It’s a widespread situation available in the market whereby costs would methodically oscillate up and down the value chart and not using a clear pattern route. This may occasionally happen in a ranging market and even in markets with out clear assist and resistance zones. One option to commerce any such market situation is by buying and selling on imply reversal indicators coming from oversold or overbought value ranges. This technique reveals us a methodical means commerce such imply reversal setups utilizing the Easy Pattern Detector and the Bollinger Bands.

Easy Pattern Detector

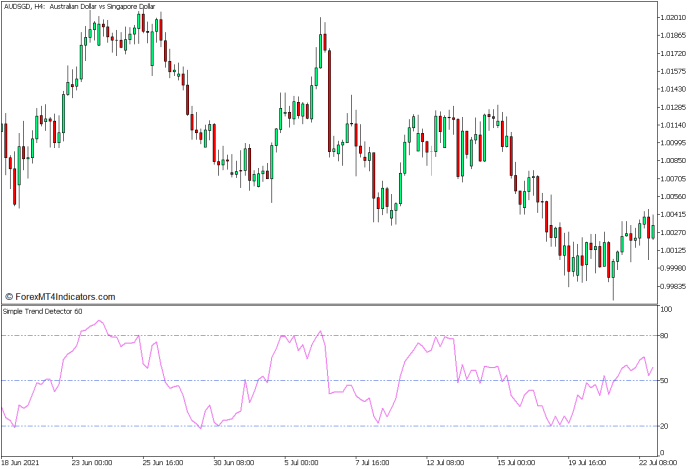

Easy Pattern Detector (STD) is an oscillator kind of technical indicator that shares a whole lot of similarities with different oscillators such because the Relative Energy Index (RSI) and the Cash Movement Index (MFI). Like the 2 oscillators talked about, it additionally signifies momentum and pattern route, in addition to overbought and oversold markets.

The STD line oscillates inside a hard and fast vary of 0 to 100. It additionally has markers at ranges 20, 50, and 80. Ranges 20 and 80 point out oversold and overbought ranges, whereas 50 delineates bullish momentum and bearish momentum.

Merchants could establish markets with a bullish momentum bias primarily based on the situation of the STD line in regards to the marker at 50. The market could also be thought of bullish at any time when the STD line is usually above 50 and bearish at any time when the STD line is usually beneath 50. Merchants could use this info to filter out trades primarily based on momentum route or make commerce entries primarily based on the shifting of market momentum.

Merchants may additionally establish oversold and overbought markets primarily based on the markers at ranges 20 and 80. The market is taken into account oversold at any time when the STD line drops beneath 20 and overbought at any time when the STD line breaches above 80. Each these situations are prime circumstances for a imply reversal as the value usually tries to revert to its common value.

Bollinger Bands

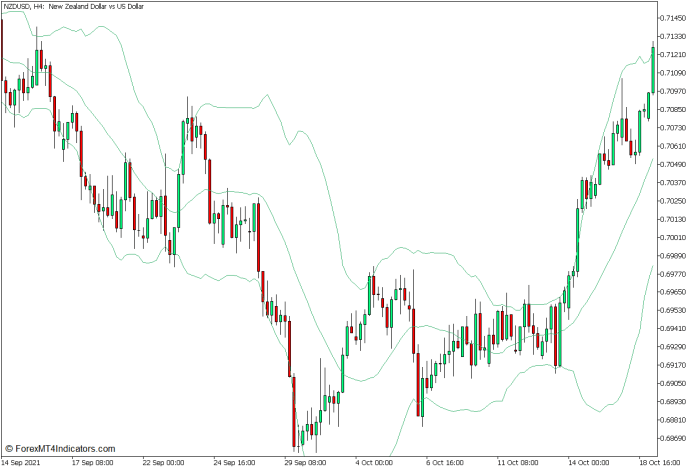

The Bollinger Bands is a technical indicator developed by John Bollinger. This indicator attracts three strains that comply with the actions of value motion and sometimes envelopes it throughout regular market circumstances. These three strains type a band-like construction, which is why the indicator is named “Bollinger Bands”.

The center line of the Bollinger Bands is a Easy Shifting Common (SMA) line which is normally preset to calculate for 20 bars. Its outer strains then again are calculated as customary deviations of value motion shifted above and beneath the 20 SMA line. That is normally preset at 2 customary deviations. These three strains type the band-like construction that might normally envelope value motion.

The Bollinger Bands is a flexible technical indicator, which can be utilized to find out pattern route, volatility, momentum breakouts, in addition to oversold and overbought value ranges.

Since its center line is a 20 SMA line, the Bollinger Bands may also be used to establish pattern route, identical to most transferring common strains are used. The market is taken into account to be in an uptrend if value motion is usually above the center line and in a downtrend if value motion is usually beneath the center line.

The outer strains may also be used to evaluate market volatility as a result of these strains are primarily based on customary deviations of value motion. The bands are inclined to contract at any time when volatility is low which is the case at any time when the market is in a contraction part. Alternatively, the bands additionally develop at any time when volatility is excessive which is the case when the market is in a market enlargement part.

