I famous a brand new report from the Decision Basis on Monday. In that report, that suppose tank recommended that perhaps 30% of all households within the UK had financial savings of lower than £1,000 obtainable to them. The answer that the Decision Basis recommended was, fairly terribly, that these households ought to be compelled to avoid wasting extra. They appeared to by no means contemplate the likelihood that the rationale why these households have such low financial savings is that they have already got virtually no capability to avoid wasting as a result of their prices of residing take in all their obtainable earnings.

Standing again, there’s a significantly perverse facet to this advice. Just a few months in the past, I highlighted one other perverse report from the Decision Basis through which they recommended that the federal government ought to run surpluses in most years. This, they recommended, would then present the federal government with the capability to run deficits if they could ever be required. Within the course of, they revealed a whole lack of awareness of macroeconomics. They clearly suppose this to be just like the economics of a family. Nothing might be farther from the reality. Governments can create cash to handle deficit spending, however households can’t. This easy reality was both not recognized to or was assumed away by the Decision Basis. What they did, nonetheless, additionally reveal was their lack of expertise of one of the primary analytical instruments inside macroeconomics, which is sectoral steadiness evaluation.

Sectoral steadiness evaluation assumes that the economic system is made up of simply 4 sectors. These are:

- The family sector

- The company sector

- The federal government sector

- The abroad sector, i.e. the transactions that these usually resident exterior the UK undertake in sterling.

Sectoral balances in an economic system like that throughout the UK search to focus on the online financial savings and borrowings that happen between the sectors.

The belief implicit on this evaluation is kind of easy. It’s assumed that if some sectors are in surplus in a interval, which means that they save, then it should observe that different sectors should be in deficit, i.e. they borrow. That is the mandatory consequence of the infallible logic implicit inside double-entry bookkeeping, which is that each motion has a response, requiring consequently that any saver should, by definition, create a borrower, even when that’s solely a financial institution.

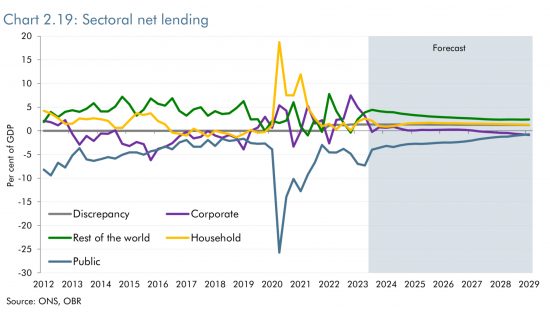

The proof of latest years is that households will not be superb at saving, besides in the course of the Covid disaster. By and enormous, additionally they appear to have spent the cash they saved then. The most recent forecast for the sectoral balances, as ready in November 2023 by the Workplace for Funds Accountability, as famous beneath, reveals that they don’t forecast any change to the modest internet financial savings now made by households for a while to come back.

I additionally notice from that forecast that the OBR doesn’t count on the company sector to borrow for a while to come back, after which, when it does, it’ll achieve this solely very modestly. Candidly, I believe that an optimistic projection by the OBR: given the stagnant UK economic system that’s forecast for years to come back there isn’t any cause for enterprise to take a position a lot.

It might additionally appear that the Workplace for Funds Accountability is, as ever, wildly optimistic concerning the likelihood that the federal government will lower its borrowing over coming years. It is a constant function of their forecasts, virtually all of which have all the time been decidedly over-optimistic on this regard.

If, nonetheless, as they do forecast, the federal government does lower its borrowing, and on condition that neither households nor companies are a lot inclined to borrow, the inevitable internet consequence is that the abroad sector should, in internet phrases, save much less within the UK than it has finished for a very long time. This would possibly occur, with Brexit lastly creating this consequence, however there isn’t any proof as but to counsel that that is possible.

Then, although, let me presume that what the Decision Basis desires happens and that households save extra and the federal government strikes into surplus, as they want, while the company sector stays broadly impartial. With these three sectors all then transferring into optimistic territory the inevitable requirement could be that the abroad sector would then must borrow sterling slightly than save in it, as has been its accustomed behaviour.

I settle for that this may be a consequence of the federal government borrowing much less when a lot of the abroad sector is saved in gilts. That, although, appears unlikely. There are, in spite of everything, very many good explanation why abroad governments do wish to maintain sterling reserves, not least to help commerce but in addition as a part of the balances that underpin the IMF’s particular drawing rights and different reserve balances. The UK additionally stays a sexy place for a lot of to avoid wasting, given the relative monetary stability that it nonetheless provides for some who require it. In abstract, I merely can’t see the abroad sector transferring into unfavourable territory, which, because the chart reveals, could be exceptionally uncommon within the present period.

In that case, does the Decision Basis’s suggestion that each households and the federal government ought to save extra make any sense in any respect? The apparent reply is that it doesn’t.

Assume tanks are superb at suggesting that governments ought to do joined-up pondering. It seems to be to me as if the Decision Basis would possibly have to do the identical. It may additionally have to sharpen up its understanding of macroeconomics. It may be a bit of extra credible if it did so.