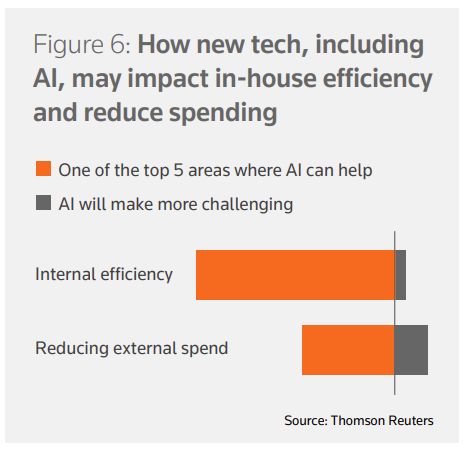

The centralization and consistency of AI outputs provide a degree discipline on which groups, even these working remotely, can collaborate extra successfully on making a extra agile and responsive work surroundings. Extra work will be capable to be performed in-house, lowering the necessity for outsourcing or exterior assets. Past consumer work, these efficiencies can be realized in administrative work, finance, HR, and IT.

Reaching operational good points and bettering the firm-client worth trade

AI may also relieve schedules by providing entry for purchasers to widespread questions, and queries and provide suggestions based mostly on customary information. The pure language processing eliminates the necessity for translation to layman’s phrases. Professionals will be capable to take a extra proactive strategy to consumer administration by scheduling consumer touchpoints all year long and utilizing AI to help within the preparation of paperwork and stories for overview as wanted.

Purchasers will admire elevated responsiveness and entry to data and recommendation. Tax professionals might discover they’ll tackle extra worthwhile work because of the elevated worth of their consultative providers, specializations, and availability.

Reshaping expertise, expertise, and recruitment by way of the AI revolution

Regardless of the concern many really feel of AI making their jobs redundant, the survey discovered that 64% of pros mentioned they see an increase within the appreciation of their skilled expertise while solely 36% had been involved their expertise would not be related or required.

With these opinions and AI use on the rise, inside groups will should be educated and up-skilled, or further expertise in different areas reminiscent of structured information will should be added, to set your accounting agency up for achievement. The report revealed that just about 90% of pros anticipate primary obligatory AI coaching within the subsequent 5 years.

Fortuitously, AI may also help automate this coaching as nicely, lowering the dependence on different employees members to take time away from their every day work to coach junior employees or assist colleagues study new roles.

Thomson Reuters has led the way in which in analysis and helping corporations in implementing into their processes for many years. The Way forward for Professionals report gives insights for tax professionals on how they’ll develop their development methods within the new age of AI.