points and discover the world by means of the lens of tax coverage. Be taught extra about taxes with TaxEDU.

Working from house is nice. The tax issues? Not a lot.

Final 12 months, 13 % of full-time staff within the U.S. labored from residence and 28 % labored a hybrid mannequin. Lots of them labored in a unique state than the one wherein their employer was situated. That’s hundreds of thousands of People who will face sophisticated revenue tax conditions this submitting season—some even getting taxed twice.

The place Is Revenue Taxed?

Usually, revenue could be taxed the place you reside and the place you’re employed. If these are the identical state—as is often the case with distant and in-person employees—then that’s the place you’ll get taxed (with one exception; extra on that under). However in the event you reside and work in two totally different states—say, you reside in New Jersey and commute into New York—then you possibly can get taxed in each.

Fortunately, each state with an revenue tax gives a credit score for taxes paid to a different state. The catch: it gained’t exceed the quantity you pay on that revenue in your house state. So, your revenue wouldn’t be double taxed, but when the second state has greater revenue tax charges, you’d be paying greater than in the event you labored solely from your individual state.

When Would I Be Double Taxed?

5 states tax individuals the place their employer’s workplace is situated, even when they work remotely and by no means set foot within the state. That is known as the “comfort of the employer” rule, and Connecticut, Delaware, Nebraska, New York, and Pennsylvania have it, although they differ on the small print.

In case your employer relies in considered one of these states, however you’re working elsewhere on your comfort (not as a result of your employer requires it), you then may pay revenue taxes each within the state the place you reside and work and within the state the place your employer relies, with out an offsetting credit score.

For instance, say your organization relies in New York however you’re employed remotely in California. Since you reside and work in California, the state expects you to pay taxes on the revenue you earn there. However as a result of New York has a comfort rule, it additionally expects you to pay taxes on the revenue you earn by means of your New York-based firm. You’d pay revenue taxes to each states.

What If I Commute throughout State Traces?

For the hybrid or in-office employees commuting throughout state strains, tax season might convey complications. Whereas residing in a single state and solely working in one other simply means you need to file two revenue tax returns and obtain a credit score, splitting your work days between totally different states means you owe taxes proportionate to the time labored in every state. Calculating that may get messy.

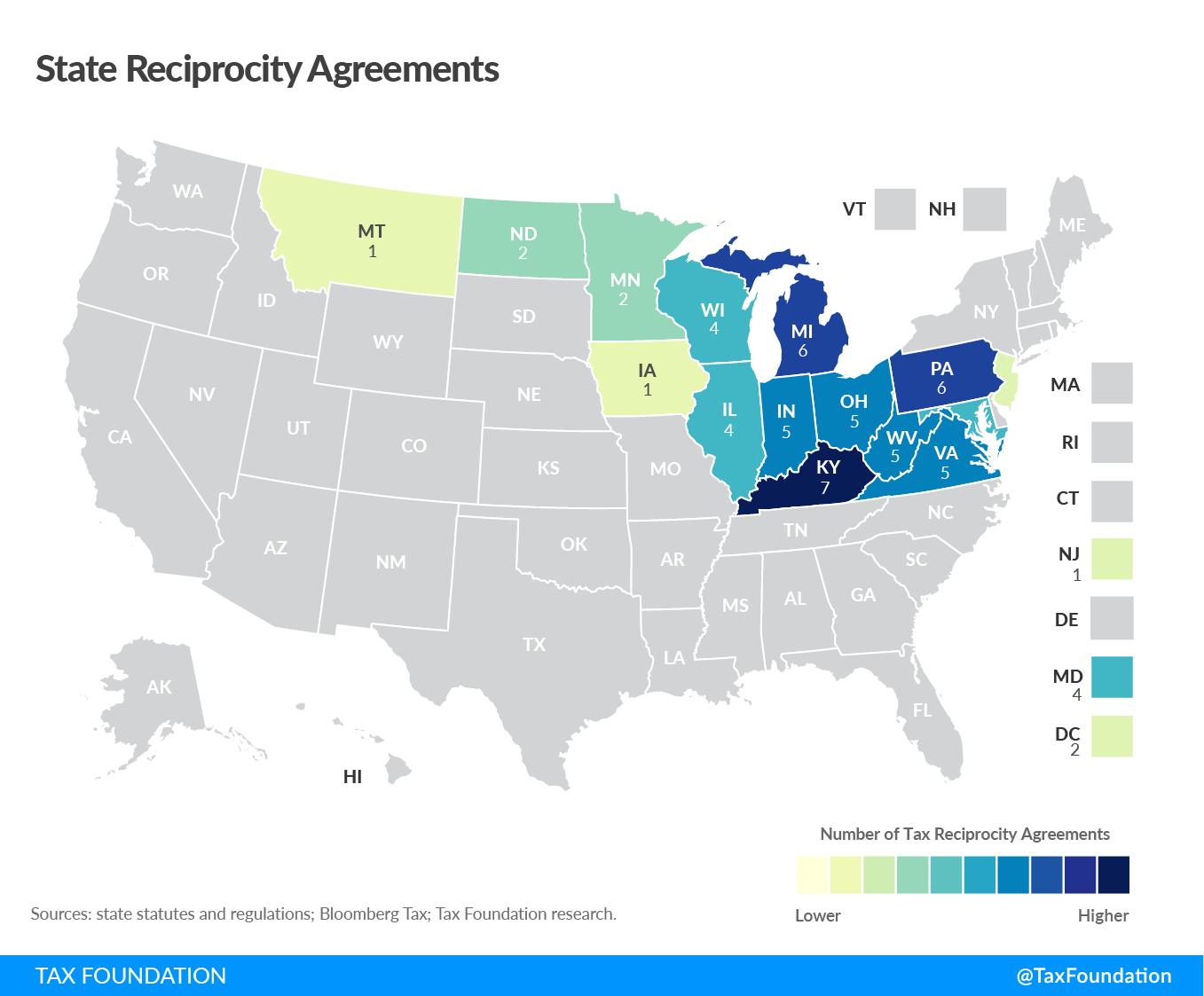

Fortunately, there’s an answer—state reciprocity agreements. Beneath these agreements, neighboring states determine to tax cross-border employees solely within the states the place they reside. There are at the moment 30 reciprocal agreements throughout 16 states and the District of Columbia (to see in case your state has one, click on right here).

Not solely do reciprocity agreements profit employees, however they’re additionally good for states themselves. Larger-tax states can preserve job alternatives whereas lower-tax states can appeal to residents—and each would take pleasure in simpler administration and decreased compliance prices for his or her taxpayers.

Distant and hybrid work preparations are modernizing the U.S. financial system; state policymakers ought to modernize their tax codes with it.

Be aware: This publish is for informational functions solely and never supposed as recommendation. Please discuss to a delegated tax skilled earlier than making tax planning selections.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share