I’ve this morning printed the newest notice in my collection that can make up the Taxing Wealth Report 2024.

This newest notice means that if an general simply system of taxation is to be delivered by the Taxing Wealth Report 2024 then some current tax costs and reliefs of allowances for these on greater incomes should be withdrawn.

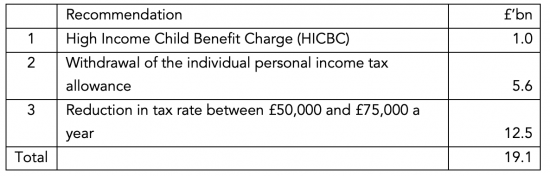

Particularly, the Excessive Earnings Little one Profit Cost and the ending of the private allowance for these on incomes over £100,000 each year should finish, and revised earnings tax charges for these with earnings between £50,000 and £75,000 each year can be required if penal tax costs are to be averted. These modifications come at a mixed price to tax income of in extra of £19 billion, however with out them, the opposite revenue-raising proposals within the Taxing Wealth Report 2024 wouldn’t be applicable.

The abstract of this report says:

Transient Abstract

This notice means that:

- Though the Taxing Wealth Report 2024 has recognized many anomalous tax charges reliefs and allowances inside the UK tax system which can be in want of correction the place doing so will elevate important additional tax revenues, there are different tax allowances and reliefs that might additionally should be addressed if the suggestions inside the Taxing Wealth Report 2024 are adopted so {that a} tax system that’s in general phrases simply could be created within the UK.

- Within the three instances highlighted on this notice, correcting anomalous tax charges reliefs and allowances inside the UK tax system would possibly scale back general tax revenues as a result of these in use do, at current, create tax injustice at price to these with greater earnings and wealth. It’s not potential to advertise tax justice with out taking these points under consideration, presuming that the opposite suggestions inside the Taxing Wealth Report 2024 are adopted.

- The primary of those points pertains to the Excessive Earnings Little one Profit Cost (HICBC). This withdraws a declare for little one profit from any particular person residing in the identical family because the little one in respect of which that declare is made if that particular person is incomes between £50,000 and £60,000. The tax collected in consequence is estimated to be £1 billion a 12 months, however marginal tax charges exceeding 70 per cent can come up in consequence, and together with the modifications within the Taxing Wealth Report 2024 these could be unacceptable and as such this cost must be abolished.

- The second cost pertains to the phasing out of the private earnings tax allowance for individuals incomes between £100,000 and £125,140 a 12 months, which means that in that vary a further 20 per cent tax cost arises. On prime of the opposite modifications beneficial within the Taxing Wealth Report 2024 that might end in unacceptable tax charges that additionally defeat the specified regular progressiveness of the tax system and as such this cost needs to be abolished, however provided that the opposite suggestions within the Taxing Wealth Report 2024 are accepted. The fee could be roughly £5.6 billion each year.

- The third change could be to the earnings tax price on earnings and beneficial properties totalling between £50,000 and £75,000. Once more, this variation is simply beneficial if the modifications urged within the Taxing Wealth Report 2024 are accepted as in any other case there could be no want to take action. If the tax charges on nationwide insurance coverage, capital beneficial properties and funding earnings beneficial within the Taxing Wealth Report 2024 have been accepted the general tax price on folks incomes between £50,000 and £75,000 would grow to be too excessive if adequate general regular progressivity is to be achieved inside the tax system. Topic in that case to these different beneficial modifications going down it’s urged that the earnings tax price on this vary be diminished to 30 per cent from the present 40 per cent price. This might have a value of roughly £12.5 billion each year.

- With out these modifications it’s seemingly that the Taxing Wealth Report 2024 could be inappropriately focused: it’s meant to focus on these with greater earnings and wealth and shouldn’t penalise most of these with earnings of between £50,000 and £75,000 a 12 months in consequence except that earnings comes from capital beneficial properties or different unearned sources.

- The general price of suggestions made on this notice is:

Of those suggestions, the primary ought to occur regardless of the opposite modifications urged within the Taxing Wealth Report 2024.

The opposite two ideas are conditional on the opposite reforms proposed within the Taxing Wealth Report 2024 being made or tax injustice would outcome.

Dialogue

There’s a dialogue of those proposals within the notice that helps these ideas, which is accessible right here.

Cumulative worth of suggestions made

The suggestions now made as a part of the Taxing Wealth Report 2024 would, taking this newest proposal under consideration, elevate whole further tax revenues or launch sums out there for different spending of roughly £92 billion each year, on prime of which a further £35 billion from pension financial savings and £70 billion from ISA financial savings could be launched for funding in social and inexperienced infrastructure tasks. Complete sums launched would possibly quantity to roughly £200 billion each year in consequence.

It’s confused that this proposal creates a value and doesn’t ship further income, however that’s the worth of making tax justice and making certain the right supply of the opposite suggestions within the Taxing Wealth Report 2024.