Canadian blue-chip shares naturally provide capital stability to funding portfolios as they generate steady money flows from mature, well-established, de-risked companies. As a welcome bonus, they could provide invaluable passive revenue streams by common dividends. Naturally, the market values such companies extremely, which means their dividend yields are often low, hardly ever above 5%. However exceptions do occur. Enbridge’s (TSX:ENB) and BCE’s (TSX:BCE) 5.6% and 5.4% respective dividend yields seem juicy and enticing but intriguing for traders trying to purchase secure high-yield dividend shares in November for passive revenue functions.

Let’s take a look at which high-yield blue-chip Canadian dividend inventory may very well be a greater purchase proper now.

BCE’s 5.4% dividend is safer following 20% money circulate progress

BCE is one among Canada’s three largest, well-established telecommunications corporations ruling the Canadian market and rising its income base because the inhabitants will increase and knowledge economic system expands. Following a 56% dividend lower in Could this yr, the funding group is warming as much as BCE inventory because it strengthens its steadiness sheet, re-engineers income and money circulate progress, and pays a sustainable dividend going ahead.

In a latest third-quarter earnings installment, BCE grew consolidated income by 1.3% and elevated its adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (Adjusted EBITDA) by 5.3% yr over yr. In the meantime, free money circulate grew 20.6% year-over-year to entice dividend traders.

Though the telecoms big continues to undergo beneath a heavy debt load throughout a disruptive but abating value competitors that weakened debt servicing capability, so do its trade friends. Although declining rates of interest in 2025 might provide it some respiration room. Aided by non-core asset gross sales, which improved liquidity, BCE is lastly bettering its monetary well being.

The cell phone subscriber base continues to develop, now nearing 10.4 million, whereas BCE prepares to roll out revolutionary direct-to-satellite providers to maintain abreast of the competitors.

BCE’s 5.3% dividend yield stays one of many highest amongst Canadian blue-chip shares, which make up the S&P/TSX 60 Index. The payout seems a lot safer now following the rationalization of capital expenditures.

Administration not too long ago confirmed its monetary steering for 2025, which included as much as 2% income progress and 6% to 11% progress in free money circulate. Maybe BCE might return to dividend progress in some unspecified time in the future within the close to future. By mid-August, BCE inventory had risen greater than 12% after its dividend lower, an indication of market approval.

If the worst is over for the telecoms and media trade, BCE inventory may very well be a rewarding contrarian wager on the long run stability of the Canadian telecoms and media trade.

Enbridge: A high-yield blue-chip inventory for passive revenue

There’s no denying Enbridge’s money circulate gushing fortress because the pipelines behemoth continues to supply dividend yields that compete with Assured Funding Certificates (GIC) choices. ENB’s excessive yield, mixed with dividend yield progress and potential capital appreciation, far outperforms mounted revenue right now. Enbridge inventory is up almost 10% year-to-date, but its 5.6% dividend yield stays excessive and juicy sufficient to supply a sleep-well-at-night passive revenue supply that dividend inventory traders might purchase in November and maintain for many years.

Enbridge not too long ago reported record-high third-quarter EBITDA. The corporate’s “toll-booth” asset base stays nicely positioned to generate steady working money circulate. Though market sentiment implied that Enbridge’s 2023 acquisition of U.S. gasoline utility belongings was costly, the corporate expanded its capability to generate boatloads of distributable money circulate as U.S. power demand soars.

Furthermore, Enbridge’s dividends are nicely lined by distributable money circulate, with a payout charge nicely beneath 70%. Following almost 30 years of dividend progress, there’s little doubt Enbridge’s administration would want to keep that popularity for a decade or extra to come back. The 5.6% yield might continue to grow.

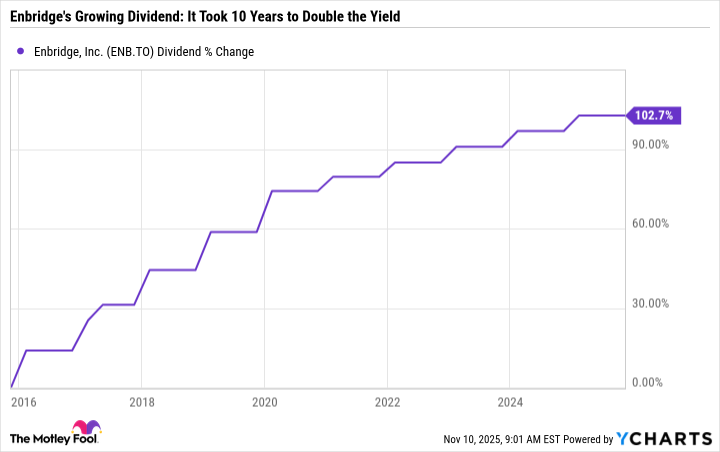

ENB Dividend information by YCharts

Enbridge has doubled its dividend in the course of the previous decade. Early traders might have doubled their yields (on value). Previous efficiency isn’t indicative of the long run, but when the identical dividend progress occurs by 2035, an 11.2% yield may very well be good to reap from ENB inventory throughout retirement.

Administration’s present capital funding finances gives for distributable money circulate progress of 5% every year put up 2026.