XRP’s newest downswing has dragged value right into a cluster of long-term quantity and mean-reversion ranges, with one distinguished market technician flagging Korea because the epicenter of near-term spot promoting.

XRP Faces Essential Help

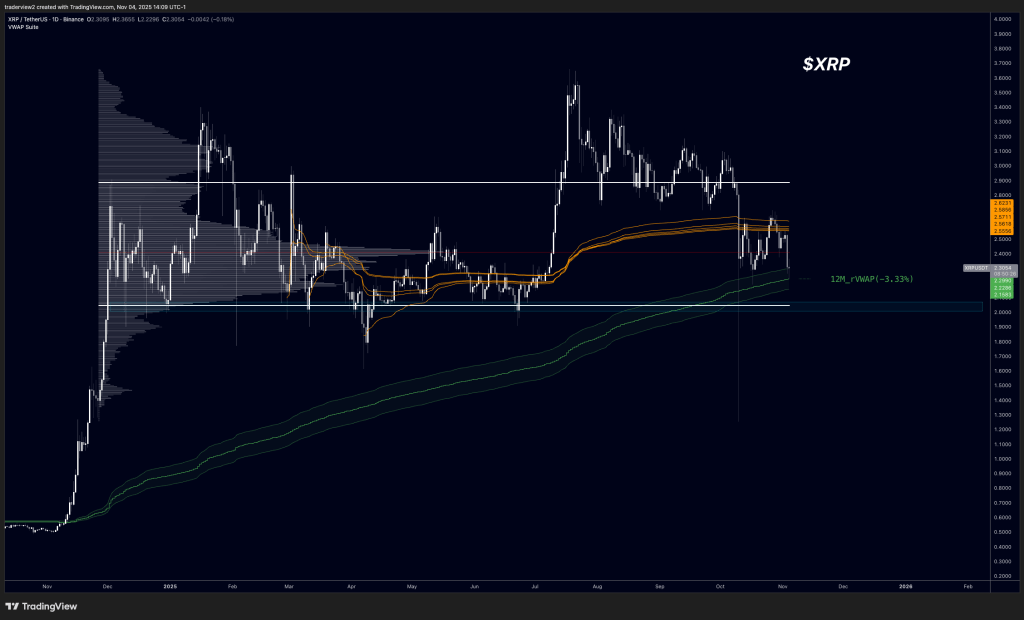

In charts shared over the previous 24 hours, dealer Dom (@traderview2) stated XRP has “reached the 12M rVWAP for the primary time this 12 months,” including that it “actually isn’t a degree we wish to be buying and selling underneath for awhile.” He warned that if bulls lose that 12-month rolling VWAP, “we’re trying on the vary low of $2 as the subsequent space of curiosity,” whereas a swift restoration would require “$2.50 [to] regain to get out of hazard space.”

Dom additionally pointed to order-book composition: “Spot orderbooks are skewed in direction of bids proper now which is optimistic, however snapping the native low will probably ship us again to $2 the place the remainder of the bids sit.”

Dom’s VWAP-suite chart locations spot value urgent straight into the 12-month rolling VWAP ribbon after failing to maintain above the prior distribution shelf, a configuration that usually separates trending from mean-reverting phases. Testing this line for the primary time this 12 months is notable as a result of multi-month rVWAPs act as dynamic fair-value proxies; sustained closes under them traditionally coincide with additional probing of high-volume nodes beneath.

Associated Studying

Korea Dictates The XRP Value Transfer As soon as Once more

The geographic focus of promoting has amplified the danger of a deeper tag of that vary. Dom stated the majority of the spot strain was exchange-specific: “They do NOT look glad over there in Korean… 84% of all of the spot promote strain over the past 2 days has got here from Upbit.”

A cumulative quantity delta (CVD) breakdown by trade corroborates the outsized position of the Korean venue, with Upbit’s CVD line deeply damaging whereas Binance, Coinbase, Bybit, OKX, Kraken and Bitstamp hover comparatively flat close to the zero line. In sensible phrases, that blend signifies real-coin distribution flowed predominantly by means of the KRW hall whilst different USD- and USDT-based venues confirmed much less aggressive web promoting.

Associated Studying

A separate high-timeframe chart from IncomeSharks frames the draw back magnet with easy readability. The analyst posted a day by day XRP/USD view with a broad demand zone centered slightly below $2.00 and commented: “XRP — For those who missed it underneath $2 you’ll in all probability have an opportunity to bid it once more.”

The chart highlights how the late-summer impulse didn’t retake overhead resistance and the way subsequent decrease highs left a clear air pocket towards the December–March worth space that begins across the psychologically dense $2.00 deal with. The analyst expects a retracement as little as $1.80-$1.70 if the psychological necessary $2 mark doesn’t maintain.

At press time, XRP traded at $2.21.

Featured picture created with DALL.E, chart from TradingView.com