![Axis Financial institution Neo Credit score Card Evaluate [Lifetime Free] – CardExpert Axis Financial institution Neo Credit score Card Evaluate [Lifetime Free] – CardExpert](https://www.cardexpert.in/wp-content/uploads/2024/01/axis-bank-neo-credit-card.jpg)

Axis Financial institution not solely has all of the superb bank cards in premium section but in addition a superb variety of entry-level playing cards, out of which Axis Neo Credit score Card is at present being issued as Lifetime Free Credit score Card.

Axis Financial institution Neo Credit score Card comes with card-linked advantages like 40% OFF on Zomato for which it’s identified for. Right here is every thing that you must know,

Overview

| Kind | Entry-Degree Credit score Card |

| Reward Charge | 0.2% |

| Annual Charge | |

| Greatest for | Eating & Invoice funds |

| USP | Zomato provide (40% low cost) |

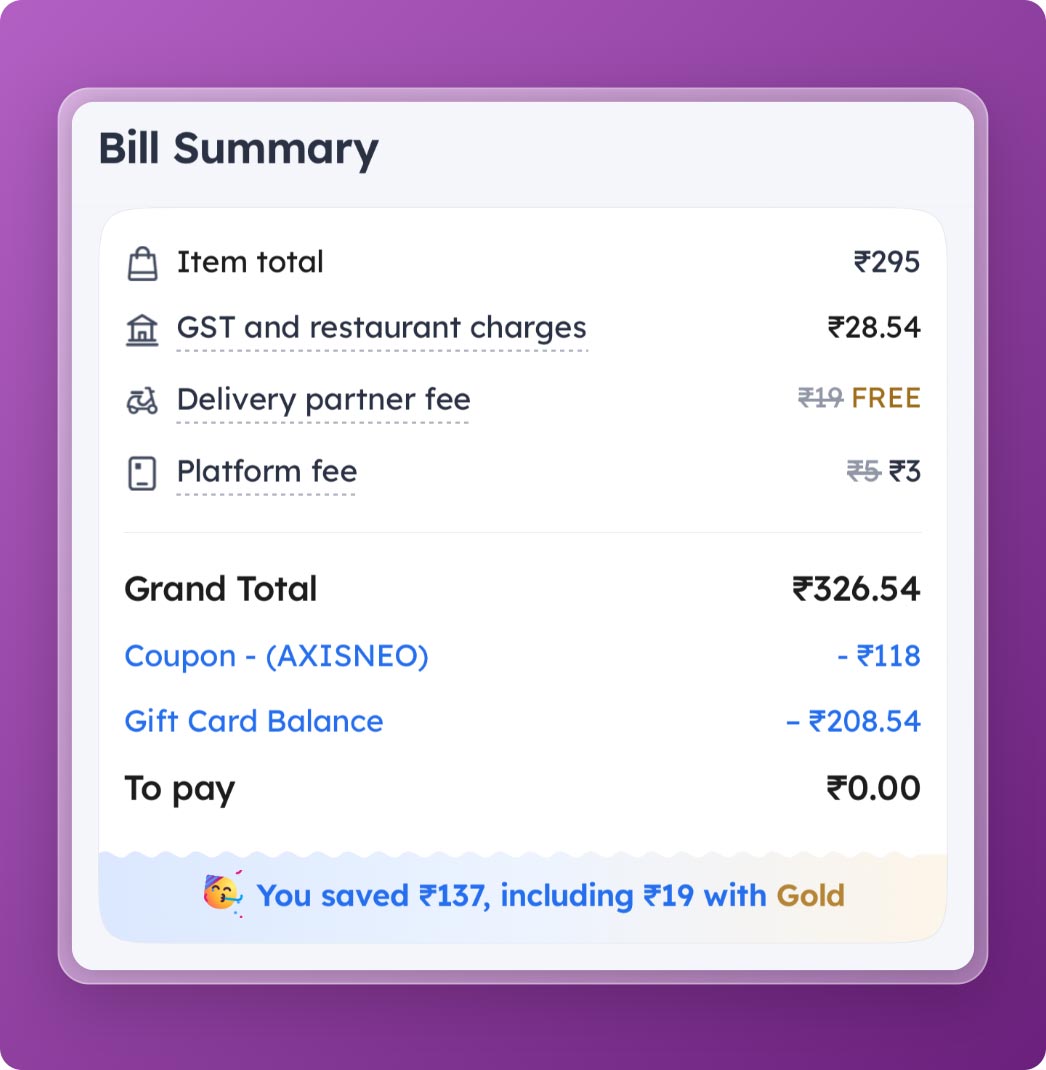

Whereas the Axis Neo Credit score Card comes with many advantages with small retailers, the noteworthy ones are the 40% OFF on Zomato and the 5% OFF on Amazon Invoice Cost.

Charges

| Becoming a member of Charge | |

| Welcome Profit | 100% cashback upto Rs 300 on first utility invoice pay |

| Renewal Charge | |

| Renewal Profit | – |

| Renewal Charge waiver | – |

It’s an entry degree card with maybe the bottom ever annual charge on a card I’ve ever seen. However anyway it’s being issued as a Lifetime Free card for now.

Rewards

- 1 RP for each 200 INR spend (Reward Charge = 0.10%)

- 1 RP = 0.20 INR on edge rewards portal

Such low reward charge on Axis Neo is unacceptable in 2024 the place even commonplace LTF playing cards can provide reward charge of ~2% or so.

In the event you’ve respectable ongoing month-to-month spends and nonetheless don’t want to pay any charges for bank card, it’s best to as a substitute discover Axis Ace Credit score Card (or) higher IDFC Credit score Playing cards just like the IDFC Millenia (or) IDFC Choose Credit score Card which comes with fairly good advantages and can be a Lifetime Free card.

Options & Advantages

- 5% off on Utility invoice funds by way of Amazon Pay (upto 150 INR, as soon as a month)

