With zero information (ZK) proofs anticipated to be a recreation changer for blockchain scaling, Polygon could also be on the point of a serious rally. Taking to X on February 2, crypto market commentator Polynya, asserts that ZK expertise is the “endgame” as its “1,000x effectivity upside is irresistible for networks.”

Will “ZK” Know-how Be The “Finish Recreation”?

This forecast on ZK adoption is huge for Polygon and its native token, MATIC, which has been underneath important promoting strain up to now few buying and selling months. As it’s, Polygon Labs, the developer of the Ethereum sidechain, has been on the forefront, advocating for the event of ZK scaling options.

In 2021, Polygon started assembling a group to develop zkEVM, a method counting on zero information to scale Ethereum cheaply whereas being appropriate with the EVM. Current Polygon Labs documentation reveals that their zkEVM is in beta and being examined.

Nonetheless, this hasn’t stopped the group from putting offers with layer-1 protocols concerned with harnessing this expertise.

In mid-January, NEAR Protocol’s Knowledge Availability (DA) answer was built-in with Polygon’s customized blockchain improvement equipment (CDK). The objective was to make it simpler for builders to create ZK rollup options appropriate for his or her wants whereas leveraging NEAR Protocol‘s infrastructure. All that is when making certain the mixing lowers price and improves efficiency.

Polygon Labs has additionally partnered with different platforms, together with Immutable–a layer-2 web3 answer for NFTs; Ankr–an infrastructure supplier; and QuickSwap–a decentralized alternate (DEX). Most of those platforms plan to function as layer-2s for Ethereum.

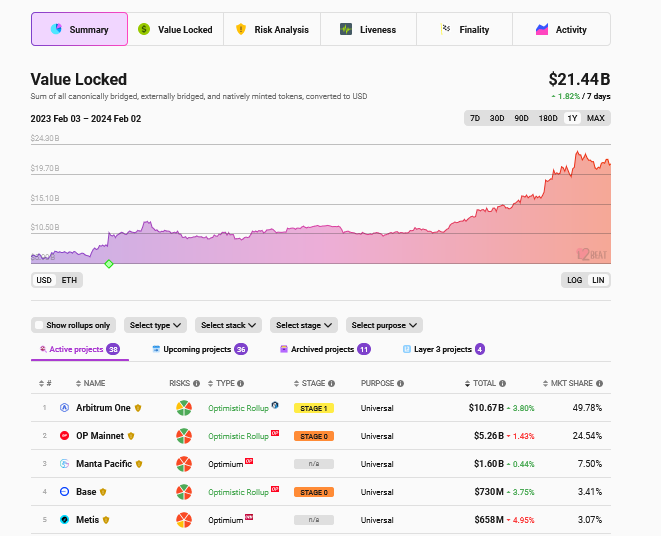

The whole worth locked (TVL) in layer-2 protocols stays in an uptrend, in accordance with L2Beat. These platforms command over $21 billion. To date, the most important layer-2 protocols, Arbitrum, Optimism, and Base, use Optimistic Rollups.

Is Polygon (MATIC) Prepared For $3?

It is a bullish improvement for Polygon. Furthermore, at this tempo, it’s prone to cement Ethereum, the pioneer layer-1 and good contract platform, as a dominant settlement layer regardless of on-chain scaling considerations and comparatively excessive charges.

From a value level perspective, MATIC will seemingly profit as extra platforms undertake Polygon’s zkEVM options. To date, MATIC is secure however agency when writing on February 2. From the every day chart, MATIC has help at round $0.70. On the higher finish, the instant resistance degree is at $1.

Spurred by partnerships as extra platforms use zkEVM, basic developments would possibly drive MATIC even larger within the coming periods. If MATIC finds momentum, the medium- to long-term goal shall be $3, or a 2021 excessive.

Function picture from iStock, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site fully at your individual danger.