Bitcoin fell sharply over the previous week, sliding nearly 15% and shifting beneath the $100,000 and $95,000 marks to commerce round $90,300, Wednesday.

Associated Studying

Based on firm disclosures, Michael Saylor’s Technique purchased an additional 8,178 BTC for $835.6 million at about $102,171 apiece throughout the downturn. That transfer has drawn recent consideration as a result of a few of these latest cash are already underwater.

Technique’s Holdings And Latest Buys

Studies have disclosed that Technique now holds 649,870 BTC, equal to roughly 3.2% of the circulating provide. The agency says it paid about $48 billion for these cash. At present costs, the holding’s market worth sits close to $59.38 billion, leaving an general paper acquire of twenty-two% or about $11 billion.

Technique has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK https://t.co/HI1TeYOvQ9

— Michael Saylor (@saylor) November 17, 2025

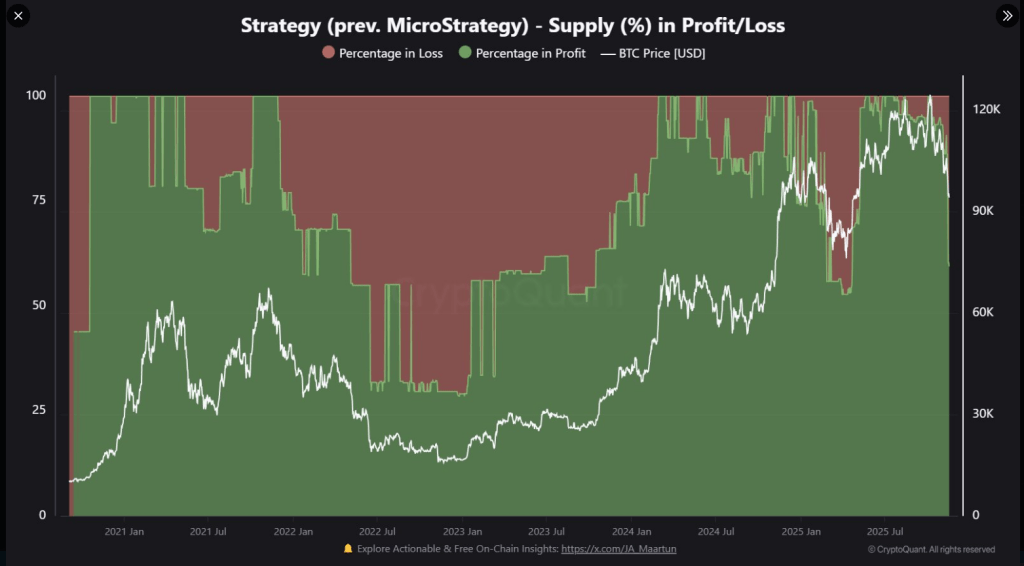

But CryptoQuant’s breakdown finds that roughly 40% of Technique’s stash is now exhibiting unrealized losses, a results of the corporate’s current shopping for exercise pushing newer heaps above at the moment’s market worth.

The latest 8,178 BTC buy is already down round 10.5%, costing the corporate roughly $88 million on paper in a matter of days.

Studies additionally present Technique made three separate buys earlier this month: smaller blocks recorded on the third and the tenth of November, bringing November’s complete to 9,062 BTC for $931.1 million. At present market ranges these November tokens are value about $827 million, a drop of simply over 11% because the buys.

Saylor’s Portfolio Turns Crimson?

He introduced the acquisition of 8,178 BTC at a mean worth of $102,171, about 10% above present market ranges.

This current bitcoin transfer places ~40% of Technique’s 649,870 BTC holdings within the purple, with solely 60% nonetheless in revenue. pic.twitter.com/hii0BmV95P

— CryptoQuant.com (@cryptoquant_com) November 18, 2025

Quick-Time period Losses Amid Lengthy-Time period Positive factors

Whereas elements of the place sit within the purple, Technique’s longer-term place stays optimistic. The corporate’s general revenue ratio of twenty-two% is nicely above the deep losses it confronted from mid-2022 into early 2023, when as a lot as 75% of its holdings had been exhibiting losses and the portfolio was down about 33%, equal to roughly $1.32 billion in paper losses then.

Early final month Technique had a peak revenue ratio close to 68% with beneficial properties calculated at about $32 billion, exhibiting how swings might be massive on either side.

Based on filings, Saylor treats dips as possibilities so as to add cash, and this newest shopping for suits that sample. Not each market participant agrees.

A Fraud?

Peter Schiff, a well known gold investor, criticized Technique’s rising common value, which he says—at about $74,433 per BTC—has been shifting nearer to the market worth and will restrict upside if costs fail to rebound.

Schiff mentioned on Sunday that Technique Inc.’s focus solely on Bitcoin is “a fraud.” He additionally challenged Michael Saylor to a stay debate at Binance Blockchain Week in Dubai this December.

Schiff argued that the corporate’s current beneficial properties primarily come from the rising Bitcoin worth. He warned that if individuals lose confidence in Bitcoin, the corporate’s funds might be in hassle.

Associated Studying

What This Means For Traders

For outdoor observers, the takeaway is simple: even the most important holders can have parts of their stock in loss when markets fall.

Technique’s newer purchases have diminished the agency’s tidy headline returns, however they didn’t wipe out the general acquire. Studies counsel the corporate continues to be sitting on a large paper revenue.

Quick-term outcomes for these November buys look poor. Lengthy-term outcomes will rely upon future worth strikes.

Featured picture from Gemini, chart from TradingView