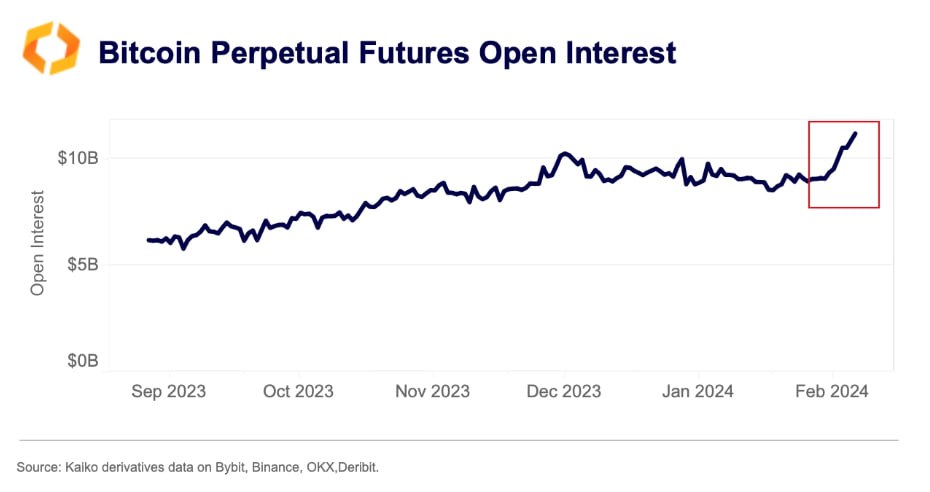

Bitcoin’s open curiosity has surged previous $11 billion for the primary time in over two years. This uptick comes when the world’s most respected coin surges, lately easing previous $51,000, the very best stage since December 2021.

Surging Open Curiosity And Order E-book Imbalance

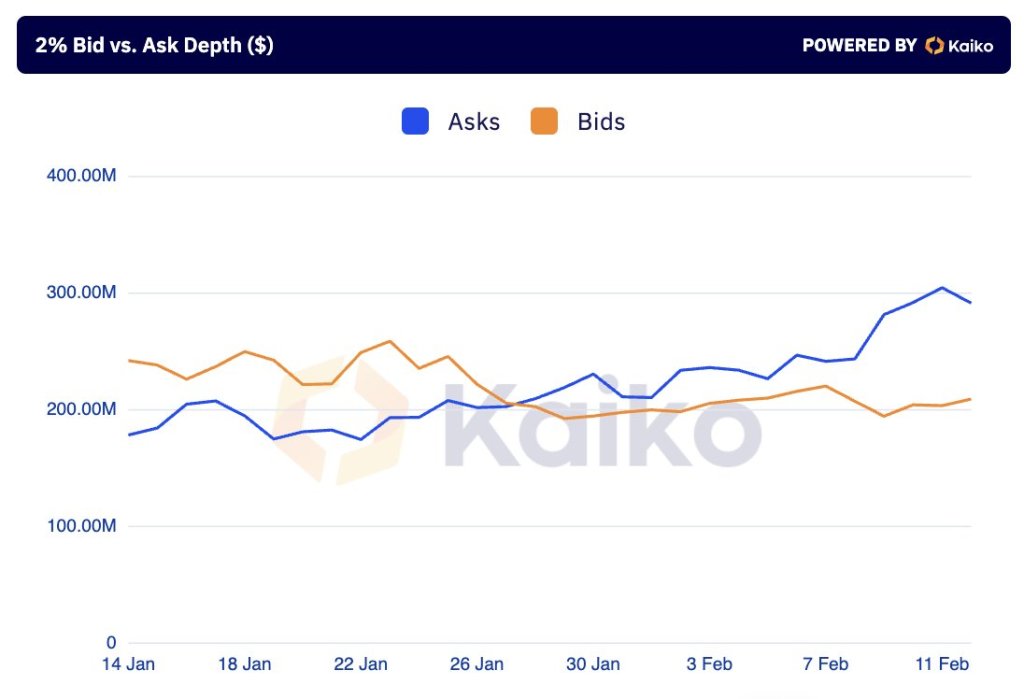

In keeping with Kaiko, a number one crypto analytics supplier, this upswing in open curiosity comes at a important time for the coin. When costs zoomed previous $48,000 on February 11, there was an order guide imbalance. Then, Kaiko noticed there have been $100 million extra bids than asks.

Technically, each time there may be an order guide imbalance with extra bids than asks, it means that patrons are extra prepared and enthusiastic to buy at spot charges than sellers are prepared to liquidate. Following this imbalance, costs shot greater the next days, breaking above the $50,000 psychological quantity to over $51,500 when writing on February 14.

Surging open curiosity, particularly because the market traits greater, is bullish. It signifies that extra persons are prepared to take part out there, hopeful of using the development. Subsequently, their participation interprets to a extra liquid market, charging the upside momentum.

Bitcoin is racing greater behind sturdy inflows into spot Bitcoin exchange-traded funds (ETFs). Over the previous few weeks, spot Bitcoin ETF issuers have been quickly accumulating the coin. The biggest up to now is BlackRock’s IBIT, proudly owning over 70,000 BTC.

In consequence, costs are edging greater, reflecting the excessive demand pinned on to institutional participation. This optimistic sentiment and expectations of much more value good points, translating to greater open curiosity, is regardless of the continued liquidation of the Grayscale Bitcoin Belief (GBTC). Following courtroom approval, GBTC is transformed into an ETF, becoming a member of others like Constancy, who additionally supply an identical product.

Genesis Trying To Promote GBTC; Will Bitcoin Rally In March?

Even with the excessive optimism, a possible cloud hangs over the Bitcoin market. Genesis, a crypto lender below chapter safety, desires the courtroom to permit them to promote over $1.4 billion of GBTC.

If the courtroom green-lights this transfer, BTC might have extra liquidation strain, presumably unwinding current good points. Thus far, the FTX property bought their GBTC, estimated to be value over $1 billion, coinciding with Bitcoin dropping to as little as $39,500 in January.

In addition to these Bitcoin-specific occasions, the market is intently watching how the financial coverage scene in america will evolve within the subsequent few weeks. America Federal Reserve is predicted to slash charges in March, a probably helpful transfer for BTC.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal danger.