It has lastly occurred. Greater than a decade after receiving the primary spot bitcoin ETF utility the SEC gave its approval yesterday.

Whereas this was extensively anticipated, it wasn’t a slam dunk as demonstrated by the tight vote: 3-2 in favor with SEC Chair Gary Gensler offering the deciding vote.

In complete, 11 spot Bitcoin ETF functions had been authorized, many from a few of the greatest names in finance equivalent to BlackRock, Constancy and Invesco. All 11 ETFs have already began buying and selling at present.

This marks a significant milestone for the mainstream acceptance of cryptocurrency. Like it or hate it, crypto goes to be round for a really very long time and these ETFs present the best manner for on a regular basis buyers to carry bitcoin.

Curiously, the worth of bitcoin is up within the final 24 hours however Ethereum is up much more as crypto merchants anticipate the subsequent step is the acceptance of an Ethereum ETF.

However given the monitor document of the SEC that’s possible not going to occur rapidly.

Featured

SEC Approves Bitcoin ETFs for On a regular basis Buyers

The exchange-traded funds will enable buyers to purchase bitcoin as simply as shares or mutual funds.

From Fintech Nexus

> Each lender has a fraud drawback, however AI-powered detection is right here to assist

By David Snitkof

Fraud is a major problem for lenders, impacting each operational effectivity and monetary stability. Legacy strategies for detecting fraud are proving to be insufficient within the face of recent strategies, so AI-powered detection is required.

> Lengthy Take: Carta’s misstep and exit from secondary markets level to an even bigger drawback

By Lex Sokolin

A lesson within the complexities of personal fairness.

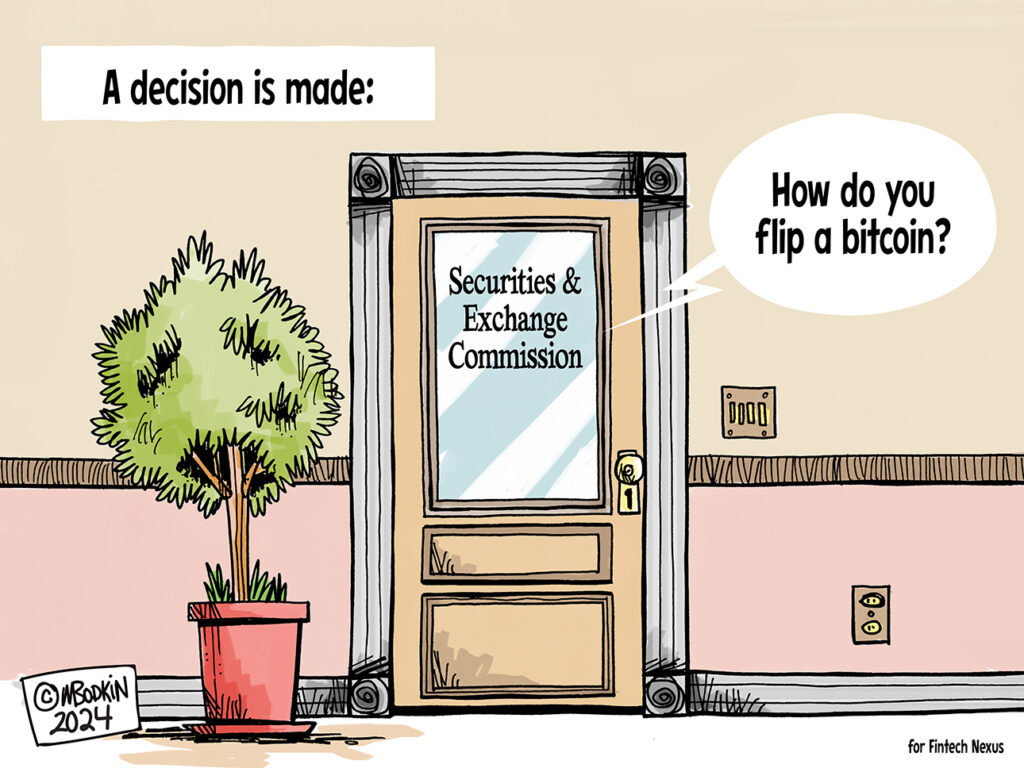

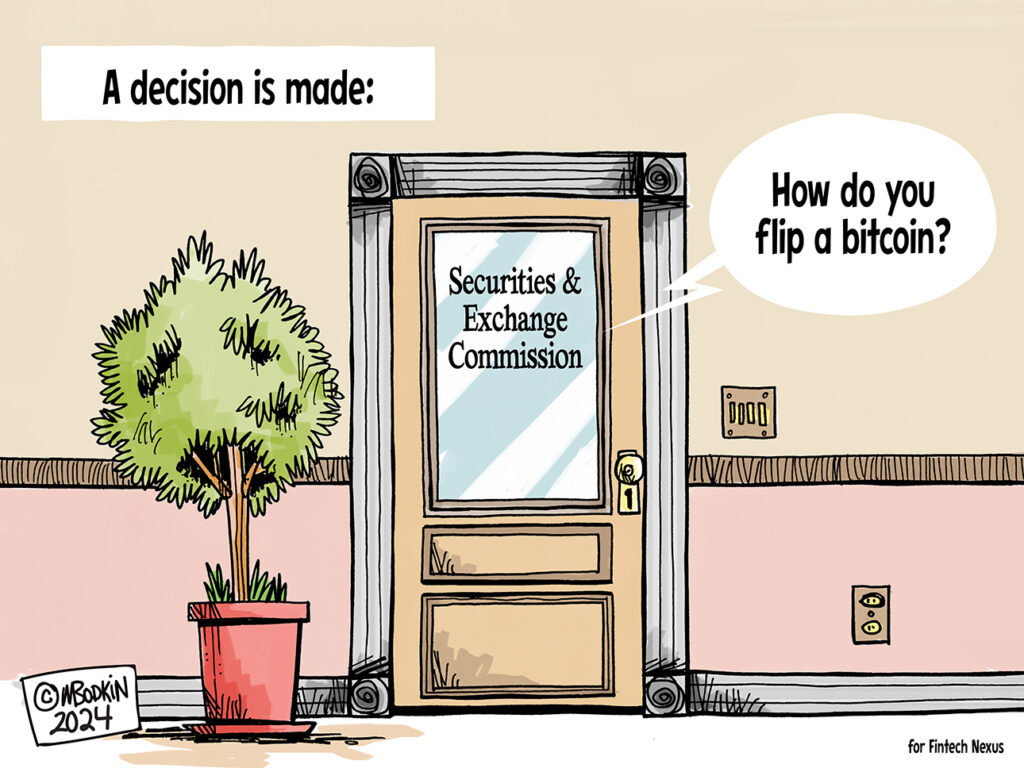

Editorial Cartoon

Webinar

Excessive Efficiency Payouts: Why real-time Pay to Card is revolutionizing entry to money

Jan 17, 12pm EST

Actual-time payouts have by no means mattered greater than they do in at present’s digital economic system. Throughout platform economies – serving creator…

Additionally Making Information

- USA: IRS transfer narrowing entry to tax knowledge sparks lender outrage

The company plans to limit entry to a system that gives borrower tax returns to mortgage lenders starting June 30. Omitted of the loop, small-business lenders say getting credit score to debtors will grow to be tougher consequently.

To sponsor our newsletters and attain 220,000 fintech lovers together with your message, contact us right here.