Key Findings

- Particular person earnings taxes are a significant supply of state authorities income, constituting 38 p.c of state taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

collections in fiscal yr 2022, the most recent yr for which knowledge can be found. - Forty-three states and the District of Columbia levy particular person earnings taxes. Forty-one tax wage and wage earnings. New Hampshire solely taxes dividend and curiosity earnings whereas Washington solely taxes capital features earnings. Seven states levy no particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges enhance with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years previous, particular person earnings taxes are the largest supply of tax income within the U.S.

in any respect. - Amongst these states taxing wages, 12 have a single-rate tax construction, with one charge making use of to all taxable earningsTaxable earnings is the quantity of earnings topic to tax, after deductions and exemptions. For each people and companies, taxable earnings differs from—and is lower than—gross earnings.

. Conversely, 29 states and the District of Columbia levy graduated-rate earnings taxes, with the variety of brackets various broadly by state. Hawaii has 12 brackets, essentially the most within the nation. - States’ approaches to earnings taxes differ in different particulars as effectively. Some states double their single-filer bracket widths for married filers to keep away from a “marriage penaltyA wedding penalty is when a family’s general tax invoice will increase due to a few marrying and submitting taxes collectively. A wedding penalty usually happens when two people with related incomes marry; that is true for each high- and low-income {couples}.

.” Some states index tax brackets, exemptions, and deductions for inflationInflation is when the overall value of products and companies will increase throughout the economic system, decreasing the buying energy of a forex and the worth of sure belongings. The identical paycheck covers much less items, companies, and payments. It’s typically known as a “hidden tax,” because it leaves taxpayers much less well-off attributable to larger prices and “bracket creep,” whereas growing the federal government’s spending energy.

; many others don’t. Some states tie their normal deductionThe usual deduction reduces a taxpayer’s taxable earnings by a set quantity decided by the federal government. It was practically doubled for all courses of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers to not itemize deductions when submitting their federal earnings taxes.

and private exemption to the federal tax code, whereas others set their very own or supply none in any respect.

Particular person earnings taxes are a significant supply of state authorities income, accounting for 38 p.c of state tax collections. Their significance in public coverage is additional enhanced by people being actively liable for submitting their earnings taxes, in distinction to the oblique cost of gross sales and excise taxes.

Forty-three states levy particular person earnings taxes. Forty-one tax wage and wage earnings. New Hampshire solely taxes dividend and curiosity earnings whereas Washington solely taxes capital features earnings. Seven states levy no particular person earnings tax in any respect.

