Bitcoin has been unable to retain its bullish momentum and appears prone to lengthen its present draw back pattern. Nevertheless, the long term stays optimistic, and the subsequent months may see BTC attain its all-time excessive, however in a special trend than in earlier rallies, in keeping with a big investor.

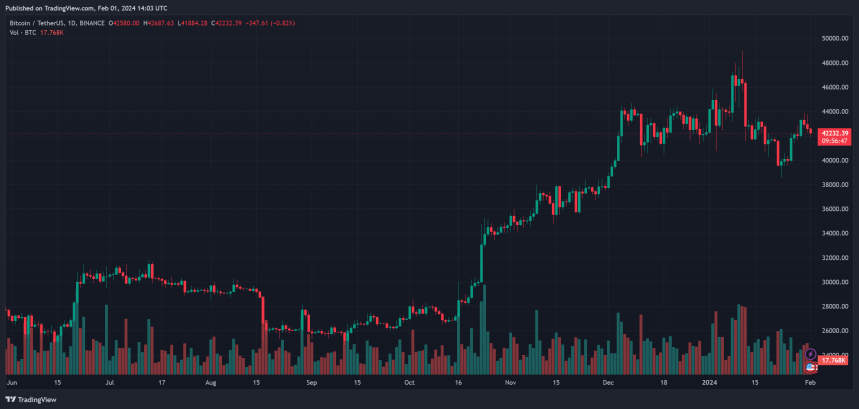

As of this writing, Bitcoin trades at $42,000 with a 1% loss within the final 24 hours. Over the earlier week, the cryptocurrency nonetheless data a 5% revenue.

Bitcoin Whales Makes Bullish Forecast

In keeping with a pseudonym Bitcoin Whale that goes by “Joe007” on social media X, the cryptocurrency is poised for a bull run. The establishments buying and selling the US spot Bitcoin Change Traded Fund (ETF) will drive this bullish momentum.

In that sense, these establishments are prone to suck the volatility out of Bitcoin by pushing to commerce much like conventional property. Thus, Joe007 claims that this cycle’s rally will lack the thrill of 2017 and 2021 when BTC hit $20,000 and $69,000, respectively, creating euphoria amongst traders.

The Bitcoin whale acknowledged:

I believe we’re about to witness probably the most boring rally in Bitcoin historical past. No retail-driven parabolic swings that excite degens/noobs and produce headlines. Relatively a sluggish relentless drive larger by skilled accumulators taking out layer after layer of paper handed holders.

The whale dismissed the chance when requested if conventional establishments may fail in “taming” BTC as a result of “systemic crises” within the area. As well as, Joe007 dismissed the potential for the cryptocurrency not working larger in the long term.

The one factor that would stand between Bitcoin and a rally is a “low likelihood” state of affairs the place the normal finance sector experiences the same crash to 2008. The BTC whale added:

(…) except there’s a sudden full tradfi meltdown (2008-style or worse). Then I can see Bitcoin being dragged right into a basic panic-crash, no less than initially. Definitely attainable however exhausting to assign sensible likelihood.

BTC Value In The Brief Time period

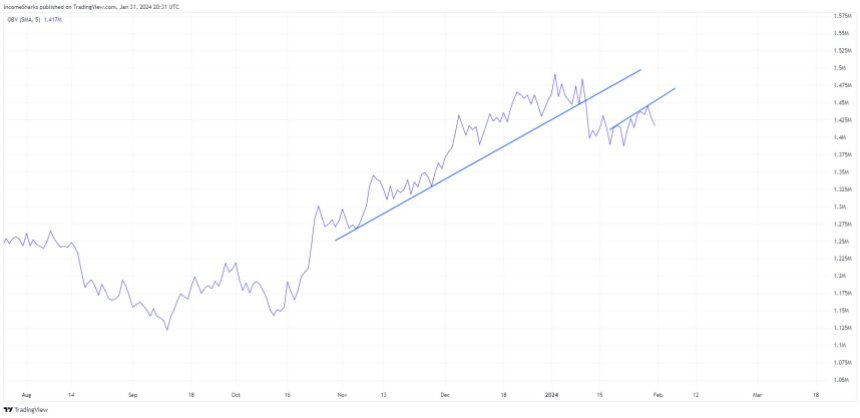

On low timeframes, an analyst pointed on the Each day On Steadiness Quantity (OBV), which suggests additional draw back for BTC. The chart beneath reveals that this metric broke out of a trending channel throughout Bitcoin’s current crash.

The OBV was rejected out of a essential stage and appears poised to pattern to the upside together with the worth of BTC. The analyst acknowledged:

Each day OBV nonetheless appears prefer it needs extra draw back. Appears like this might need been a decrease excessive that we simply put in.

Cowl picture from Unsplash, chart from Tradingview

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site fully at your personal threat.