This Friday, the highlight is turned to Deribit, the main crypto derivatives alternate, because it gears up for a notable occasion in its buying and selling historical past. Notably, the alternate is poised to witness the expiration of over $9.5 billion in Bitcoin choices open curiosity.

For context, Open curiosity refers back to the whole variety of excellent by-product contracts, equivalent to futures or choices, that haven’t been settled or closed. It represents the variety of contracts market individuals maintain on the finish of every buying and selling day.

This surge in open curiosity recorded by Deribit displays elevated market participation and indicators heightened liquidity, marking a notable milestone within the crypto derivatives panorama.

Report-Breaking Open Curiosity

Notably, this occasion is important in two methods: It underscores the rising curiosity in Bitcoin as an asset class and highlights the rising “sophistication” of the cryptocurrency market. It is because Open curiosity may also function a vital indicator of market well being and dealer sentiment.

As such, the report ranges of open curiosity set to run out on Deribit counsel a “vibrant” buying and selling setting, with extra traders partaking in advanced monetary devices like choices.

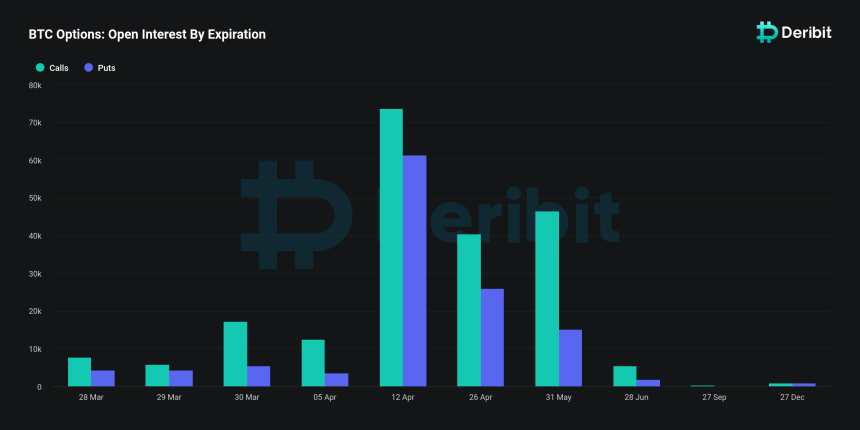

In response to Deribit knowledge, the alternate is ready to host considered one of its largest possibility expiries ever, with $9.5 billion value of Bitcoin choices poised for expiry on the finish of the month. This determine represents a considerable portion, roughly 40%, of the alternate’s whole choices open curiosity, which stands at $26.3 billion.

The magnitude of this expiry occasion eclipses earlier months, with January and February end-of-month expiries totaling $3.74 billion and $3.72 billion, respectively. This pattern signifies a big enhance in market exercise and investor engagement on the platform.

Implications Of The Bitcoin Expiry

The upcoming expiry has notable implications for the market, particularly contemplating the present pricing dynamics of Bitcoin.

With Bitcoin’s spot value hovering beneath $70,000, an estimated $3.9 billion of the open curiosity is anticipated to run out “within the cash,” in accordance with Deribit analysts, presenting worthwhile alternatives for holders of those choices contracts.

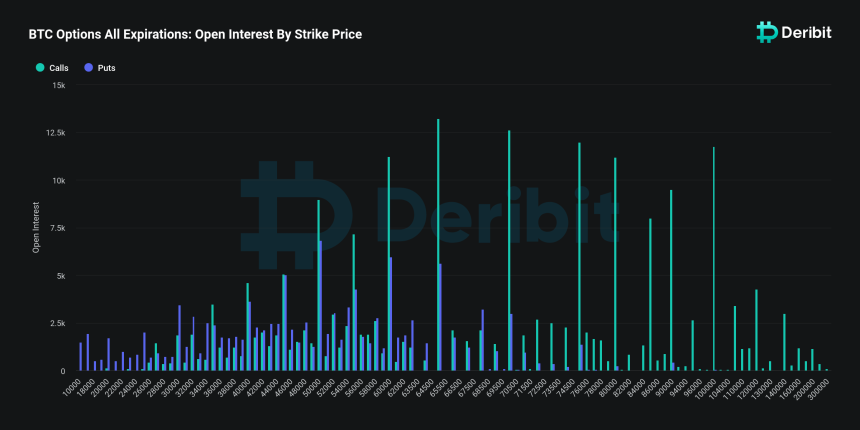

The “max ache” value, which represents the strike value at which the very best variety of choices would expire nugatory, thereby inflicting the utmost monetary loss to possibility holders, is recognized at $50,000.

In response to the analysts, this state of affairs suggests {that a} vital variety of merchants are positioned to learn from the present market situations, probably resulting in “elevated shopping for exercise” as these choices are exercised.

Moreover, Deribit analysts speculate that the excessive stage of “in-the-money expiries” might exert upward strain on Bitcoin’s value or amplify market volatility. They added that as merchants “hedge their positions” or “speculate on future value actions,” the market might witness a flurry of exercise, impacting Bitcoin’s value trajectory within the brief time period.

This comes at a time when Bitcoin has skilled a slight retracement from its current all-time excessive above $73,000, with the worth adjusting to roughly $68,946, on the time of writing

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site completely at your personal danger.