On this situation, NETS assumes the position of the first acquirer for retailers, taking full duty for the merchant-acquirer relationship. This contains overseeing important features equivalent to onboarding, settlement, and reconciliation, thereby considerably simplifying the method for retailers.

SGQR+ to Pave the Method for Cross-Border Connectivity

Globally, the potential of interoperable QR funds has been recognised, with nations implementing methods to develop well-connected and inclusive cost ecosystems. In Southeast Asia, notable techniques embody Indonesia’s Fast Response Code Indonesian Commonplace (QRIS), Malaysia’s DuitNow QR, QR Ph within the Philippines, and Thai QR established by the Financial institution of Thailand. These techniques not solely facilitate seamless funds for inbound prospects but additionally enhance inbound transactions by means of cross-border linkages.

These nations have established cross-border linkages amongst themselves, attaining various levels of interoperability, with some having well-connected cross-border QR cost techniques in place. With its established cross-border connectivity, SGQR+ goals to extend inbound transactions by means of these linkages, whereas guaranteeing a seamless funds expertise for inbound prospects.

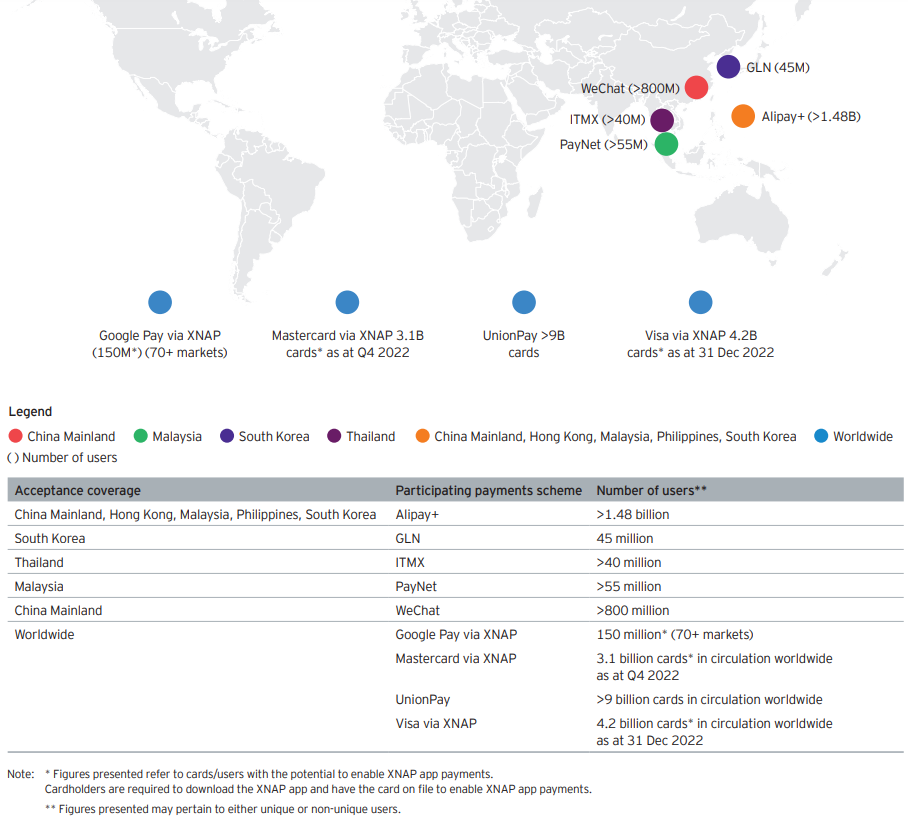

Below the SGQR+ POC, cost schemes from mainland China (AliPay+ and WeChat), South Korea (GLN), Thailand (ITMX), Malaysia (PayNet), in addition to international schemes by way of XNAP card and app retailer cost choices, might be accommodated. A bigger vary of service provider acquirers, native issuers, and taking part worldwide schemes have proven curiosity, indicating a transfer in the direction of establishing seamless QR funds throughout quite a few nations.

Bolstering Monetary Inclusion to Unlock the Potential of MSMEs

SGQR+ will allow acquirers to achieve a extra complete view of a service provider’s money flows, in distinction to closed-loop cost ecosystems like SGQR. This broader perspective facilitates various credit score scoring strategies, probably rising lending to beforehand unserved or underserved segments.

By seamlessly connecting cost suppliers and retailers, SGQR+ goals to sort out present service provider challenges and open up new avenues for digital inclusion. Emphasising interoperability, scheme contributors are inspired to develop service choices centered on each retailers and shoppers. That is facilitated by leveraging the improved propositions made attainable by means of scheme incentives and beneficial unit economics.

For a lot of of Singapore’s neighbouring nations, MSMEs taking part in interoperable QR system cost rails will support in enhancing monetary inclusion for the unbanked and underbanked populations, thereby driving financial improvement in these areas.