On-chain knowledge reveals the latest Bitcoin drawdown has shaken up the short-term holders, main them to make massive change deposits at a loss.

Bitcoin Brief-Time period Holders Have Transferred Enormous Quantity In Loss To Exchanges

As analyst James Van Straten identified in a submit on X, the BTC short-term holders have not too long ago participated in a considerable amount of loss-taking. The “short-term holders” (STHs) are the Bitcoin buyers who purchased their cash throughout the previous 155 days.

The STHs make up one of many two foremost divisions of the BTC market, which is completed on the idea of holding time, with the opposite cohort being generally known as the long-term holders (LTHs).

Statistically, the longer an investor holds onto their cash, the much less probably they grow to be to promote them at any level. As such, the STHs would replicate the weak-minded facet of the market, whereas the LTHs can be the persistent diamond fingers.

Given their fickle nature, the STHs often simply react at any time when a notable sector change happens, like a value rally or crash. Lately, BTC has registered a major drawdown, so these buyers would probably have made some strikes.

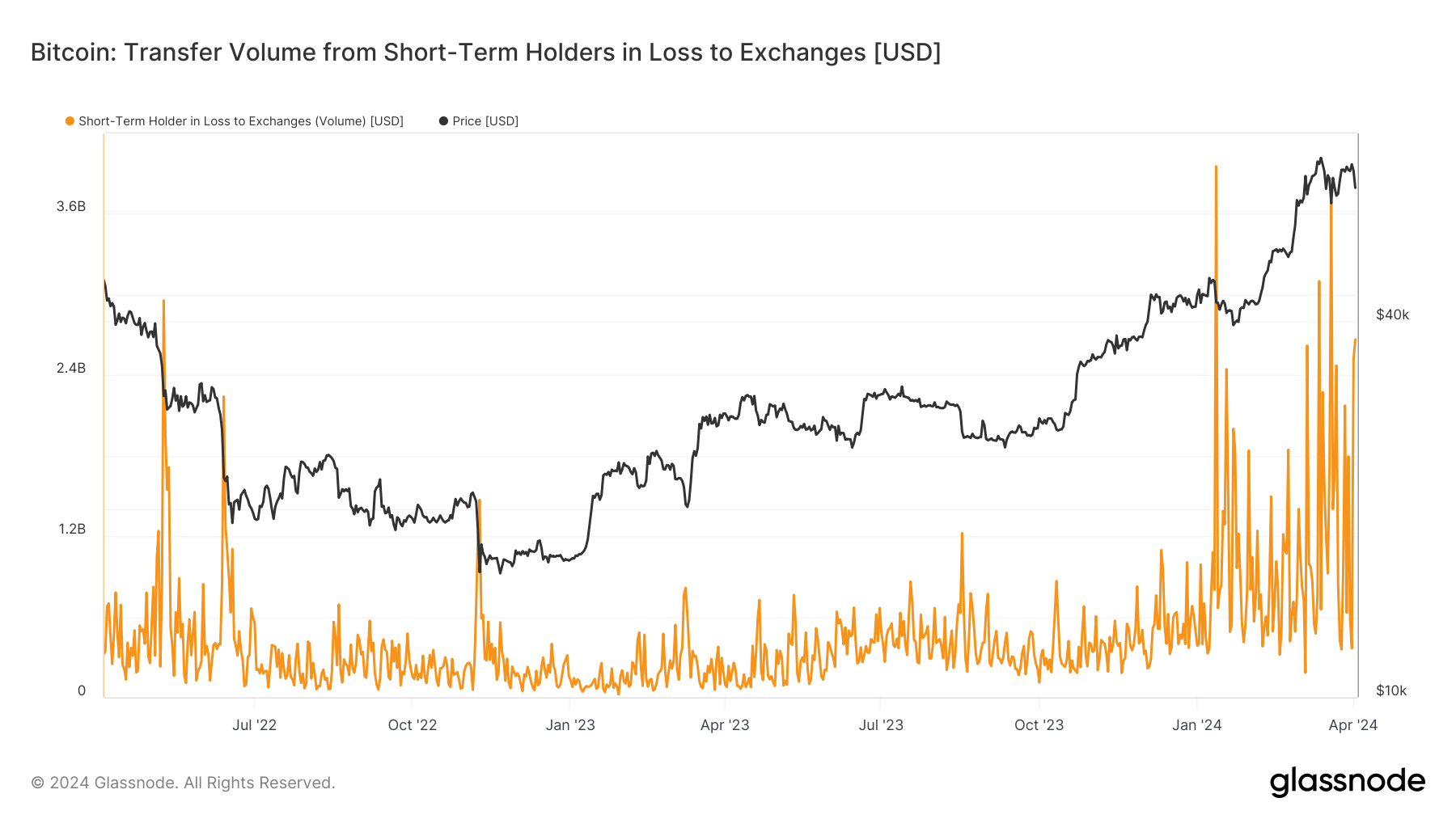

Certainly, on-chain knowledge would verify this. Under is a Glassnode chart shared by Straten, which reveals the pattern within the switch quantity in loss (in USD) going from the wallets of the STHs to centralized exchanges.

The worth of the metric seems to have been fairly excessive in latest days | Supply: @jvs_btc on X

As displayed within the above graph, Bitcoin short-term holders have not too long ago deposited numerous tokens holding a loss into exchange-affiliated wallets.

Change inflows often recommend demand for utilizing the providers these platforms present, which might embody promoting. As these newest deposits from the STHs have come following a pointy drop within the value, it could seem doable that the panic-sellers certainly made these inflows.

Because the Bitcoin value is at present close to the all-time excessive (ATH), many of the STH group can be holding a revenue. So, all this loss quantity can solely come from those that purchased on the latest highs.

This isn’t the primary time the market has noticed such fast capitulation from FOMO patrons this yr. The chart reveals that the change switch quantity in loss from the STHs additionally spiked very excessive throughout the plunge that adopted the newest value ATH.

The spike again then was even larger in scale than the one witnessed not too long ago and recommended the shakeout of the holders who the information of the ATH had pushed in.

Within the newest capitulation occasion, the Bitcoin STHs have deposited $5.2 billion value of underwater cash to the exchanges inside a two-day window.

BTC Value

For the reason that plunge just a few days in the past, Bitcoin has been unable to seek out any important upward momentum, as its value has solely been capable of get well to $66,500.

Appears to be like like the worth of the asset has been buying and selling sideways over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal danger.