The 12 months 2023 marked a pivotal second for the fintech trade, with the prevailing international funding tendencies encapsulating a interval of introspection and recalibration amidst a backdrop of financial fluctuations, together with notable financial institution failures and precipitous cryptocurrency downturns.

This period, whereas difficult, underscored the sector’s resilience and its capability for innovation, navigating by means of valuation reassessments and the ebb and circulate of “mega” offers to proceed its trajectory of reimagining monetary companies, as mentioned within the Monetary Know-how (FT) Companions Analysis report, The FinTech Journey Continues: What to look at for in 2024.

International Funding Traits and Dynamics within the Fintech Ecosystem

Because the fintech sector weathered the storms of 2023, a big international transformation was noticed within the dominant funding tendencies of the 12 months. The quantity of fintech deal exercise in 2023 fell by roughly 70% from its peak in 2021, carefully mirroring the figures from 5 years earlier. A decline in M&A quantity was largely liable for this downturn, with fewer offers exceeding US$1 billion being introduced.

Nevertheless, personal capital elevating concluded the 12 months on a constructive notice after rising for 3 quarters, with fourth-quarter volumes reaching US$15 billion, a year-on-year improve of 30%. The general public markets in 2023 noticed a resurgence of worldwide fintech IPO exercise, though the debuts and performances had been considerably underwhelming.

When it comes to the variety of offers, each financing and M&A have remained extra resilient in comparison with the amount. Over the previous two years, there was a tilt in direction of earlier-stage or smaller offers, with 65% of funding rounds being under US$10 million (in distinction to 46% in 2021). Seed funding notably hit a document excessive in 2022, with volumes exceeding US$5 billion throughout 1,100 offers. This vital exercise on the seed stage continued into 2023, with each quantity and the variety of offers surpassing these of 2021 and former years.

Supply: The FinTech Journey Continues: What to look at for in 2024. FT Companions Analysis

Furthermore, early-stage financing within the Center East, as demonstrated by the Islamic-oriented crypto belongings trade Haqqex, additional illustrated the worldwide confidence in fintech’s potential.

On the M&A entrance, the acquisition of Singlife by Japanese insurer Sumitomo Life positioned Singlife’s valuation at SG$4.6 billion, representing certainly one of Southeast Asia’s most substantial insurance coverage offers. The flurry of deal exercise additional attested to the dynamic nature of the sector and its attractiveness to vital investments.

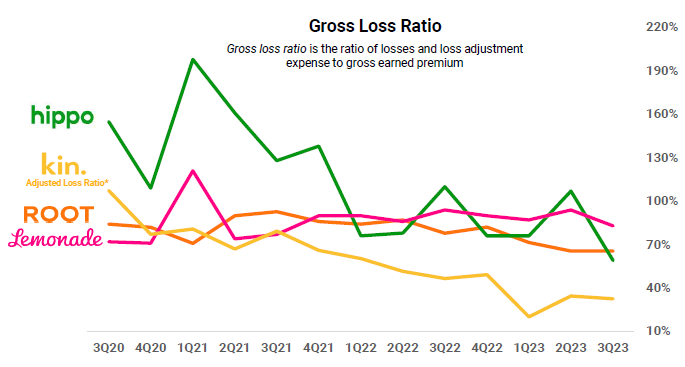

Ushering in Insurtech 2.0

The insurance coverage sector, historically perceived as resistant to alter, has witnessed a wave of innovation over the previous decade, culminating in what the report dubs as “Insurtech 2.0”. This new section is characterised by a strategic pivot in direction of business-to-business (B2B) fashions, diversified distribution channels, and a heightened concentrate on underwriting efficiency.

Insurtech 2.0 seeks to construct upon the foundations laid by its predecessor, which launched digital, consumer-friendly options, thereby pressuring incumbent insurers to modernise their choices.

Supply: The FinTech Journey Continues: What to look at for in 2024. FT Companions Analysis

On this evolving panorama, Insurtech 2.0 candidates akin to Singapore’s bolttech and Oona Insurance coverage have emerged as front-runners, efficiently elevating vital funds and showcasing the potential for innovation inside the insurance coverage trade. bolttech is a platform that connects insurers, distributors, retailers, and prospects, streamlining the method of shopping for and promoting safety and insurance coverage merchandise. It raised US$196 million in Collection B funding final 12 months, bringing its whole valuation to US$1.6 billion.

Oona Insurance coverage leverages know-how to simplify the insurance coverage course of, enhance buyer expertise, and improve transparency. It raised US$350 million in Collection A funding. And fixing early insurtech complications in India is PolicyBaazar, a web based insurance coverage market that goals to carry transparency and forestall mis-selling and coverage lapses. It has over 9 million prospects and gives high insurance policy from main insurers on the Indian subcontinent.

These entities exemplify the sector’s shift in direction of leveraging know-how to streamline processes, improve buyer experiences, and foster transparency, setting new benchmarks for the trade.

B2B Fintech Fashions Draw Investor Curiosity

The prevailing financial circumstances have steered buyers’ desire in direction of B2B fintech fashions, distinguishing them from their business-to-consumer (B2C) counterparts. This shift is attributed to the inherent benefits of B2B fashions, akin to decrease advertising prices and a faster path to profitability, that are notably interesting within the present market setting.

B2B fintech firms, by offering crucial infrastructure and companies, allow incumbents to digitise their operations, providing a extra sustainable and environment friendly various to the direct client strategy. Nonetheless, these entities have historically targeting increasing their major choices fairly than exploring various answer units.

Supply: The FinTech Journey Continues: What to look at for in 2024. FT Companions Analysis

Traditionally, massive banks have thought-about small and medium companies (SMBs) a low precedence, usually perceiving them as high-risk, whereas quite a few smaller banks are technologically unequipped to cater to SMBs digitally. At this time, established fintech companies like service provider acquirers, payroll processors, and various lenders serve SMBs.

Embedded finance emerges as one of the crucial promising B2B fintech fashions, facilitating the mixing of economic companies inside non-financial platforms. This innovation has gained vital momentum, pushed by functions in banking-as-a-service (BaaS) and embedded funds.

The mannequin’s success is additional illustrated by the dominance of ‘tremendous apps’ in Asia, akin to Southeast Asian heavyweight Seize and WeChat from China, which have revolutionised the supply and accessibility of economic companies starting from microlending to ‘pay later’ to embedded insurance coverage merchandise inside the identical app ecosystem, embodying the potential of embedded finance to reshape the instant monetary panorama.

The Outlook Past 2024

Because the fintech sector advances into 2024, international tendencies point out that it stands on the cusp of additional transformation, pushed by the continued development of early and growth-stage funding, the evolution of Insurtech 2.0, and the ascendancy of B2B fashions, particularly in embedded finance. These tendencies not solely mirror the trade’s enduring adaptability and dedication to innovation but in addition promise a dynamic and transformative journey forward.

The fintech sector, amidst the trials of 2023, has demonstrated a exceptional capability for resilience and evolution. By adopting a strategic concentrate on early-stage funding, embracing the subsequent wave of insurtech innovation, and prioritising B2B fashions, the trade is poised to proceed its upward trajectory.

The journey of fintech is way from over, with the years forward set to carry additional developments, disruptions, and alternatives. This vibrant and ever-evolving sector stays on the forefront of redefining the monetary companies panorama, heralding a future the place know-how and finance converge to create extra inclusive, environment friendly, and revolutionary options.