- 10% off on Myntra, Blinkit, Bookmyshow (capping & min txn worth applies)

Besides the 5% off on utility invoice fee profit, all else are near ineffective on this time and age.

I really feel that the financial institution ought to have additionally refreshed the options and advantages of the cardboard whereas refreshing the design.

However of-course it’s a extremely low charge card, so one can’t complain.

Palms-on Expertise

To expertise the Axis Financial institution Neo bank card, we took one in household assuming that it might assist us save a bit with Zomato orders nevertheless it’s tough.

The issue is that it doesn’t work with all eating places just like the Swiggy provide which we used to have with Axis MyZone Credit score Card.

The eating places which might be eligible to make use of the Axis Neo 40% Off coupon code already has the identical 40% provide with none card. So it’s helpful solely when that you must avail the provide very many occasions.

I want the Zomato coupon utilization is extra liberal than it’s now to make sense for many.

From my expertise Axis Financial institution is barely degrading their worth by partnering with such t&c making the provide inaccessible to most.

So if you happen to’re planning to get the cardboard, I might counsel checking the provide as soon as along with your most popular eating places after which determine. That mentioned, when the provide is on the market, it’s definitely helpful.

Backside line

The Axis Financial institution Neo Credit score Card is sweet for individuals who can actually make use of the Zomato & Amazon provide amongst different small service provider presents.

In any other case one has to contemplate going for different bank cards with higher rewards or cashback. Right here is record of a few of the greatest bank cards issued in India so that you can select from.

Do you discover any worth in Neo Credit score Card? Be happy to share within the feedback under.

![Axis Financial institution Neo Credit score Card Evaluate [Lifetime Free] – CardExpert Axis Financial institution Neo Credit score Card Evaluate [Lifetime Free] – CardExpert](https://i2.wp.com/www.cardexpert.in/wp-content/uploads/2024/01/axis-bank-neo-credit-card.jpg?w=696&resize=696,0&ssl=1)