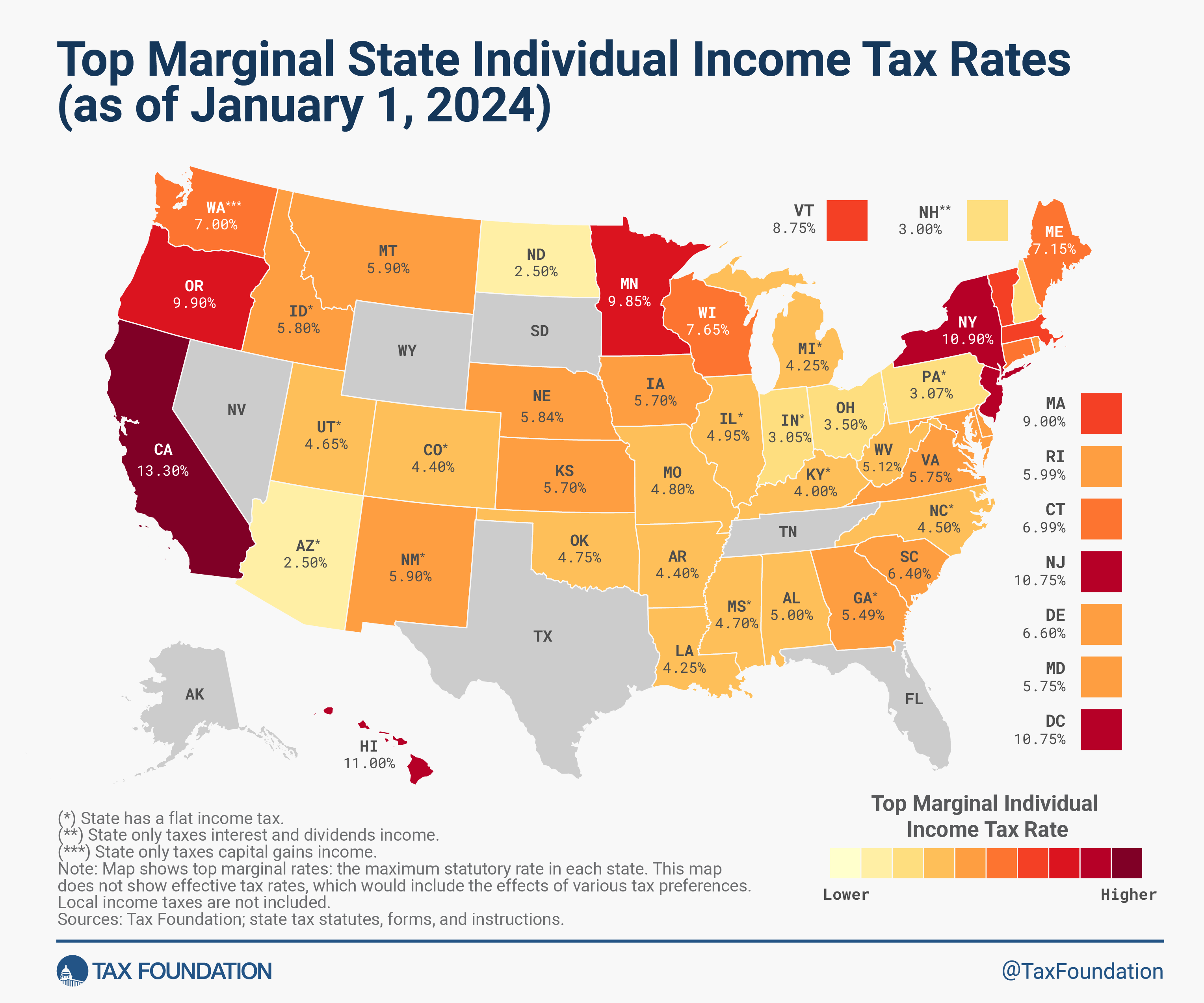

Of these states taxing wages, 12 have single-rate tax constructions, with one charge making use of to all taxable earnings. Conversely, 29 states and the District of Columbia levy graduated-rate earnings taxes, with the variety of brackets various broadly by state. Montana, for instance, is certainly one of a number of states with a two-bracket earnings tax system. On the different finish of the spectrum, Hawaii has 12 brackets. High marginal charges span from Arizona’s and North Dakota’s 2.5 p.c to California’s 13.3 p.c. (California additionally imposes a 1.1 p.c payroll taxA payroll tax is a tax paid on the wages and salaries of workers to finance social insurance coverage applications like Social Safety, Medicare, and unemployment insurance coverage. Payroll taxes are social insurance coverage taxes that comprise 24.8 p.c of mixed federal, state, and native authorities income, the second largest supply of that mixed tax income.

on wage earnings, bringing the all-in high charge to 14.4 p.c as of this yr.)

In some states, a lot of brackets are clustered inside a slender earnings band. For instance, Virginia’s taxpayers attain the state’s fourth and highest bracket at $17,000 in taxable earnings. In different states, the highest charge kicks in at a a lot larger stage of marginal earnings. For instance, the highest charge kicks in at or above $1 million in California (when the “millionaire’s tax” surcharge is included), Massachusetts, New Jersey, New York, and the District of Columbia.

The desk beneath exhibits how every state’s particular person earnings tax is structured. Evaluate states with no earnings tax, flat earnings taxes, or graduated-rate earnings tax.

Revenue Tax Constructions by State

States’ approaches to earnings taxes differ in different particulars as effectively. Some states double their single-filer bracket widths for married filers to keep away from imposing a “marriage penalty.” Some states index tax brackets, exemptions, and deductions for inflation, whereas many others don’t. Some states tie their normal deductions and private exemptions to the federal tax code, whereas others set their very own or supply none in any respect.

The Tax Cuts and Jobs Act (TCJA) elevated the usual deduction (set at $14,600 for single filers and $29,200 for joint filers in 2024) whereas suspending the private exemption by decreasing it to $0 by means of 2025. As many states use the federal tax code as the place to begin for their very own normal deduction and private exemption calculations, some states that beforehand linked to those provisions within the federal tax code have up to date their conformity statutes lately. They both adopted federal modifications, retained their earlier deduction and exemption quantities, or maintained their very own separate system whereas growing the state-provided deduction or exemption quantities.

Within the following tables, we now have compiled essentially the most up-to-date knowledge out there on state particular person earnings tax charges, brackets, normal deductions, and private exemptions for each single and joint filers. Following the tables, we doc notable particular person earnings tax modifications carried out in 2024.

2024 State Revenue Tax Charges and Brackets

Notable 2024 State Particular person Revenue Tax Adjustments

Final yr continued the historic tempo of earnings tax charge reductions. In whole, 26 states enacted particular person earnings tax charge reductions from 2021 to 2023. Solely Massachusetts and the District of Columbia elevated their high marginal tax charges in these years. A number of modifications carried out later in 2023 had been retroactive to January 1, 2023. Nonetheless, various notable modifications come into impact on January 1, 2024, or are set to happen on particular future dates, with charges phasing down incrementally over time. A number of the scheduled future charge reductions depend on tax triggers, the place particular modifications to tax charges will happen as soon as sure income benchmarks are met. Notable modifications to main particular person earnings tax provisions already licensed for 2024 embody the next:

Arkansas

Underneath S.B. 8, enacted in September 2023, the highest particular person earnings tax charge in Arkansas was decreased from 4.7 p.c to 4.4 p.c for tax years starting on or after January 1, 2024. This high charge applies to incomes between $24,300 and $87,000 for taxpayers incomes $87,000 or much less and to incomes over $8,801 for taxpayers incomes greater than $87,000.