The Bollinger Bands may also be used to establish momentum breakouts, which usually happen after a market contraction part. Merchants could establish momentum breakouts primarily based on sturdy momentum candles closing exterior of the bands after a decent market contraction.

The Bollinger Bands are additionally primarily used to establish imply reversals coming from oversold and overbought markets. Value dropping beneath the decrease line signifies an oversold market, whereas value breaching above the higher line signifies an overbought market. Value rejection patterns creating in these areas are telltale indicators of a possible imply reversal situation.

Buying and selling Technique Idea

This buying and selling technique is a imply reversal buying and selling technique that trades on the confluence of imply reversal indicators coming from the Bollinger Bands and the Easy Pattern Detector indicator.

On the Easy Pattern Detector, merchants could establish oversold and overbought markets merely primarily based on the STD line dropping beneath 20 or breaching above 80.

Legitimate oversold and overbought situations also needs to present costs dropping beneath the decrease line or breaching above the higher line of the Bollinger Bands.

Value ought to then reverse coming from such an oversold or overbought value degree, which is indicated by a momentum candle reverting in the direction of the center line of the Bollinger Bands. This needs to be accompanied by the STD line reverting inside the 20 to 80 vary.

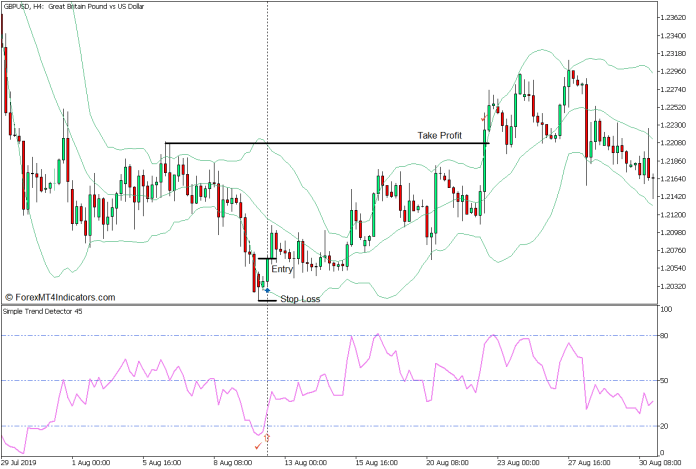

Purchase Commerce Setup

Entry

- Value ought to drop beneath the decrease line of the Bollinger Bands.

- The STD line ought to drop beneath 20.

- Open a purchase order as quickly as a bullish momentum candle varieties in confluence with the STD line reverting above 20.

Cease Loss

- Set the cease loss on the fractal beneath the entry candle.

Exit

- Set the take revenue goal on the following swing excessive degree.

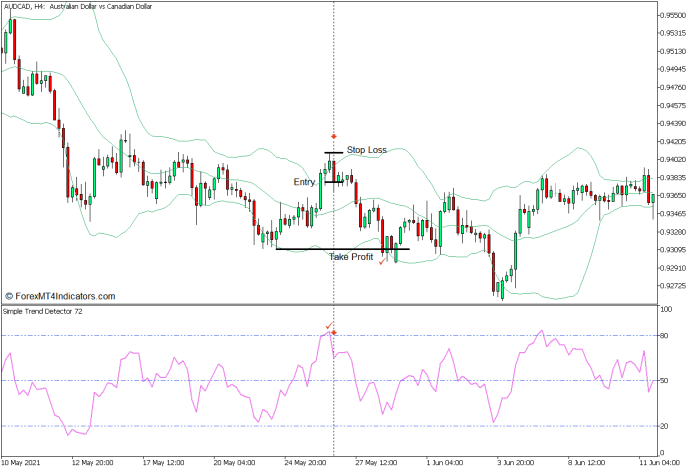

Promote Commerce Setup

Entry

- Value ought to breach above the higher line of the Bollinger Bands.

- The STD line ought to breach above 80.

- Open a promote order as quickly as a bearish momentum candle varieties in confluence with the STD line reverting beneath 80.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Set the take revenue goal on the following swing low degree.

Conclusion

This buying and selling technique is a viable option to commerce non-trending markets. It could simply be traded on ranging markets with clear assist and resistance zones, nevertheless it may be traded on markets with out outlined ranges, so long as the market reveals a sample whereby value swings are clearly outlined as the value turns into oversold or overbought. Nevertheless, this buying and selling technique works finest when traded along with a market move kind of system. Seasoned merchants could discover excessive chance reversal zones at any time when they decipher what the market construction is.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past knowledge and buying and selling indicators.

This MT5 technique supplies a possibility to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and regulate this technique accordingly.

Beneficial Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

The best way to set up This MT5 Technique?

- Obtain the Zip file beneath

- *Copy mq5 and ex5 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out the MT5 technique

- You will note technique setup is obtainable in your Chart

*Be aware: Not all foreign exchange methods include mq5/ex5 recordsdata. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: