The long-awaited arrival of spot Bitcoin ETFs has ignited a gold rush within the crypto world, attracting each newcomers and seasoned traders. Whereas these new funding autos provide a handy and accessible strategy to acquire publicity to Bitcoin, their impression on the cryptocurrency’s core ideas and long-term stability stays a fancy query.

Bitcoin ETF: Preliminary Surge, However Possession Shift A Concern

The information paints an enchanting image. Following the SEC’s approval of 11 ETFs, the variety of non-zero Bitcoin wallets initially soared, reaching a peak of almost 53 million in January. This surge was possible fueled by the accessibility and safety supplied by ETFs, attracting people beforehand hesitant to immediately interact with the intricacies of crypto wallets and exchanges.

Nevertheless, in line with knowledge offered by Santiment, a regarding development emerged 30 days later: almost 730,000 fewer wallets held any Bitcoin, suggesting a possible shift in the direction of holding by ETFs as a substitute of immediately proudly owning the tokens. This raises questions concerning the long-term impression on Bitcoin’s decentralized nature and the potential for decreased on-chain exercise.

📊 There are 729.4K much less #Bitcoin wallets holding larger than 0 $BTC, in comparison with one month in the past. After the #SEC accepted 11 Spot Bitcoin #ETF‘s, this quantity of non-0 wallets peaked on January twentieth at 52.95M. That is attributed to the elevated curiosity in #hodlers

(Cont) 👇 pic.twitter.com/FThtSDOmk0

— Santiment (@santimentfeed) February 21, 2024

ETF Growth, However Provide/Demand Dynamics Unchanged

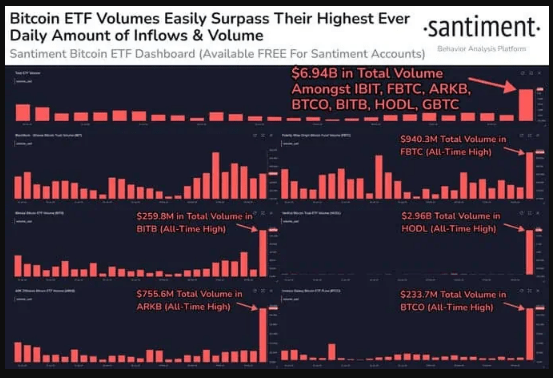

Whereas the ETF market is prospering, its impression on Bitcoin’s core ideas is much less clear. The current report quantity and inflows exceeding $7 billion throughout the highest 7 ETFs spotlight robust market curiosity and the potential for mainstream adoption.

Supply: Santiment

Nevertheless, it’s essential to do not forget that these ETFs can maintain each precise Bitcoin and futures contracts. This implies traders acquire publicity with out immediately impacting the underlying provide or demand of the cryptocurrency itself. This raises questions on whether or not ETFs are actually driving adoption or just making a derivative-based market with its personal set of dangers and dynamics.

Hypothesis Surges, Elevating Pink Flags

Maybe probably the most regarding development is the surge in speculative buying and selling utilizing derivatives. Open curiosity on centralized exchanges, notably for Bitcoin, has reached unprecedented ranges, exceeding $10 billion for the primary time since July 2022.

BTC market cap stays within the $1 trillion area. Chart: TradingView.com

This means traders are taking over extra danger by leveraging derivatives, probably fueled by the “crowd euphoria” surrounding Bitcoin and the attract of probably fast good points. This echoes the speculative frenzy seen in 2017, elevating considerations about potential market volatility and potential crashes. Ethereum, Solana, and Chainlink additionally exhibit important open curiosity, suggesting broader market-wide traits past simply Bitcoin.

The Verdict: A Double-Edged Sword

The arrival of spot Bitcoin ETFs has undoubtedly opened doorways for brand new traders, however it’s vital to acknowledge the potential downsides. Whereas accessibility has elevated, direct possession could be lowering, and the rise of speculative buying and selling utilizing derivatives raises considerations about future market stability.

Transferring ahead, it will likely be essential to observe how these traits evolve and their long-term impression on the general well being of the crypto ecosystem. Moreover, ongoing regulatory developments surrounding ETFs and derivatives may additional form the panorama.

Featured picture from Nicola Barts/Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal danger.