Connecticut

As a part of the state price range invoice, H.B. 6941, Connecticut legislators decreased particular person earnings tax charges for the 2 lowest brackets, from 3 p.c to 2 p.c and from 5 p.c to 4.5 p.c, respectively. The change comes into impact on January 1, 2024. The discount won’t have an effect on taxpayers with an annual earnings of $150,000 or above ($300,000 or above for married {couples} submitting a joint return).

Georgia

On January 1, 2024, Georgia transitions from a graduated particular person earnings tax with a high charge of 5.75 p.c to a flat taxAn earnings tax is known as a “flat tax” when all taxable earnings is topic to the identical tax charge, no matter earnings stage or belongings.

with a charge of 5.49 p.c. Moreover, the state considerably elevated its private exemption (to $12,000 for single taxpayers and $18,500 for married {couples} submitting a joint return). These modifications had been enacted by H.B. 1437 in April 2022.

Indiana

Underneath H.B. 1001, enacted in Could 2023, Indiana accelerated its beforehand enacted tax charge reductions, decreasing the person earnings tax charge from 3.15 in 2023 to three.05 p.c in 2024. The regulation additionally repealed beforehand enacted tax triggers, as a substitute prescribing a charge discount to three.0 p.c in 2025, 2.95 p.c in 2026, and a pair of.9 p.c in 2027 and past.

Iowa

As a part of its complete tax reform, efficient January 1, 2024, Iowa consolidated its 4 particular person earnings tax brackets into three (H.F. 2317). Because of this, its high charge decreased from 6 p.c to five.7 p.c. The state is at the moment transitioning to a flat earnings tax system with a charge of three.9 p.c by 2026.

Kentucky

H.B. 1, signed into regulation in February 2023, decreased Kentucky’s flat particular person earnings tax charge from 4.5 p.c in 2023 to 4.0 p.c beginning in 2024, codifying a discount that was triggered underneath the circumstances established by H.B. 8, enacted in 2022.

Mississippi

Underneath H.B. 531, enacted in April 2022, Mississippi will proceed decreasing its flat particular person earnings tax charge from 2024 to 2026. Efficient January 1, 2024, the tax charge decreased from 5 p.c to 4.7 p.c (utilized on taxable earnings exceeding $10,000).

Missouri

Efficient January 1, 2024, Missouri’s Division of Income decreased its high particular person earnings tax charge from 4.95 p.c to 4.8 p.c because the respective income triggers had been met within the earlier fiscal yr, per S.B. 3 enacted in October 2022.

Montana

S.B. 121, enacted in March 2023, simplified the person earnings tax system in Montana and, efficient January 1, 2024, decreased the variety of tax brackets from seven to 2 with the highest tax charge of 5.9 p.c. Moreover, beginning in 2024, taxpayers will use their federal taxable earnings as a base for calculating Montana taxable earnings, implying that the federal normal deduction or the sum of itemized deductions will probably be routinely accounted for.

Nebraska

L.B. 754, enacted in Could 2023, decreased the highest particular person earnings tax charge from 6.64 p.c in 2023 to five.84 p.c in 2024 and outlined the gradual discount of the state’s high charge to three.99 p.c by 2027.

New Hampshire

New Hampshire continues to part out its curiosity and dividends tax. In 2024, per H.B. 2, the tax charge will go down from 4 p.c to three p.c. Beginning in 2025, the tax will probably be repealed, two years sooner than initially deliberate.

North Carolina

Underneath H.B. 259, enacted in September 2023, North Carolina accelerated the discount of its flat particular person earnings tax charge. Efficient January 1, 2024, the tax charge decreased from 4.75 p.c to 4.5 p.c. The speed is scheduled to say no to three.99 p.c by 2026.

Ohio

H.B. 33, enacted in July 2023, decreased the variety of particular person earnings tax brackets in Ohio from three to 2 and lowered the highest charge from 3.75 p.c to three.5 p.c, persevering with the person earnings tax charge discount and simplification development that state legislators began in 2021.

South Carolina

Efficient January 1, 2024, South Carolina decreased its high particular person earnings tax charge from 6.5 p.c to six.4 p.c, per S.B. 1087. Additional reductions to six p.c are scheduled however are topic to common fund income triggers. Governor McMaster’s govt price range assumes that the income set off for the earlier fiscal yr was met, and the highest charge should go down additional to six.3 p.c, as per the statutory schedule. The change has not but been confirmed by the state’s Division of Income.

Historic State Particular person Revenue Tax Charges

Obtain Information (2015-2024)

Share